Bankware Global IPO Price Below Offering on 12th

9 Companies to Go Public in Second Half... Only 3 Exceed Offering Price

There is still controversy over the bubble in the public offering price in the initial public offering (IPO) market. More than half of the newly listed companies in the second half of the year have traded below their public offering price.

According to the Korea Exchange on the 13th, Bankware Global, which was listed the day before, closed at 15,750 won, down 250 won (1.56%) from the public offering price of 16,000 won. Although it rose to as high as 19,800 won during the session, it ultimately failed to maintain the upward trend. This marks the first day on the KOSDAQ where the stock price fell below the public offering price. Bankware Global is also the first company this year to record a price below the lower end of the public offering price. The company’s expected public offering price range was 16,000 to 19,000 won. The demand forecast competition rate was 155.74 to 1, and the subscription competition rate was 239.18 to 1.

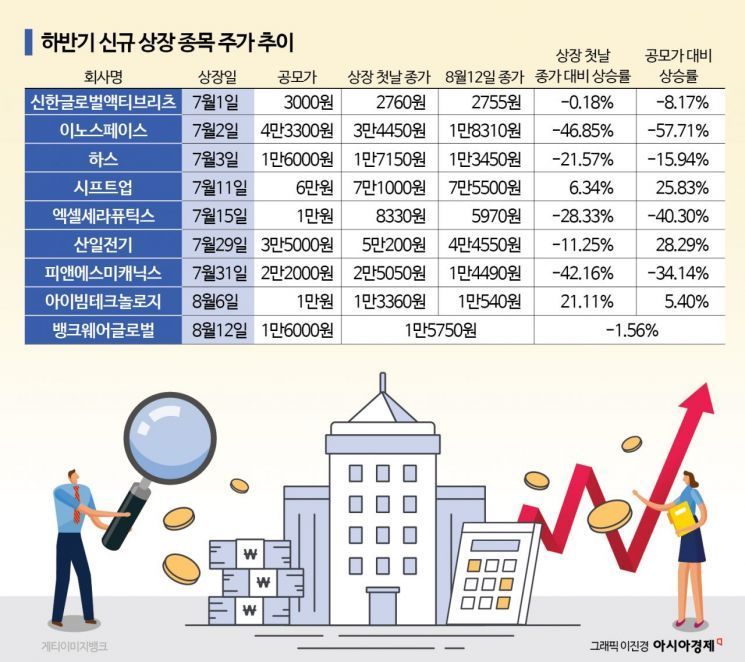

The performance of companies listed in the second half of this year, including Bankware Global, has not been good. From last month until this day, a total of nine stocks have been listed, including Shinhan Global Active REITs. Among these stocks, only Shift Up, Sanil Electric, and iBeam Technologies are trading above their public offering prices.

The company with the highest decline rate compared to the public offering price is Innospace. Innospace’s public offering price was set at the upper end of the expected price range (36,400 to 43,300 won) during the demand forecast. A total of 2,159 domestic and foreign institutions participated, recording a competition rate of 598.87 to 1. In the public subscription for general investors, the competition rate was 1,150.72 to 1, with about 8.2836 trillion won in subscription deposits. However, on the first day of listing, it closed at 34,450 won, below the public offering price. Notably, on the 12th of this month, it recorded 18,650 won, a 57.71% drop compared to the public offering price.

Additionally, Excel Therapeutics closed at 8,330 won on the first day of listing, down 28.33% from the public offering price of 10,000 won. On the 12th, it recorded 5,970 won, a 40.30% decline from the public offering price. Along with this, P&SM Mechanics also closed at 14,490 won, down 34.14% from the public offering price of 22,000 won.

This decline in stock prices is interpreted as a phenomenon resulting from the expansion of price fluctuation limits to 60-400% since June 26 last year. Because the stock price tends to rise sharply on the first day of listing, selling at the opening price can yield profits. In fact, the opening prices of stocks listed in the first half of last year rose by an average of 67.8% compared to the public offering price, but in the second half, they rose by 95.49%. In the first half of this year, it reached 124.07%.

Oh Kwang-young, a researcher at Shin Young Securities, said, "Concerns still remain due to excessive interest in some stocks, leading to overvaluation controversies and rapid changes in stock price trends after listing, so caution is necessary." He added, "Excessive interest increases the likelihood of overheating due to the limited number of public offering shares." He continued, "Therefore, we must not forget the experience where some overvalued public offering stocks appeared, causing the public offering market to freeze rapidly."

However, there is also analysis that the public offering market is moving from an overheated state to stabilization. According to Eugene Investment & Securities, the opening price increase rate compared to the public offering price for companies listed in July was 32.8%, the lowest this year. The closing price yield was even lower at 7.6%. Park Jong-sun, a researcher at Eugene Investment & Securities, said, "Excluding REITs and SPACs, companies listed in July maintain high profitability, but the closing price yield is low," adding, "It is judged that the previously high volatility after the expansion of the first-day price fluctuation limit has entered a stabilization phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)