The Last Scenario: Forced Sale of 11st Also Fails

Accountability Raised for Financial Investors Including National Pension Service

"Will SK Square really just leave 11st like that?"

On the 19th, a senior official from the investment banking (IB) industry cautiously raised the possibility of a capital increase by SK Square regarding 11st, whose sale has become uncertain following the recent Tmon and Wemakeprice (Timep) incident.

11st, an open market platform affiliated with SK, is currently undergoing a forced sale process led by financial investors (FIs) due to accumulated deficits and a failed initial public offering (IPO). Recently, Oasis, a domestic dawn delivery platform company, attempted to acquire 11st, but the deal reportedly fell through due to disagreements over the merger and acquisition (M&A) method.

Moreover, with the large-scale unpaid sales proceeds incident involving Timep, the e-commerce market atmosphere has become more strained than ever, making the exit (capital recovery) of FIs through the sale of 11st increasingly difficult.

A senior official from a private equity firm stated, "With the National Pension Service having invested several hundred billion won, SK Square cannot just leave 11st unattended," adding, "They will have no choice but to present additional measures, even for the sake of the group's pride."

The most likely scenario at present is a capital increase plan where SK Square injects additional capital into the deficit-ridden 11st. The industry views the most realistic approach as SK Square proceeding with a capital increase that dilutes the shares of major FIs and partially adjusts shareholder agreements.

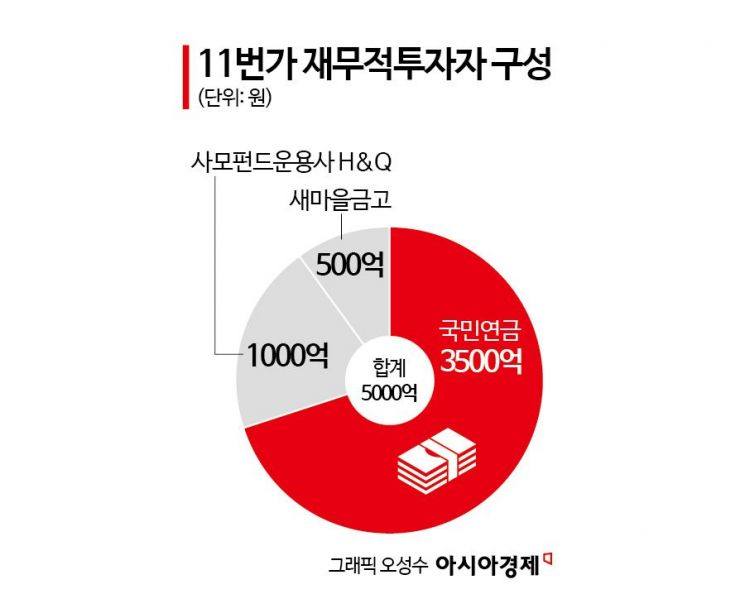

In 2018, SK Square received a total investment of 500 billion won in 11st under the condition of an IPO within five years, including 350 billion won from the National Pension Service, 100 billion won from the blind fund of private equity firm H&Q, and 50 billion won from Saemaeul Geumgo.

The agreement included a call option clause allowing SK Square to repurchase FI shares for about 550 billion won, which is the principal plus an annual interest rate of 3.5%, in case of failure. If SK Square waived this, FIs were guaranteed a tag-along right to sell the shares of the major shareholder SK Square to a third party.

In 2022, SK Square selected Korea Investment & Securities, Goldman Sachs, and Samsung Securities as lead underwriters to challenge the IPO, but due to liquidity deterioration and other factors, the listing was delayed and eventually missed the deadline. Subsequently, focusing more on recovering FI investments than the IPO, SK Square negotiated a sale with e-commerce platform Qoo10, but the deal ultimately collapsed due to disagreements over transaction terms.

11st, which has continued to operate at a loss, is in a difficult position to survive without additional capital injection. Since the second half of last year, it has implemented two rounds of voluntary retirement and conducted workforce efficiency improvements through internal personnel redeployment. In September, to reduce costs, the headquarters located at Seoul Square in front of Seoul Station will be relocated to U Planet Tower in Gwangmyeong, Gyeonggi Province.

As the forced sale of 11st, once considered the last scenario, has become difficult, the IB industry expects SK Square to intervene. Despite the chaotic situation with SK Group’s plans for affiliate mergers, the consensus is that SK Square will want to demonstrate responsibility toward FIs, including the National Pension Service, in line with industry sentiment.

The current corporate value of 11st is mentioned to be around 500 billion won. At the time of the 2018 investment, it was valued at 2.7 trillion won, but the valuation discussed during negotiations with Qoo10 dropped sharply to about one-third, approximately 1 trillion won. After several failed attempts to sell to potential buyers such as Amazon, Alibaba, Qoo10, and Oasis, 11st has reached a dead end with no room to retreat.

An SK Square official said, "We plan to actively cooperate with the FI-led sale," adding, "11st has also demonstrated profit improvement by achieving profitability in the open market sector in the first half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.