Prominence of ICG, BC Partners, Permira, etc.

World's 4th Largest PEF Manager Also Attracts AI-Focused VC

Dominant 'Buyout' Investments... Increasing Private Debt Investments

The National Pension Service's (NPS) private equity fund (PEF) investment scale has increased by about 8 trillion won in one year. Additionally, British asset management firms have emerged as trusted partners for the NPS.

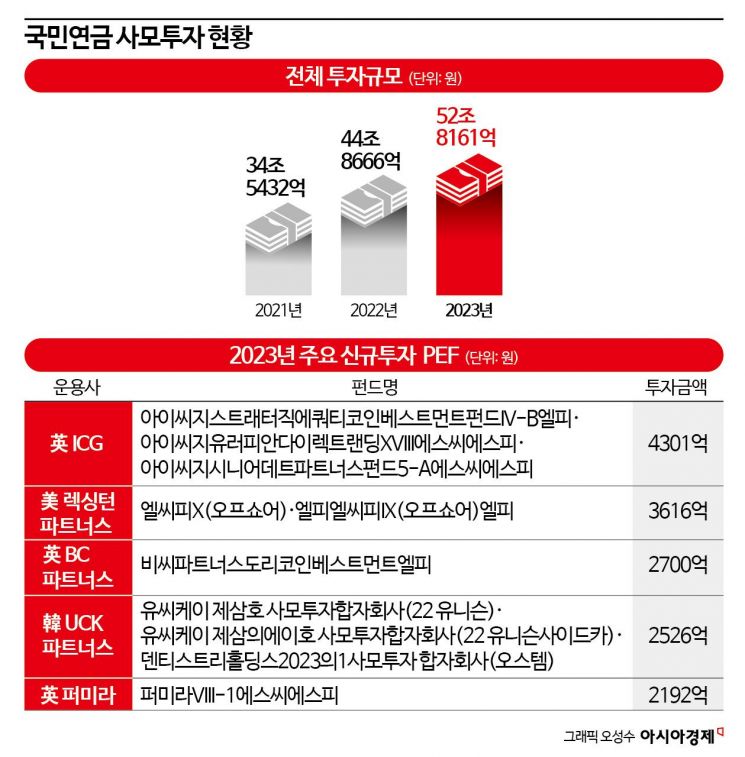

According to the 'Alternative Investment Status by Fund and Related Statistics (2023)' released by the NPS Fund Management Headquarters on the 16th, the total PEF investment amount as of the end of last year was 52.8161 trillion won. Compared to 44.8666 trillion won in 2022, this represents an increase of 7.9495 trillion won (17.7%). The NPS discloses investment statistics by sector every August for the previous year.

Among the top 5 new fund managers, 3 are British

Looking at the detailed investment status by fund, the NPS was invested in a total of 494 PEFs. Among these, 48 were newly added to the portfolio. Among the newly invested funds, the fund manager receiving the largest investment from the NPS was the British firm ICG. The NPS invested 292.5 billion won in the 'ICG Strategic Equity Coinvestment Fund IV-B LP' and a total of 430.1 billion won across three ICG funds. ICG is recognized as a global leader in private debt management. Its assets under management (AUM) stood at $101 billion (approximately 137 trillion won) as of the end of June.

The second most selected manager was the US-based Lexington Partners, which received 361.6 billion won across two funds. Following were the British BC Partners (one fund, 270 billion won), Korean UCK Partners (three funds, 252.6 billion won), and British Permira (one fund, 219.2 billion won). Among the top five managers by investment amount, three are British. BC Partners has maintained ties with the NPS since 2021, when the NPS acquired shares and became a major shareholder. UCK Partners received investments from the NPS in all three of its blind funds (funds raised without predetermined investment targets) and was named an 'Outstanding Manager' by the NPS in 2022.

Additionally, notable investments include 145.9 billion won (three funds) in the US-based Apollo Global and 66.1 billion won (one fund) in the venture capital (VC) firm SAI Group. Apollo Global manages assets ranked fourth globally after Blackstone, Carlyle, and Kohlberg Kravis Roberts (KKR), and is recognized as the world leader in private debt. Silicon Valley-based SAI Group is gaining attention as an AI-focused investment firm. Both Apollo Global and SAI Group were not on the NPS investment list in 2022 and have newly appeared.

Buyout concentration remains... Private debt also growing

By strategy, buyouts aimed at acquiring controlling stakes accounted for the largest share at 57.9%, up from 56.9% in 2022. This indicates that most investments were made through buyout-type private equity fund managers. Following were private debt (11.9%), distressed assets (6.6%), secondary funds (6.0%), mezzanine (5.0%), and venture capital (3.5%). Notably, private debt investments increased by 1.2823 trillion won from 4.0807 trillion won in 2022 to 5.363 trillion won. This is related to the fact that a significant portion of newly invested funds are private debt.

The domestic share of private equity investments was 17.2%, while overseas investments accounted for 82.8%. Overseas investments have been increasing year by year, while domestic investments have been declining. 'Global investments' covering all regions worldwide accounted for the highest share at 40.1%, followed by North America (22.0%), Europe (15.4%), and Asia excluding Korea (5.3%). By type, project-type investments accounted for 14.7%, and fund-type investments accounted for 85.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)