352 Cases, 15.3 Billion KRW in Sojinkong Funds

395 Cases, 133 Billion KRW Applied for in Jungjinkong Funds

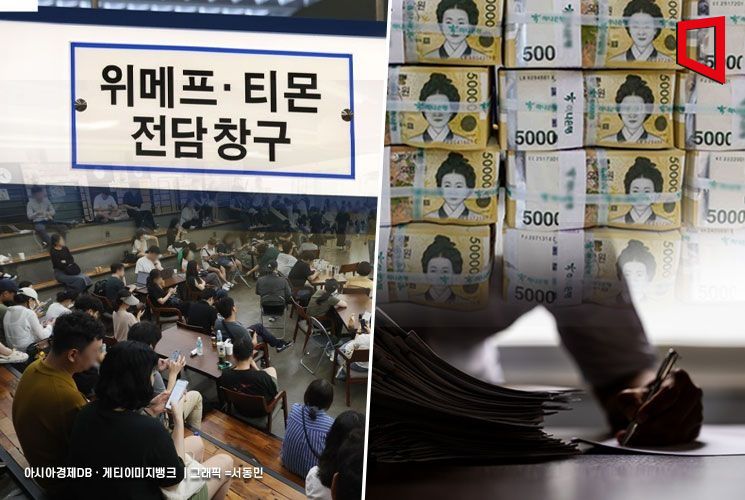

On the 12th, the Ministry of SMEs and Startups announced that as of now, 747 applications totaling 148.3 billion KRW have been submitted for the emergency management stabilization funds for small and medium-sized enterprises (SMEs) and small business owners affected by unpaid settlements from Tmon and Wemakeprice, which began accepting applications on the 9th.

Specifically, as of 6 PM on the 11th, 352 applications amounting to 15.3 billion KRW were received for the Small Enterprise and Market Service's emergency management stabilization fund, and 395 applications totaling 133 billion KRW were received for the Korea SMEs and Startups Agency's emergency management stabilization fund.

The Ministry plans to operate the Small Enterprise and Market Service (SEMAS) fund at a scale of 170 billion KRW. Accordingly, applications and submissions for SEMAS funds will continue. SEMAS funds provide support up to a maximum of 150 million KRW within the unpaid amounts from Tmon and Wemakeprice, with an interest rate of 3.51% (variable) and a term of 5 years including a 2-year grace period. The support will be provided through direct loans to reduce guarantee fee burdens, and SEMAS will handle all procedures from application and submission to disbursement to ensure prompt support.

Applications for SEMAS funds are being accepted via the Small Business Policy Fund website and at 77 regional centers nationwide, and submissions can be made including weekends until the funds are exhausted. However, considering that applications for the Korea SMEs and Startups Agency (KOSME) fund, initially planned to operate at 30 billion KRW, have reached 133 billion KRW, submissions are now closed. Various measures will be reviewed to maximize support for already submitted applications within feasible limits.

Additionally, SMEs affected by unpaid settlements from Tmon and Wemakeprice can also utilize agreement programs with Industrial Bank of Korea and Korea Credit Guarantee Fund besides the KOSME fund. By applying for special guarantees at Korea Credit Guarantee Fund branches, support is provided through Korea Credit Guarantee Fund’s guarantee screening followed by fund supply from Industrial Bank of Korea. For more details, inquiries can be made to Korea Credit Guarantee Fund or Industrial Bank of Korea.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)