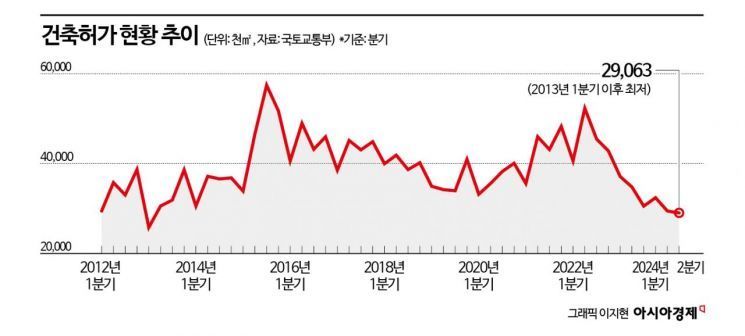

Q2 Building Permit Area Lowest Since Q1 2013

Housing Supply Red Light... Industry Cautious Despite 8.8 Measures

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. The new apartments on the left are Acro Riverview Sinbanpo, the low old apartments on the right are Sinbanpo 2nd Complex, and the apartments under construction in the back are the Maple Xi construction site. Photo by Huh Younghan younghan@

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. The new apartments on the left are Acro Riverview Sinbanpo, the low old apartments on the right are Sinbanpo 2nd Complex, and the apartments under construction in the back are the Maple Xi construction site. Photo by Huh Younghan younghan@

The building permit area, a barometer of the construction market and housing supply, has fallen to its lowest level in 11 years. This is the aftermath of private construction companies, who are supposed to build residential and commercial buildings, holding back due to the economic downturn. Although the August 8th measures aimed at revitalizing housing supply were recently announced, the industry predicts it will be difficult to revive the private construction market, which has bottomed out. The reduction in building permit area will lead to a shortage of housing supply in the future. There are calls for measures to revive the construction market to ensure the effectiveness of policies.

According to the Ministry of Land, Infrastructure and Transport on the 14th, the building permit area in the second quarter of this year was 29.063 million square meters. This is the lowest level since the first quarter of 2013 (25.842 million square meters), when the worst real estate market downturn hit. In 2013, the then Deputy Prime Minister Choi Kyung-hwan, who took office the following year, even urged people to "buy houses with debt," reflecting the recession. On the other hand, compared to the quarterly average building permit area during the real estate boom from 2018 to 2022 (40.362 million square meters), the second quarter of this year shows a decrease of about 30%.

The building permit area compiled by the Ministry of Land, Infrastructure and Transport mainly consists of residential and commercial buildings constructed by private construction companies. Looking at the building permit area by use in the second quarter of this year, residential buildings including apartments and villas accounted for 9.891 million square meters, and commercial buildings such as office buildings accounted for 7.264 million square meters. Compared to the 2018?2022 average, these figures represent decreases of 27% and 35%, respectively.

On the 12th, at the Cheonho 4 Promotion Zone Urban Environment Improvement Project site in Gangdong-gu, Seoul

On the 12th, at the Cheonho 4 Promotion Zone Urban Environment Improvement Project site in Gangdong-gu, SeoulPhoto by Jinhyung Kang aymsdream@

An official from a construction company said, "The decrease in permit area reflects the atmosphere that construction companies are less willing to build." He added, "Although housing prices in Seoul are rising, construction costs have increased, lowering the profitability of redevelopment projects. It is a situation where it is difficult to jump in readily." Last month, only DL E&C participated in the selection of the contractor for the Hannam 5 district redevelopment project in Yongsan-gu, resulting in an automatic failure. Earlier this month, no construction companies participated in the bidding for the Machon 3 district construction rights in Songpa-gu, leading to a situation where a re-bid is necessary.

There are also opinions that the expansion of housing supply under the August 8th measures may not significantly help private construction companies secure orders. A representative from a major construction company said, "Although they said they would create new sites by lifting the Greenbelt and normalize the speed of redevelopment projects, it will take at least five years, and even then, related laws must be amended in the National Assembly before any expectations can be made. Therefore, there will be little effect on increasing permits or construction starts."

At least, the construction start area in the second quarter of this year was recorded at 21.219 million square meters, up from 16.906 million square meters in the first quarter. This is because more projects that had obtained permits in the past but had not yet broken ground have started construction. A Ministry of Land, Infrastructure and Transport official explained, "The number of projects starting construction has recently increased as the government has expanded project financing (PF) guarantee policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.