Focus on Powell's Jackson Hole Speech on the 23rd

FOMC Minutes and Unemployment Claims Also Released

The three major indices of the U.S. New York stock market showed slight gains in early trading on the 19th (local time). Investors appear to be taking a breather ahead of key events this week, including the Jackson Hole meeting.

As of 9:46 a.m. in the New York stock market, the Dow Jones Industrial Average, centered on blue-chip stocks, was up 0.24% from the previous trading day, standing at 40,758.52. The S&P 500, focused on large-cap stocks, rose 0.18% to 5,564.07, and the Nasdaq, centered on technology stocks, was trading 0.13% higher at 17,655.03.

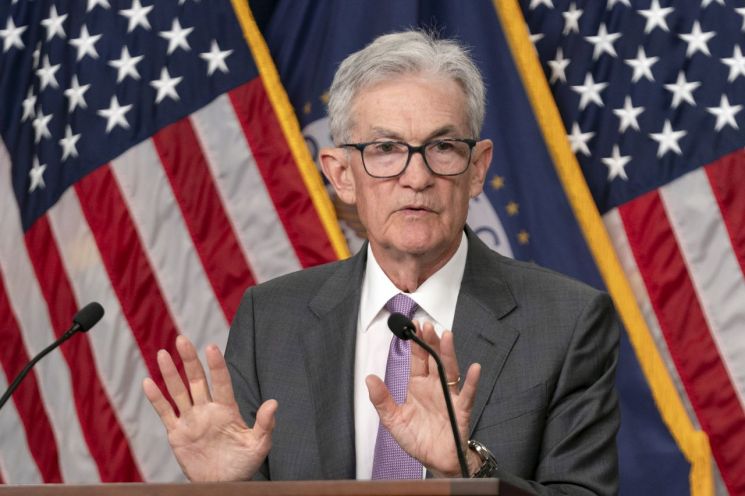

Investors are focusing on the Jackson Hole meeting, which will be held over three days starting on the 22nd in Wyoming. The Jackson Hole meeting is an annual economic policy symposium attended by central bank officials from major countries. Jerome Powell, Chair of the U.S. Federal Reserve (Fed), is scheduled to deliver a speech on the morning of the 23rd at 10 a.m. titled "Economic Outlook." With expectations for a rate cut in September growing, the market hopes to find clues regarding next month's rate decision through Powell's remarks.

The market expects the Fed to begin its first rate cut in September. According to the Chicago Mercantile Exchange (CME) FedWatch tool, the federal funds futures market currently reflects a 73.5% probability that the Fed will cut rates by 0.25 percentage points in September. The possibility of a 0.5 percentage point cut, which surged to the 80% range earlier this month amid rising unemployment and recession concerns, has now dropped to 26.5%.

This is due to easing recession fears as inflation slowed more than expected and retail sales remained robust. The Producer Price Index (PPI) for July rose 0.1% month-over-month, below both the forecast and the previous month's 0.2%. The Consumer Price Index (CPI) for the same month increased 2.9% year-over-year, falling into the 2% range for the first time since March 2021. Both the forecast and the previous month's 3.0% were exceeded. Additionally, July retail sales, which account for two-thirds of the U.S. real economy, rose 1% month-over-month, surpassing both the forecast of 0.4% and the previous month's 0.2% decline, easing recession concerns.

Wall Street expects that economic indicators will continue to conflict, leading to increased market volatility.

Greg Marcus, Managing Director at UBS Private Wealth Management, said, "The market has almost fully recovered from the exaggerated recession fears earlier this month. However, the economy is slowing, and conflicting economic data are likely to persist over the coming months, so the recession debate will continue." He added, "We expect volatility to remain at elevated levels for the rest of the year."

Besides the Jackson Hole meeting, the market is also awaiting the release of the July Federal Open Market Committee (FOMC) minutes on the 21st and last week's initial jobless claims on the 22nd. Fed officials will continue to speak as well. On this day, Fed Governor Christopher Waller will speak, followed by speeches from Raphael Bostic, President of the Atlanta Federal Reserve Bank, and Fed Vice Chair Michael Barr on the 20th.

Major political events are also underway. The Democratic Party is holding its national convention in Chicago, Illinois, from today through the 22nd. Vice President Kamala Harris will be officially confirmed as the Democratic presidential candidate at this convention.

U.S. Treasury yields are moving within a narrow range. The 2-year Treasury yield, sensitive to monetary policy, is slightly up at 4.07% compared to the previous trading day, while the 10-year Treasury yield, a global bond benchmark, remains steady at 3.89%.

By individual stocks, U.S. semiconductor company AMD is up 2.2% on news of acquiring ZT Systems. Cosmetics company Est?e Lauder is down 1.6% following disappointing quarterly results and annual outlook. Coffee chain Dutch Bros is down 2.51% after investment bank Piper Sandler downgraded its rating from "overweight" to "neutral."

International oil prices are slightly down amid concerns over weakening demand from China, the world's largest crude oil importer. West Texas Intermediate (WTI) crude is trading at $76.64 per barrel, down $0.01 from the previous day, while Brent crude, the global oil price benchmark, is down $0.19 (0.2%) at $79.49 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.