National Pension Service Increases M7 Holdings... KIC Net Sells

KIC Focuses on Buying Retailers like Walmart and Home Depot

Both Institutions Newly Include AI and Bitcoin Beneficiaries

South Korea's two major national investment institutions, the National Pension Service (NPS) and the Korea Investment Corporation (KIC), are showing divergent moves in U.S. stock investments. While the NPS is increasing its holdings in the large tech stocks known as the 'Magnificent 7 (M7, Apple, Microsoft (MS), Google Alphabet, Amazon, Nvidia, Meta, Tesla),' KIC has started to realize some profits.

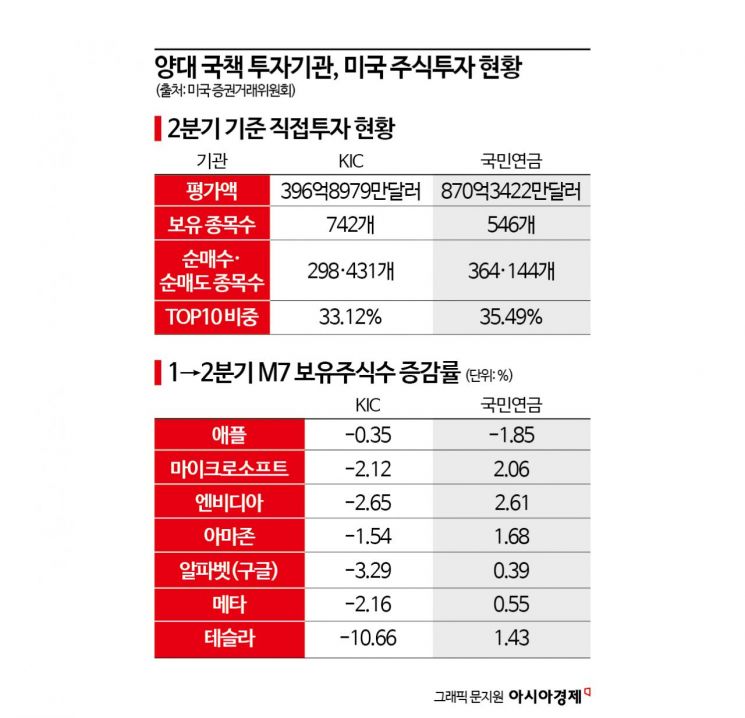

According to the U.S. Securities and Exchange Commission (SEC) '13F (disclosure of institutional investors holding over $100 million)' as of the end of Q2, the direct investment asset value in U.S. stocks was $87.03422 billion (approximately 118 trillion KRW) for the NPS and $39.68979 billion (approximately 54 trillion KRW) for KIC. The NPS recorded its highest level for five consecutive quarters, and KIC for three consecutive quarters. The NPS increased holdings in 364 stocks, while KIC made net purchases in 298 stocks.

NPS Continues Buying M7, KIC Focuses on Retail Sector

The two institutions showed starkly contrasting approaches to M7 investments. In Q2, except for a 1.85% reduction in Apple holdings, the NPS increased its shares in the other six stocks. Nvidia holdings rose by 2.61% compared to Q1, followed by MS (2.06%), Amazon (1.68%), Tesla (1.43%), Meta (0.55%), and Google Alphabet (0.39%). On the other hand, KIC reduced its shares in all M7 stocks, notably selling 10.66% of its Tesla holdings.

The trading pattern was similar in Q1 as well. The NPS increased its M7 holdings across the board, while KIC made net sales in all except Meta. M7 stocks have led the U.S. stock market rally this year, centered around Nvidia. Wall Street opinions are mixed between "peak-out" (reaching a peak and declining) and "still undervalued."

One of the representative sectors KIC turned to after realizing profits from M7 in Q1 and Q2 is retail. In Q2, it increased holdings in Walmart and Home Depot by 7.27% and 10.83%, respectively. Walmart is the world's largest retail chain, and Home Depot operates warehouse-style stores selling interior goods and more. Meanwhile, the NPS made significant purchases of Exxon Mobil, the largest energy company in the U.S., increasing its holdings by 14.92%. Among stocks with over $100 million holdings, Exxon Mobil had the largest increase in shares.

Both Institutions Newly Include AI and BTC Beneficiary Stocks

In Q2, the NPS newly added 20 stocks, and KIC added 13. Five stocks overlapped: GE Vernova, Emcor Group, MicroStrategy, Solventum, and Grail. Among these, GE Vernova, Grail, and Solventum are companies spun off from existing large corporations and independently listed. Emcor Group is strong in data and energy infrastructure construction and is classified as an artificial intelligence (AI) beneficiary stock. MicroStrategy is famous as the largest holder of Bitcoin (BTC). Both the NPS and KIC also hold Coinbase, a U.S. virtual asset exchange. Thus, both institutions are expanding their 'indirect investment' in BTC.

Both the NPS and KIC see overseas stocks as having a significant impact on their annual returns. Last year, the overseas stock return was 23.8% for the NPS and 22.4% for KIC, the highest among all asset classes. This year, with high volatility in the stock market, success or failure in the stock market is expected to become even more important. The NPS's overseas stock investment ratio this year is 33% of total assets. For KIC, a sovereign wealth fund managing assets with 100% overseas investments, stocks accounted for 39.2% of assets as of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.