2Q Revenue 7.056 Trillion KRW, Down 3%

Emart Separate Basis H1 Operating Profit Up

Trader's Performance Improved with Increased Customers

Shinsegae Property & SCK Company Also Strong Results

Focus on Profitability Enhancement in H2

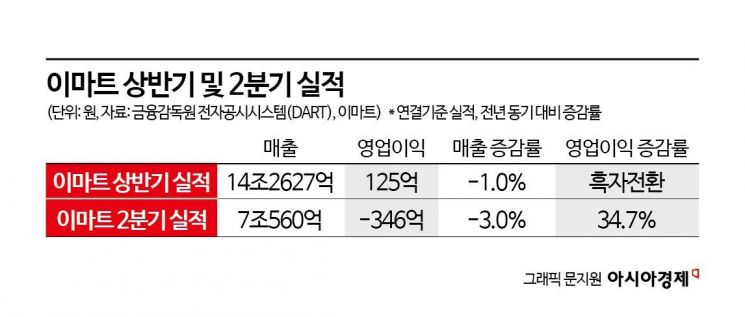

Emart recorded an operating profit of 12.5 billion KRW in the first half of this year, turning profitable compared to the same period last year.

Emart announced on the 13th that it achieved consolidated sales of 14.2627 trillion KRW and an operating profit of 12.5 billion KRW in the first half of this year. Compared to the first half of last year, sales decreased by 143.8 billion KRW, a 1% decline, but operating profit improved by 51.9 billion KRW.

Emart’s Separate Sales Decline... Profitability Improves

Excluding the performance of subsidiaries, Emart’s separate total sales for the first half decreased by 0.1% year-on-year to 8.0422 trillion KRW, while operating profit increased by 33.7 billion KRW to 72.2 billion KRW.

However, consolidated sales in the second quarter of this year fell 3% year-on-year to 7.056 trillion KRW. Operating loss improved by 18.4 billion KRW compared to last year, recording a loss of 34.6 billion KRW. When reflecting one-time costs of 8.9 billion KRW, the consolidated operating loss is approximately 25.7 billion KRW.

On a separate basis, total sales in the second quarter decreased by 2.5% year-on-year to 3.8392 trillion KRW, and operating loss improved by 4.8 billion KRW to 21 billion KRW. The deficit continued due to the inclusion of property tax amounting to 72 billion KRW. Previously, Emart recorded second-quarter losses due to the one-time reflection of property taxes in 2022 and 2023, but it had posted an annual operating profit of around 200 billion KRW.

Emart analyzed that despite challenging domestic and international conditions, efforts to strengthen core business competitiveness and improve profitability, such as the 'Price Shock Declaration' and 'Price Reversal,' were effective. In addition, major offline subsidiaries like Shinsegae Property showed strong performance, while online subsidiaries such as SSG.com and Gmarket succeeded in improving operating results for two consecutive quarters.

Regarding the slight decrease in sales, Emart explained that the closure of Cheonan Pentaport store in April and Sangbong store in May, along with renovation work at four large stores including Jukjeon, partially restricted business activities.

Continuous Increase in Customer Numbers? Traders and Subsidiaries Show Strong Performance

Warehouse discount store Traders recorded a 3.9% increase in sales in the second quarter compared to the same period last year, with operating profit rising 65% to 22 billion KRW.

Major offline subsidiaries also showed growth in performance. Shinsegae Property, benefiting from the opening of Starfield Suwon, recorded sales of 75.2 billion KRW, a 14.1% increase compared to the same period last year. Operating profit improved by 6 billion KRW during the same period, successfully turning profitable.

SCK Company, which operates Starbucks, posted an operating profit of 43.1 billion KRW, an increase of 6.7 billion KRW year-on-year, supported by continuous new store openings. Shinsegae Food recorded an operating profit of 9.7 billion KRW, up 1.7 billion KRW, due to increased demand in the group catering business and improved operational efficiency. Chosun Hotel & Resort achieved an operating profit of 6.9 billion KRW, maintaining profitability for two consecutive quarters thanks to improved occupancy rates.

However, Shinsegae Construction continued to post operating losses due to the downturn in the construction market and rising construction costs.

Online subsidiaries continued to improve profitability by reducing losses. SSG.com achieved an EBITDA-based operating profit of 2.2 billion KRW, an increase of 3.1 billion KRW year-on-year, thanks to strong sales of online-exclusive products including department store items, increased advertising revenue, and reduced logistics costs. During the same period, Gmarket also improved its EBITDA by 3.9 billion KRW to an operating loss of 1 billion KRW, supported by reduced inefficient promotions and logistics cost optimization.

Emart will continue its focused strategies on strengthening profitability both online and offline in the second half of the year.

Offline, Emart plans to enhance product competitiveness through increased purchasing power from the integration of procurement organizations of Emart and Emart Everyday, as well as joint product development to create synergy. Additionally, a new type of store focused on groceries will be introduced within the year, and some stores scheduled for renovation this year will be converted to mall-type stores to improve operational efficiency.

An Emart official stated, "Offline will secure cost competitiveness through integrated procurement among the three companies, and by activating integrated marketing and improving logistics efficiency, we aim to achieve both sales growth and profitability enhancement. Online will build a stable EBITDA-positive structure by enhancing product and price competitiveness. With intensive efforts to improve profitability, a more distinct performance rebound is expected in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.