Three Consecutive Quarters of Losses Lead to Lower Target Prices

Prolonged Recession... Industry Outlook Remains 'Cloudy' in Second Half

"Valuation at Bottom, Need to Monitor Financial Soundness"

Lotte Chemical's stock price slump continues. Securities firms predict that the petrochemical industry will remain challenging in the second half of the year and have collectively lowered Lotte Chemical's target price. However, they analyzed that the possibility of further stock price decline is low, and it is necessary to monitor the trend of financial soundness through the improvement of free cash flow (FCF).

According to the Korea Exchange on the 13th, Lotte Chemical closed at 81,500 won the previous day. The stock price, which was 153,200 won at the beginning of this year, has fallen by a whopping 46.80%. On the 9th, the day after the Q2 earnings announcement, the stock price plunged more than 10% in a single day, hitting a 52-week low.

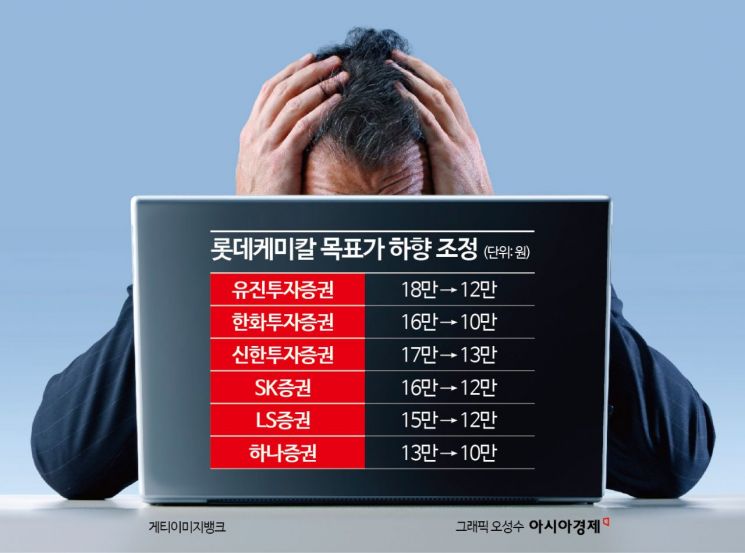

Lotte Chemical reported consolidated sales of 5.2 trillion won and an operating loss of 111.2 billion won in Q2 this year. Sales increased by 3.2% compared to the previous quarter, but the operating loss was far below market expectations (-48.1 billion won). As a result, securities firms hurriedly lowered their target prices one after another. Eugene Investment & Securities (180,000 won → 120,000 won), Hanwha Investment & Securities (160,000 won → 100,000 won), Shinhan Investment Corp. (170,000 won → 130,000 won), and SK Securities (160,000 won → 120,000 won) adjusted their target prices. In particular, Hanwha Investment & Securities downgraded its investment opinion from 'Buy' to 'Hold.'

Jeon Yujin, a researcher at iM Securities, said, "Lotte Chemical did not present a bright outlook during the conference call, and even the faint hope is disappearing," adding, "It is also disappointing that key indicators such as China's manufacturing Purchasing Managers' Index (PMI), exports, and retail sales are slowing down."

In the securities industry, there is an analysis that it is necessary to lower expectations for the remaining second half performance. Yoon Yongsik, a researcher at Hanwha Investment & Securities, said, "In addition to the current low profitability, inventory valuation gains and losses, which have a greater impact on performance than in the past, may be negatively affected by falling oil prices," adding, "Moreover, the burden is that global new capacity expansions are expected to increase again to 7 million tons in 2026 and 10 million tons in 2027."

Yoon Jaesung, a researcher at Hana Securities, also said, "It is highly likely that operating losses will continue in the third quarter following the second quarter," and "Due to the recent slowdown in manufacturing centered on China and the United States, the petrochemical market is weak, so performance improvement will be limited."

Although the securities industry's outlook is bleak, Lotte Chemical announced at last month's 'CEO Investor Day' that it will improve free cash flow by a total of 4.9 trillion won to overcome the difficult petrochemical industry. Accordingly, Lee Jinmyung, a researcher at Shinhan Investment Corp., analyzed, "In the short term, until 2025, asset lightening, operational efficiency, and financial soundness enhancement through investment risk management will have an important impact on fundamentals," adding, "The current price-to-book ratio (PBR) has fallen to the lowest level ever, so the possibility of further stock price decline is low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.