Seoul Real Estate Market Stirred... Rising Household Debt Raises Alarm

From September, Tier 2 Stress DSR Increased by 0.75%P... Capital Area Raised by 1.2%P

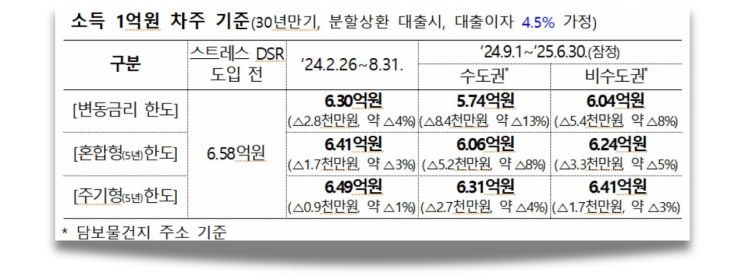

Loan Limits Down 13% in Capital Area, 8% in Non-Capital Areas Compared to Pre-Implementation

Additional Loan Restriction Measures Under Review Including Higher Risk Weights on Bank Mortgage Loans

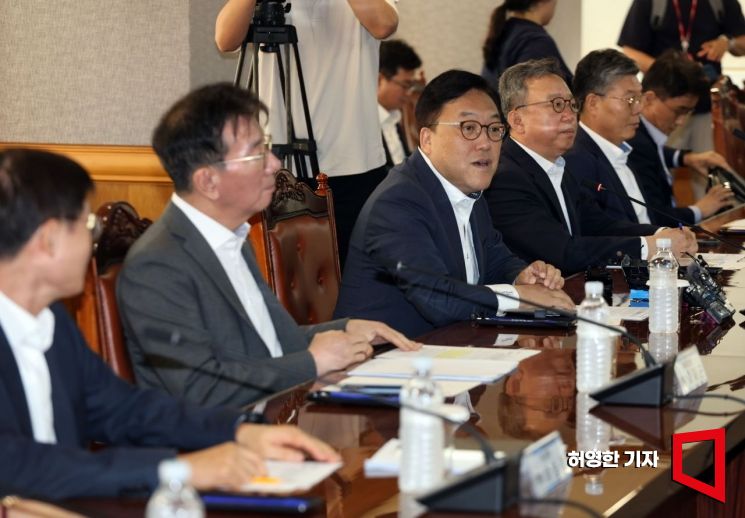

A meeting between Kim Byung-hwan, Chairman of the Financial Services Commission, and heads of major banks was held on the 20th at the Seoul Banking Hall. Before the meeting, Chairman Kim delivered a greeting. Photo by Heo Young-han younghan@

A meeting between Kim Byung-hwan, Chairman of the Financial Services Commission, and heads of major banks was held on the 20th at the Seoul Banking Hall. Before the meeting, Chairman Kim delivered a greeting. Photo by Heo Young-han younghan@

The government has launched a 'pinpoint regulation' mainly targeting the Seoul metropolitan area ahead of the implementation of the second phase of the stress Debt Service Ratio (DSR) from September to curb the rising household loans. This move is interpreted as a response to the concern that the real estate market, which is bustling mainly in Seoul, could stimulate household loans beyond manageable levels.

On the 20th, Kim Byung-hwan, Chairman of the Financial Services Commission, announced at a meeting with 19 bank presidents held at the Bankers' Hall in Jung-gu, Seoul, that the second phase of the stress DSR, scheduled to be implemented from September, will be enforced with a stress interest rate of 1.2 percentage points applied to mortgage loans in the metropolitan area, instead of the previously announced 0.75 percentage points. Chairman Kim stated, "From the second quarter of this year, household debt, centered on bank mortgage loans, has turned to an increasing trend due to the rise in housing prices mainly in Seoul and expectations of interest rate cuts," and emphasized, "We hope the banking sector will autonomously establish a household debt management system based on repayment ability, that is, the DSR."

The loan limits for metropolitan area mortgage loans subject to the second phase stress DSR with additional stress interest rates will be further reduced. The stress DSR is a system that restricts loan limits by adding a surcharge interest rate (stress interest rate) to the existing loan interest rate, and when the stress interest rate is applied, the loan limit decreases. In February, the financial authorities applied a stress surcharge interest rate of 0.38 percentage points to bank mortgage loans as the first phase measure and postponed the implementation of the second phase, which raises the surcharge interest rate to 0.75%, from July to September. The second phase measure will expand to include credit loans and second-tier financial institution mortgage loans, in addition to bank mortgage loans.

According to the financial authorities' strengthened household loan regulations, from September, the loan limit for a borrower with an annual income of 50 million KRW applying for a variable-rate mortgage loan will decrease by up to 42 million KRW from 329 million KRW before the introduction of the stress DSR (assuming a 30-year term, installment repayment loan, and 4.5% loan interest). According to the authorities' simulation, the loan limit for metropolitan area mortgage loans will shrink by about 13% to 287 million KRW, and for non-metropolitan areas by about 8% to 302 million KRW. This loan limit is calculated assuming no other loans besides bank mortgage loans.

Additionally, for borrowers with an annual income of 100 million KRW, the mortgage loan limit before the introduction of the stress DSR was 658 million KRW, but from September, it will be limited to 574 million KRW in the metropolitan area and 604 million KRW in non-metropolitan areas. This represents a decrease of about 13% (84 million KRW) in the metropolitan area and about 8% (54 million KRW) in non-metropolitan areas. When taking out mortgage loans with fixed-rate or mixed (fixed + variable) interest types, the reduction is relatively smaller compared to choosing variable interest rates.

Additional Measures Under Review Following Metropolitan Area 'Pinpoint Regulation'

Following the announcement of the strengthened stress DSR regulations for the metropolitan area, the financial authorities are also considering additional measures to curb household loans. As of the 14th, the outstanding household loans of the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?amounted to 719.9178 trillion KRW, increasing by 4.1795 trillion KRW in August alone. Furthermore, according to the 'Consumer Sentiment Survey Results' released by the Bank of Korea on the same day, the housing price expectation index for August rose by 3 points from the previous month to 118, marking the highest level since October 2021 (125).

Chairman Kim stated that from September, banks will calculate internal management DSRs for all household loans, and from next year, banks will be required to establish and implement DSR management plans based on these calculations. He also mentioned that the authorities will closely monitor household loan trends and consider expanding the scope of DSR application or additional measures such as raising risk weights on bank mortgage loans if necessary. If the risk weights on bank mortgage loans are increased, banks will need to reduce household loans to maintain capital ratios.

Meanwhile, the financial authorities expect that the increased stress DSR interest rate applied to metropolitan area mortgage loans will have a demand-suppressing effect but will not increase interest repayment burdens. A financial authority official explained, "Considering the downward trend in market interest rates due to expectations of interest rate cuts after the implementation of the stress DSR, we decided on 1.2 percentage points," and added, "We also took into account the recent continuous reduction of preferential mortgage loan interest rates by commercial banks under the pretext of managing household debt."

Similar to the first phase of the stress DSR implementation, transitional measures will be put in place to minimize inconvenience to actual homebuyers. A financial authority official said, "Even if the stress interest rate is raised, only borrowers with a DSR level of 37-40% (6.5% of bank mortgage loan borrowers) are expected to be affected by some reduction in loan limits," and assessed, "For fixed-rate (mixed or periodic) mortgage loans, which constitute the majority recently, only part of the stress interest rate is reflected, so inconvenience to actual homebuyers will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.