CPI Increase Rate at 3% Year-on-Year

0.2% Month-on-Month Forecast

Signs of Customer Consumption Slowdown

Detected in Recent US Corporate Earnings

Home Depot on 13th, Walmart on 15th

Top Focus for Earnings Releases

Investor fears over a potential U.S. economic recession have somewhat eased, but Wall Street remains on edge. This week’s release of U.S. inflation and retail sales data, along with earnings reports from retail giants, could reignite negative factors for the stock market, potentially sending it on another rollercoaster ride.

Major Inflation Indicators to Be Released Simultaneously This Week

According to Yahoo Finance on the 11th (local time), this week will see the simultaneous release of key U.S. inflation indicators such as the Consumer Price Index (CPI), Producer Price Index (PPI), as well as retail sales, industrial production, and manufacturing data from regional Federal Reserve Banks. These major indicators, which could provide hints about signs of recession that recently triggered market declines and the direction of the Federal Reserve’s (Fed) monetary policy, will all be unveiled at once.

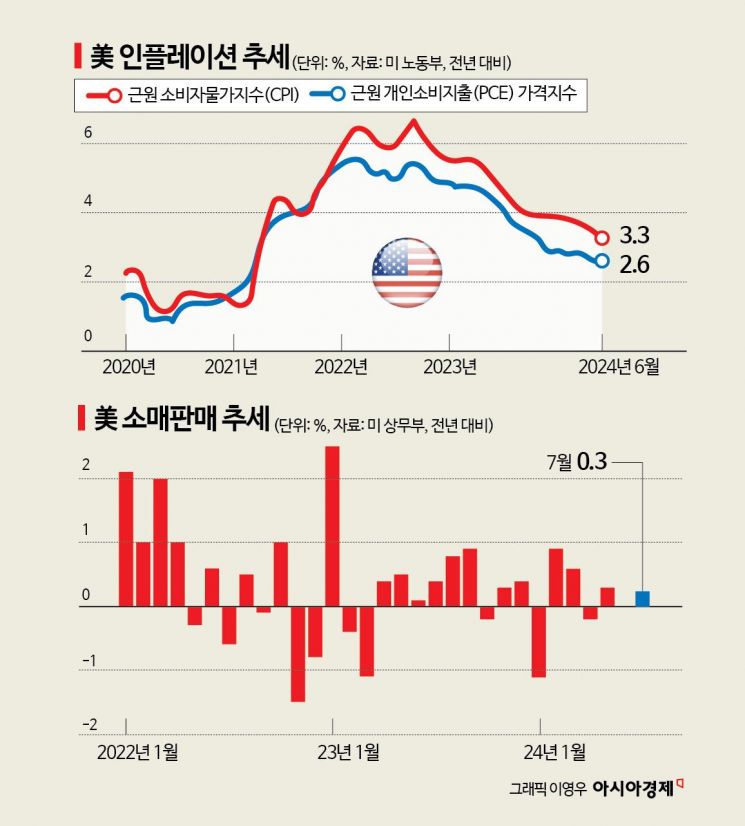

Yahoo Finance estimates that the July CPI will rise 3.0% year-over-year and 0.2% month-over-month. The core CPI, which excludes the volatile energy and food sectors, is expected to increase 3.2% year-over-year, slightly down from 3.3% the previous month. Yahoo Finance noted, "Inflation will come back into focus," adding that "the interest rate debate surrounding the Fed will be put to the test on Wednesday, the 14th, when the July CPI is released."

Retail sales, which account for two-thirds of the U.S. economy, will also be released. July retail sales, scheduled for release on the 15th, are expected to increase by 0.3% month-over-month. If strong consumer spending is confirmed, fears of a recession could recede. Industrial production, manufacturing, regional Federal Reserve manufacturing indexes, and weekly unemployment claims will also be disclosed. MarketWatch pointed out that the market is already overreacting to each indicator, and if these data fail to sufficiently alleviate concerns about recession and inflation, another stock market plunge is highly likely.

Earnings of Consumer Barometer Companies Also in Focus

Among companies wrapping up the earnings season, retail giants stand out. Following signs of consumer slowdown detected in the second-quarter earnings of major companies such as Walt Disney and Airbnb, the earnings reports of large retailers like Home Depot (on the 13th) and Walmart (on the 15th) have become the center of attention.

Brad Conger, Chief Investment Officer (CIO) at Hirtle Callaghan & Co., said, "There is no doubt that a very tough consumer environment persists," adding that "this reflects increased uncertainty about consumers’ future income." Brian Moynihan, Chief Executive Officer (CEO) of Bank of America (BoA), appeared on CBS’s Face the Nation that day and remarked, "If rate cuts don’t start soon, it could dampen consumer enthusiasm. Once consumer sentiment turns negative, it’s hard to reverse."

Four Fed Officials Scheduled to Speak... Is a 'Big Cut' in September Coming?

With a rate cut expected in September, the market is closely watching statements from Fed officials. This week, public remarks are scheduled from Raphael Bostic, President of the Atlanta Fed; Patrick Harker, President of the Philadelphia Fed; Austan Goolsbee, President of the Chicago Fed; and Alberto Musalem, President of the St. Louis Fed. Amid ongoing recession concerns due to consumer slowdown, investors will likely seek hints from their comments on whether the Fed will implement a 'big cut' in September.

Michelle Bowman, a Fed Governor known as a hawk (favoring monetary tightening), stated in a private speech to the Kansas Bankers Association on the 10th that inflation and labor market strength risks remain, suggesting that a rate cut in September is still uncertain.

Meanwhile, last week the U.S. New York Stock Exchange was shaken by a series of negative factors, including the shock from the July employment report and the unwinding of the yen carry trade (investing in asset markets using low-interest-rate yen). However, toward the end of the week, the market recovered as indicators showing expansion in the service sector and employment were confirmed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.