Individuals Accumulate 1.2 Trillion KRW Net Purchases in the KOSPI Market from 5th to 16th

Samsung Electronics Achieves 8% Return with 1.6 Trillion KRW Low-Price Buys

The KOSPI, which had fallen below the 2400 level on the 5th, is now on the verge of recovering to the 2700 level. While the domestic stock market has made a 'V'-shaped rebound, individual investors have been focusing on net buying Samsung Electronics, outperforming the market returns.

According to the financial investment industry on the 19th, individual investors recorded a cumulative net purchase of 1.19 trillion KRW in the KOSPI market over 10 trading days from the 5th to the 16th. During the same period, foreign investors and institutional investors showed net selling of 420 billion KRW and 960 billion KRW, respectively.

On the 5th, the KOSPI plunged more than 10% intraday, dropping to 2386.96. For the first time in about 4 years and 2 months since June 2020, a sidecar was triggered.

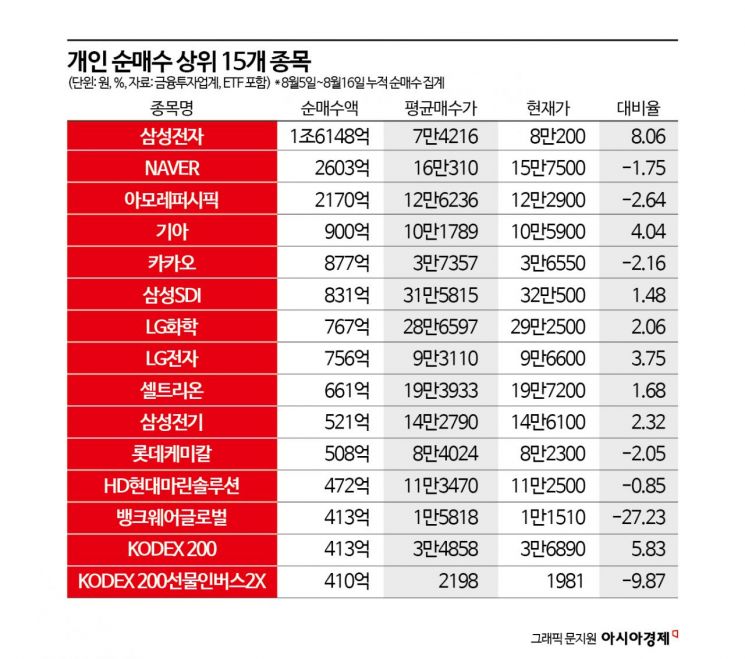

As the domestic stock market declined amid concerns of a US-led economic recession, individual investors saw it as a buying opportunity at low prices and focused on purchasing Samsung Electronics, NAVER, Amorepacific, Kia, and others.

Over the past 10 trading days, individuals net purchased Samsung Electronics shares worth 1.615 trillion KRW. On the 5th, when the stock price fell more than 10%, they bought shares worth 1.35 trillion KRW in a single day. As concerns about a global economic recession grew, not only in the US but worldwide, fear of further declines peaked, and individuals chose to buy at low prices. Samsung Electronics recovered to the 80,000 KRW level, and individuals recorded an evaluation return of 8.1% on Samsung Electronics.

Market experts are optimistic about further gains in Samsung Electronics. Min-sook Chae, a researcher at Korea Investment & Securities, said, "Samsung Electronics has completed NVIDIA certification for high-bandwidth memory (HBM) and will expand production significantly from next year," adding, "It is realistic to expect simultaneous improvement in HBM and general DRAM performance from next year."

Dong-won Kim, a researcher at KB Securities, also forecasted, "Samsung Electronics is expected to begin supplying HBM 3E to NVIDIA, AMD, Amazon, Google, and others in earnest from the fourth quarter of this year," and predicted, "The proportion of HBM 3E sales in Samsung Electronics' total HBM revenue will rise from 16% in the third quarter to 64% in the fourth quarter."

Considering the evaluation returns and optimistic outlook for Samsung Electronics, individual investors’ low-price buying strategy is regarded as excellent. However, there is some regret as SK Hynix rebounded more sharply than Samsung Electronics after 'Black Monday.' If investors had bought SK Hynix instead of Samsung Electronics, the returns might have been higher. Foreign investors, who purchased 503 billion KRW worth of shares from the 5th to the 16th, achieved an evaluation return of 14.6%.

Among the top net purchase stocks by individuals from the 5th to the 16th, none except Samsung Electronics recorded double-digit returns. NAVER and Amorepacific, which were purchased for more than 200 billion KRW, have continued to show sluggish performance. Individuals who bought Kia, LG Electronics, and the KODEX 200 Exchange-Traded Fund (ETF) recorded returns in the 3-5% range.

Individuals who succeeded in buying at low prices appear to be weighing their investment timing. Although the domestic stock market drew a steep rebound curve after the sharp drop on the 5th, there are many variables to expect further gains. Jaeman Lee, a researcher at Hana Securities, explained, "The debate over the US economy is still ongoing," adding, "The Citi US Economic Surprise Index has rebounded from its low but remains in negative territory." He added, "We need to check the US unemployment rate announced on the 6th of next month and whether the Federal Reserve (Fed) will cut the benchmark interest rate on the 18th of next month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.