KOSPI Rises 6% After 5-Day Plunge

Concerns Over US Recession and Yen Carry Trade Unwinding Ease

Buying Opportunity Considering September Rate Cut

However, Response Needed While Monitoring Economic Indicators

The stock market has been gradually recovering since the 'Black Monday' on the 5th. As the factors that caused the market crash have eased, the fear sentiment is also calming down.

However, since the market was severely shocked due to recession concerns, it does not seem easy for the frozen investor sentiment to recover quickly. Experts advise adopting a short-term trading strategy with a stepwise upward pattern in mind.

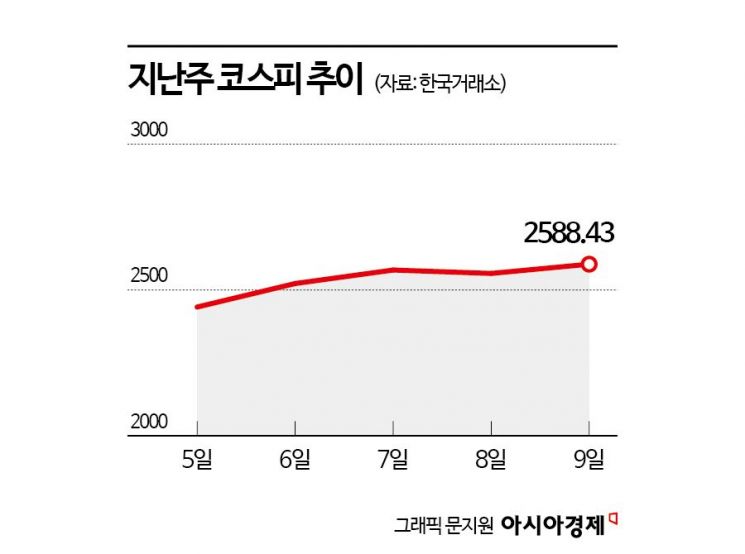

According to the Korea Exchange on the 12th, the KOSPI, which plummeted 8.77% to the 2440 level on the 5th, has since risen more than 6% to the 2580 level, recovering much of the loss.

As recession concerns have eased and worries about the unwinding of the yen carry trade have somewhat subsided, opinions suggest that this market correction has passed a major hurdle. Kang Daeseok, a researcher at Yuanta Securities, said, "The main issues identified as causes of this correction are concerns about a U.S. recession, unwinding of the yen carry trade, price burdens in tech sectors including artificial intelligence (AI), and a slowdown in momentum during earnings season." He added, "Among these, the concerns about a U.S. recession were momentarily excessive, and although uncertainty remains regarding the yen carry trade, it is judged that the worst sell-off has passed." He continued, "Ultimately, the market has rebounded after the sharp drop, volatility surges have stopped, and the domestic market as well as Asian markets, which had relatively large declines, are recovering nearly half of their losses."

Although fear sentiment is calming, investors inevitably face deep deliberation regarding investment strategies. This is because recession concerns and yen carry trade unwinding have not been completely resolved, and geopolitical tensions in the Middle East are escalating, maintaining uncertainty. If economic indicators that could trigger recession fears are released, the market could fluctuate again. Lee Kyungmin, a researcher at Daishin Securities, said, "The cyclical link between U.S. recession fears and yen carry trade unwinding is the main cause of this market crash and will determine short-term market fluctuations for the time being."

Considering possible interest rate cuts in September, some opinions suggest that now is a buying opportunity. Kang Jaehyun, a researcher at SK Securities, said, "The likelihood of the U.S. economy entering a recession is very low, so the recent global market correction due to recession worries was excessive." He explained, "Moreover, from September onward, with the start of interest rate cuts, a real improvement in economic momentum is expected, so the current low stock market level will be a buying opportunity." Lim Haein, a researcher at Hanwha Investment & Securities, also said, "I think this correction should be seen as a buying opportunity," adding, "If the market recognizes that the economy is sound and focuses on the September base rate cut, stocks will return to a recovery trend."

However, since uncertainties still remain, it seems prudent to respond with some caution rather than aggressively buying. Kim Younghwan, a researcher at NH Investment & Securities, said, "Currently, the U.S. unemployment rate is not historically high enough to discuss recession concerns, but the recent rise is similar to pre-recession situations in the past. If it continues to rise sharply over the coming months, recession fears could increase again." He added, "On the other hand, if the rise is due to temporary factors such as hurricanes and does not increase significantly in the future, recession concerns may subside. At present, it is difficult to assert either side, so investors should watch indicators with some caution."

The researcher said, "Until the U.S. Federal Open Market Committee (FOMC) meeting in September, every economic indicator released will cause the KOSPI and global financial markets to react sensitively between monetary policy and recession concerns. Therefore, at this point, a short-term trading strategy with a stepwise upward pattern in mind is effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.