Woori and Hyundai Achieve Single-Digit Growth... Lotte Down 80%

Concerns Over Mid- to Long-Term Performance Amid 1.7% Delinquency Rate

In the first half of this year, the net profit of the card industry increased by 5% compared to last year, while interest expenses (financial costs) caused mixed results. The delinquency rate recorded a higher level than last year, raising concerns about long-term profitability decline.

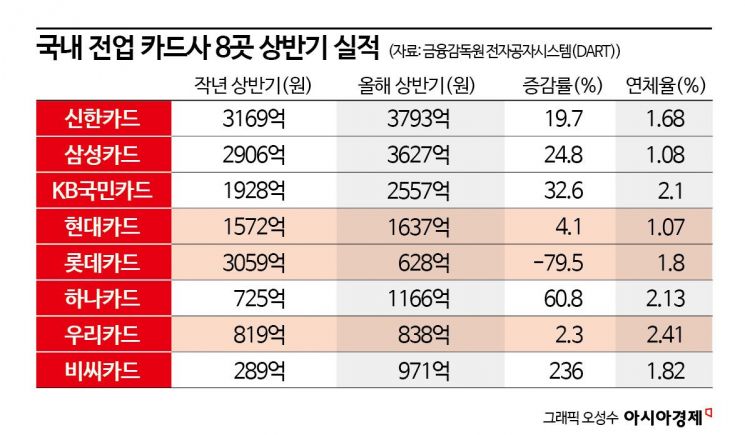

According to each card company on the 16th, the net profit (based on controlling shareholder equity) of eight domestic full-service card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Hana, BC, and Woori Card) totaled 1.522 trillion KRW in the first half of this year. This represents a 5.19% increase compared to the same period last year (1.4469 trillion KRW).

By card company, five companies including Shinhan, Samsung, Kookmin, Hana, and BC Card saw significant profit growth. Shinhan Card, the number one credit card company, recorded a net profit of 379.3 billion KRW in the first half of this year, a 20% increase from the previous year. During the same period, Samsung Card’s net profit rose 25% from 290.6 billion KRW to 362.7 billion KRW. Kookmin Card achieved a 33% growth with 255.7 billion KRW in net profit, and Hana Card recorded a 61% increase with 116.6 billion KRW. BC Card’s net profit was around 28.9 billion KRW in the first half of last year but surged 236% to 97.1 billion KRW this year.

However, Lotte, Woori, and Hyundai Cards saw sharp declines or minimal growth in net profit. Lotte Card’s net profit dropped 79.5% from 305.9 billion KRW in the first half of last year to 62.8 billion KRW this year. Even excluding the one-time gains from subsidiary sales last year, the net profit decline was about 41.7%. A Lotte Card official attributed the poor performance to “increased funding costs leading to decreased net profit,” adding, “From the second half of this year, performance improvement is expected through optimization of funding structure, reduction of new funding interest rates, and turning the Vietnamese subsidiary profitable.”

Woori and Hyundai Cards recorded single-digit growth rates. Woori Card’s net profit increased by 2.3% to 83.8 billion KRW in the first half of this year, while Hyundai Card’s net profit rose 4.1% to 163.7 billion KRW.

Industry insiders evaluated that interest expenses due to prolonged high interest rates divided the card companies’ performance in the first half of this year. Although market interest rates have fallen due to expectations of rate cuts, they remain higher than the average interest rate of borrowings raised during past low-interest periods, so the efficiency of interest expenses determines profitability. Lotte, Woori, and Hyundai Cards, which did not see significant net profit growth compared to the first half of last year, experienced interest expense increases of around 30%. Conversely, BC and Samsung Cards, which showed large growth, had interest expense increases of only 0.2% and 4%, respectively.

An industry official explained, “Card companies that have expanded operations through installment plans and card loans and increased assets inevitably see total interest expenses rise,” adding, “For the time being, performance is expected to increase mainly for card companies that smoothly secure funding and suppress the growth of interest expenses.”

In the mid to long term, asset soundness was identified as a factor that will determine card companies’ performance. As of the end of June, the actual delinquency rate of the eight card companies was 1.76% (arithmetic average). Although it stabilized compared to the end of March (1.85%), it slightly increased compared to last year’s 1.4?1.6%. The actual delinquency rate refers to the ratio of loans overdue by more than one month, including refinancing loans. An industry insider said, “If the delinquency rate is high, there is a risk of decreased performance due to bad debt expenses. Soundness management should also be a focus.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.