K Bank Removes Subscription Amount Limit for Plus Box

Tiered Differential Interest Rates Also Planned

"Plan to Expand High-Net-Worth Customers"

Kakao Bank Increases Benefits Through Corporate Partnerships

Last-Minute Demand Rises Amid Possible October Rate Cut

Efforts to Secure Deposit Balances

As the possibility of an interest rate cut increases in the second half of this year and market uncertainty grows, demand for savings and installment savings accounts is surging. Internet banks are also expanding various benefits to broaden their customer base and devise strategies to attract deposits.

According to the financial sector on the 19th, K-Bank will change the subscription amount and interest rate application method for its demand deposit account ‘Plus Box’ starting from the 9th of next month. The previous limit on the subscription amount, which was capped at 1 billion KRW, will be completely removed, and the fixed interest rate of 2.3% per annum will be replaced with tiered interest rates based on the amount. Through this, K-Bank aims to attract high-net-worth individuals. Previously, whether depositing 100 million KRW or 1 billion KRW, the same interest rate (2.3% per annum) was applied. Although specific details have not been released, it is expected that preferential interest rates will be applied for larger amounts. K-Bank explained that after raising the subscription limit for this account from 300 million KRW to 1 billion KRW last November, surplus funds from the affluent middle class (people with financial assets between 100 million and 1 billion KRW) flowed in. A K-Bank representative stated, “We are preparing measures to expand benefits for affluent middle-class and other high-net-worth customers.”

KakaoBank is increasing savings and installment savings benefits through partnerships with companies. From June to this month, customers who subscribe to major installment savings products (26-week installment savings, one-month installment savings, and piggy bank savings) receive coupons and other benefits through partnerships with Hyundai Department Store Group, Baskin Robbins, Megabox, and McDonald’s. For example, the ‘26-week installment savings with McDonald’s,’ which is on limited sale from the 1st to the 31st of this month, offers weekly discounts on six McDonald’s menu items upon successful savings. Additionally, 100 winners selected by lottery will receive 20,000 points usable within the McDonald’s mobile application (app). KakaoBank and its partners explain that this event aims to secure new customers. McDonald’s stated, “Since the partnership began in October last year, the number of new customers using the McDonald’s mobile app has increased, and the mobile ordering service has been revitalized.”

With an interest rate cut expected in the second half of this year, both companies appear to be increasing benefits to capture demand from customers trying to catch the ‘last train’ for high-interest savings and installment savings products. The market expects the Bank of Korea’s Monetary Policy Committee to keep the base rate unchanged at the policy meeting on the 22nd and to cut it at the next meeting in October.

As the possibility of a base rate cut within the year gains attention, subscriptions to savings and installment savings products have increased since the first half of this year. The balance of fixed deposits at the five major commercial banks has shown an upward trend from April to July. The fixed deposit balance, which was 872.882 trillion KRW in April, increased to 909.3403 trillion KRW in July. The balance of installment savings also rose from 32.453 trillion KRW to 35.7311 trillion KRW during the same period.

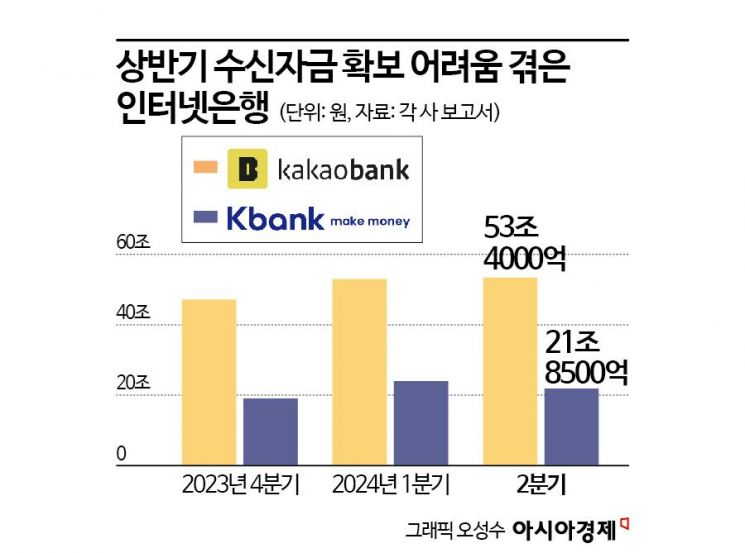

On the other hand, K-Bank and KakaoBank saw either a decrease or a slowdown in deposit balances in the first half of this year. K-Bank’s deposit balance in the first quarter was 23.97 trillion KRW, up 25.7% from 19.07 trillion KRW in the previous quarter (fourth quarter of last year). However, the deposit balance in the second quarter dropped by about 2 trillion KRW to 21.85 trillion KRW compared to the first quarter. KakaoBank’s deposit balance increased by 400 billion KRW from 53 trillion KRW in the first quarter to 53.4 trillion KRW in the second quarter, but this growth slowed compared to the 5.8 trillion KRW increase from the fourth quarter of last year to the first quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)