Two Largest US Pension Funds Approve Merger

Global Proxy Advisory Firms' Opinions Are Decisive

National Pension Service Amid Foreign Shareholders' Support

Major US investors have decided to vote in favor of the merger between SK Innovation and SK E&S. This decision came after two major global proxy advisory firms recommended approval. The likelihood of the merger passing at the shareholders' meeting scheduled for the 27th has increased significantly.

According to the financial investment industry on the 21st, the California Public Employees' Retirement System (CalPERS) and the California State Teachers' Retirement System (CalSTRS) announced on their respective websites that they will exercise their voting rights in favor of the merger between SK Innovation and SK E&S at the SK Innovation shareholders' meeting. CalPERS is the largest pension fund in the US with assets under management (AUM) of $520.3 billion (approximately 700 trillion KRW). CalSTRS has an AUM of $344.9 billion (approximately 460 trillion KRW).

'Activist Pension Funds' as Allies for the Merger

The exact shareholding percentages of these two pension funds in SK Innovation are unclear, as they hold less than 5% and are not required to disclose their stakes. Their support is significant because they are pension funds that actively implement the Stewardship Code (guidelines for institutional investors' voting rights). In March, these two pension funds also voted in favor of a proposal by a coalition of activist funds aiming to increase dividends at the Samsung C&T shareholders' meeting. Although the proposal was ultimately defeated after a vote, it demonstrated strong cohesion as shareholder proposals received 23% support, mainly from foreign investors.

In particular, CalPERS, known as a pioneer of shareholder activism, is known to exert strong influence on other US state and foreign pension funds. The 2004 Walt Disney shareholders' meeting, where CalPERS led the CEO's ousting with only a 2% stake, is still legendary. When CalPERS moves, other US pension funds such as those in Ohio and New Jersey often follow suit, making it a global "textbook" example of shareholder activism.

Despite controversies over the merger ratio raised by some, the decisive reason these two pension funds supported the SK Innovation board appears to be the approval recommendations from global proxy advisory firms ISS and Glass Lewis. Their key points were that the merger ratio was appropriate and the corporate valuation was reasonable. These two firms provide advisory services to over 90% of institutional investors worldwide.

Foreign Shareholders Leaning Toward Approval... National Pension Fund Yet to Decide

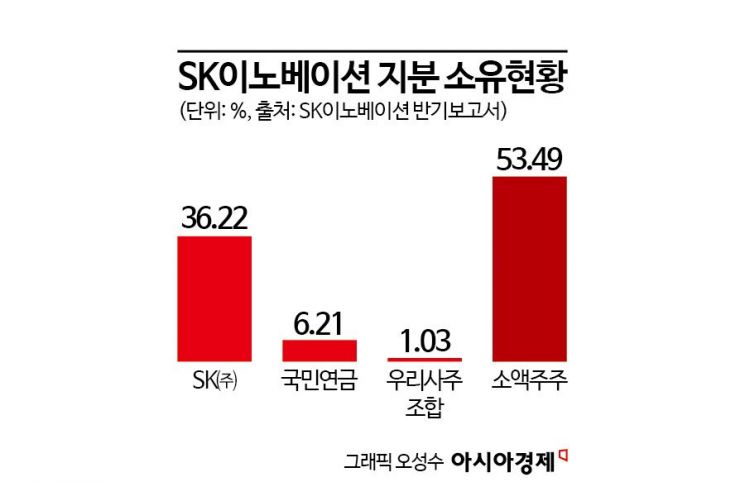

The merger, which requires special resolutions, must be approved by at least two-thirds of the shareholders present at the meeting and at least one-third of the total issued shares. According to SK Innovation's semiannual report, SK Holdings is the largest shareholder with a 36.22% stake, followed by the National Pension Service (NPS) with 6.21%. Minority shareholders holding less than 1% each collectively own 53.49%. Foreign shareholders hold approximately 22%. Since there is a growing atmosphere of foreign shareholders leaning toward approval, the chances of the merger passing have become very high.

The National Pension Service has not yet disclosed its voting intentions. Typically, voting decisions are made by the Fund Management Headquarters, but there is speculation that the Stewardship Responsibility Committee (SRC) may decide on this merger proposal. If the Fund Management Headquarters finds it difficult to make a judgment on its own or if more than one-third of the SRC members request it, the SRC will determine the voting rights. There is also an option to abstain from voting and instead exercise the right to request stock purchase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.