Botox Stocks Hit New Highs Amid Recent Price Surge

Strong Exports Drive Both Earnings and Stock Gains

Expecting Significant Profit Growth Starting Next Year

Botox-related stocks are capturing two birds with one stone by achieving both solid earnings and strong stock price performance, driven by robust export growth. As export growth is expected to continue, expectations for earnings and stock prices are also anticipated to rise.

According to the Korea Exchange on the 20th, Hugel reached an intraday high of 294,500 KRW, setting a new 52-week high. It closed at 286,500 KRW, up 5.33% from the previous session, continuing its upward trend for four consecutive days. Since 'Black Monday' on the 5th, Hugel has shown an upward trend on all days except one. As a result, the stock price, which had fallen to the 210,000 KRW range, has risen to the 280,000 KRW level, approaching the 300,000 KRW mark. Daewoong Pharmaceutical also set a new 52-week high by rising to 141,700 KRW intraday, surging over 10% and breaking through the 140,000 KRW level. Medytox closed up 1.74%, continuing its upward trend for three consecutive days. Medytox's stock price had dropped to the 150,000 KRW level during the crash on the 5th but recently climbed back to the 200,000 KRW range. Pharmarise also recorded a 52-week high by rising to 190,800 KRW intraday.

The recent remarkable stock price strength of Botox stocks is interpreted as being driven by solid earnings and expectations for high export growth.

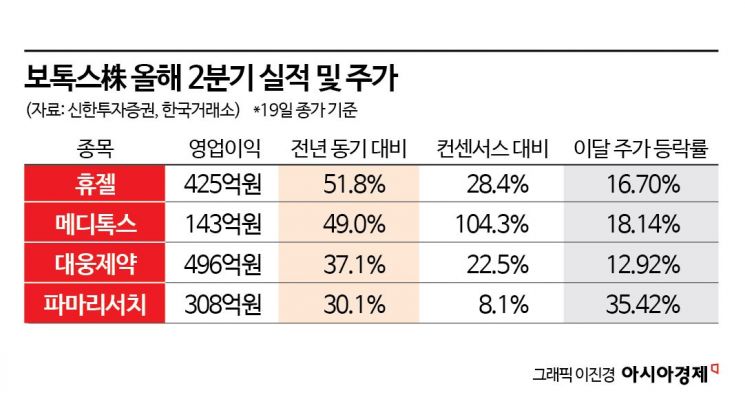

Botox stocks posted better-than-expected earnings in the second quarter of this year. Hugel's operating profit in Q2 was 42.5 billion KRW, up 51.8% year-over-year, which is 28.4% higher than the consensus (average securities firm forecast). Medytox recorded an operating profit of 14.3 billion KRW in Q2, a 49.0% increase, exceeding consensus by 104.3%. Daewoong Pharmaceutical posted an operating profit of 49.6 billion KRW in Q2, up 37.1% year-over-year, beating consensus by 22.5%. Pharmarise's Q2 operating profit increased by 30.1% to 30.8 billion KRW, surpassing market expectations by 8.1%. Jeong Hee-ryeong, a researcher at Shinhan Investment Corp., said, "All companies in the sector recorded earnings that significantly exceeded market expectations in Q2," adding, "The sector's average operating profit growth rate year-over-year was 42.0%, showing a substantial profit increase in Q2. Profitability improved due to reduced legal expenses and cost control, and export sales growth was driven simultaneously by strong demand in key export countries for each company."

For Hugel, Q2 toxin export sales amounted to 30.8 billion KRW, a 62% increase year-over-year. Medytox's toxin export sales rose 24% to 16.0 billion KRW due to balanced overseas growth. Daewoong Pharmaceutical's botulinum toxin product 'Nabota' recorded sales of 53.1 billion KRW in Q2, a 62.4% increase year-over-year, marking the highest quarterly sales ever for Nabota. Export sales reached 45.2 billion KRW, with growth in U.S. sales driving the strong performance.

Based on export growth, it is expected that a full-scale profit growth phase will begin next year. Researcher Jeong said, "Starting from the strong Q2 results, through the seasonal peak in the second half of the year, significant profit growth is expected in 2025," adding, "Export-import data for the companies are at record highs, and with planned operation of expanded factories next year, substantial sales growth is possible. This is considered an operating leverage phase where sales and profitability rise together."

Ha Tae-gi, a researcher at Sangsangin Securities, commented on Hugel, "Exports to the U.S. started in the second half of this year, and full-scale sales will begin next year," forecasting, "From 2025, overall toxin exports will grow sharply." He added, "Filler sales are also growing rapidly, centered on exports, with filler exports increasing mainly in Asia-Pacific and Latin America."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)