Won-Dollar Exchange Rate Hits 5-Month Low Since Mid-March

Dollar Weakness Influenced by Expectations of US Interest Rate Cuts

Forecasted to Stabilize Downward Through Year-End

Dealers are working in the dealing room of Hana Bank in Jung-gu, Seoul, on the 20th, where the won-dollar exchange rate recorded the 1,330 won level for the first time in five months since last March. On the same day, the KOSPI index started the session at 2,699.74, up 25.38 points from the previous trading day. Photo by Jinhyung Kang aymsdream@

Dealers are working in the dealing room of Hana Bank in Jung-gu, Seoul, on the 20th, where the won-dollar exchange rate recorded the 1,330 won level for the first time in five months since last March. On the same day, the KOSPI index started the session at 2,699.74, up 25.38 points from the previous trading day. Photo by Jinhyung Kang aymsdream@

As expectations for a U.S. interest rate cut grow, the won-dollar exchange rate hit its lowest level in five months. With increasing speculation that the U.S. will begin to cut its benchmark interest rate starting next month, forecasts suggest that the dollar's weakness will continue for the time being.

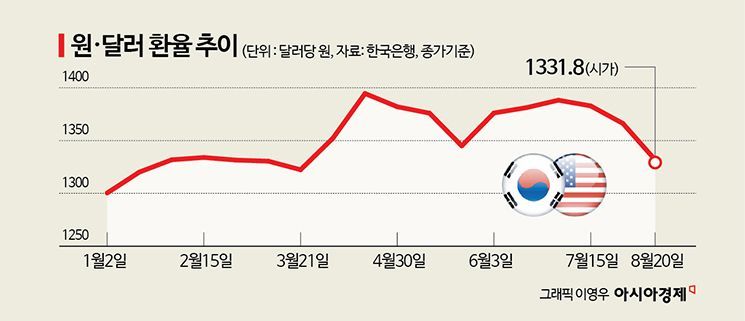

On the 20th, in the Seoul foreign exchange market, the won-dollar exchange rate opened at 1,331.8 won, down 2.2 won from the previous trading day. As of 9:41 a.m., it was trading slightly higher than the opening price at 1,333.9 won.

The won-dollar exchange rate closed at 1,334.0 won in the previous day's weekly trading, down 23.6 won from the previous trading day. This is the lowest level in about five months since it recorded 1,322.4 won on March 21, based on the closing price.

Dollar Weakness Stands Out Amid Expectations of U.S. Interest Rate Cuts

The won-dollar exchange rate has plunged about 30 won just this month. The decline in the exchange rate is due to the pronounced dollar weakness driven by expectations of a U.S. interest rate cut. The dollar index, which measures the relative value of the dollar against the currencies of six major countries, fell to 102 yesterday, marking its lowest level in over seven months since January 5 (101.908).

While inflation in the U.S. has somewhat stabilized recently, economic indicators have been sluggish, strengthening the outlook for a rate cut starting next month. According to the U.S. Department of Commerce, new housing starts last month decreased by 6.8% month-on-month to 1.238 million units (seasonally adjusted annual rate). This figure was significantly below the expert forecast of 1.34 million units compiled by Dow Jones. The Institute for Supply Management (ISM) July Manufacturing Purchasing Managers' Index (PMI) also fell short of expectations at 46.8.

On the other hand, the U.S. Consumer Price Index (CPI) for July rose by only 2.9% year-on-year. This was below the market expectation of 3.0% and marked the slowest increase since March 2021.

Park Sang-hyun, a senior advisor at iM Investment Securities, explained, "The easing of inflation concerns in July, combined with weak housing data and some slowdown in real economic indicators, has increased the likelihood of the Federal Reserve cutting its benchmark interest rate, thereby intensifying downward pressure on the dollar." He added, "There is also anticipation that Fed Chair Jerome Powell might send strong signals regarding rate cuts at this week's Jackson Hole meeting, which is another factor driving dollar weakness."

While the possibility of a U.S. interest rate cut is rising, South Korea is expected to find it difficult to lower its benchmark rate this month due to rising housing prices and increasing household debt, which is also cited as a reason for the won's strength. The market expects the Bank of Korea to keep the benchmark interest rate unchanged at the monetary policy meeting scheduled for the 22nd.

Kim Jeong-sik, emeritus professor of economics at Yonsei University, said, "Due to recent increases in housing prices in the metropolitan area and rising household debt, it is highly likely that the Bank of Korea will hold the benchmark interest rate steady this month. Considering the U.S. economic situation as well, South Korea may lower the rate around October."

Regarding the sharp decline in the won-dollar exchange rate, foreign investors' supply and demand factors also played a role. Kim Chan-hee, an economist at Shinhan Investment Corp., analyzed, "Since the beginning of the year, foreign investors' long positions in dollar currency futures, which had accumulated up to 4.2 trillion won, began to decrease from the 14th. Just yesterday, nearly 1.6 trillion won of long positions were liquidated, causing the exchange rate to plunge." This indicates that the exchange rate temporarily dropped sharply as foreign investors' bearish bets on the won were unwound.

Downward Trend in Won-Dollar Exchange Rate Expected to Continue Until Year-End

Experts believe the won-dollar exchange rate may decline further for the time being. This is because the U.S. is expected to cut its benchmark interest rate once or twice more in the fourth quarter following September, which could sustain downward pressure on the dollar.

In a survey conducted last week by Asia Economy targeting nine economic experts on exchange rate forecasts, 89% (eight respondents) predicted that the won-dollar exchange rate would remain below 1,350 won until the end of this year.

Lee Joo-won, an economist at Daishin Securities, stated, "As we approach year-end, the U.S. growth momentum is expected to slow down, and monetary easing (interest rate cuts) policies will become more prominent, continuing the dollar's weakness trend. The won-dollar exchange rate will fluctuate but stabilize on a downward path."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.