Summary of Supportive and Opposing Opinions in the Political Sphere

The introduction of the Financial Investment Income Tax (Fin-Income Tax) is just five months away. In the political arena, heated debates are ongoing daily over the 'abolition of the Fin-Income Tax.' The People Power Party has submitted a bill to abolish the Fin-Income Tax as a party stance. The Democratic Party of Korea is discussing all possibilities, including implementation, abolition, and adjustment. This article summarizes the positions of both ruling and opposition parties on the Fin-Income Tax and key issues.

In August, the political sphere is heatedly debating the 'Financial Investment Income Tax (Geumtu Tax)' to be introduced next year. Han Dong-hoon, leader of the People Power Party, strongly advocates for the abolition of the Geumtu Tax, while Jin Seong-jun, policy chief of the Democratic Party, maintains the position to implement it as planned.

In August, the political sphere is heatedly debating the 'Financial Investment Income Tax (Geumtu Tax)' to be introduced next year. Han Dong-hoon, leader of the People Power Party, strongly advocates for the abolition of the Geumtu Tax, while Jin Seong-jun, policy chief of the Democratic Party, maintains the position to implement it as planned.

Controversy over Double Taxation

Song Eon-seok, a member of the People Power Party, said after a 'Fin-Income Tax abolition' forum last month, "We concluded that it is not appropriate to implement the Fin-Income Tax immediately," adding, "There were many discussions about whether the Fin-Income Tax constitutes double taxation considering the securities transaction tax." On the other hand, Jin Sung-jun, the policy chief of the Democratic Party, stated in a phone interview, "If the securities transaction tax is abolished and the Fin-Income Tax is introduced, it will be very advantageous for retail investors," and "So far, 75% of the securities transaction tax has been paid by individuals."

When the Fin-Income Tax implementation bill was passed, both ruling and opposition parties agreed on the premise of easing the securities transaction tax. The securities transaction tax, which was paid unconditionally even without realized gains, was reduced from 0.23% to 0.18% this year. Next year, it will be lowered to 0.15%. Jin, the policy chief, argues that since the 0.15% is levied under the name of the Special Rural Development Tax (Nongteukse), the securities transaction tax is effectively abolished. However, criticism remains about the appropriateness of collecting the Nongteukse during securities transactions, and there is an analysis that as long as the 0.15% remains, the controversy over double taxation will persist.

Meanwhile, the government faces the challenge of addressing the 'tax revenue shortfall' issue. Last month, the Ministry of Economy and Finance stated that while submitting a bill to abolish the Fin-Income Tax, it would maintain the policy of easing the securities transaction tax. However, concerns arise about whether it is acceptable for both taxes not to be collected. There are worries that the securities transaction tax might be raised again to secure tax revenue.

Which Side Represents Tax Cuts for the Wealthy?

Han Dong-hoon, leader of the People Power Party, said at the highest council meeting the day before, "The real wealthy investors in the stock market invest through private equity funds," adding, "Currently, profits from private equity fund redemptions are taxed as dividend income at up to 49.5%, but if the Fin-Income Tax is enforced, the top tax rate will be reduced to 27.5%." Jin, the policy chief, said at the emergency economic inspection meeting on the 7th, "The government and ruling party want to cut taxes for the ultra-wealthy," and asked, "If the Fin-Income Tax for the ultra-wealthy, who make up only 1% of stock investors, is abolished, will the domestic economy revive?"

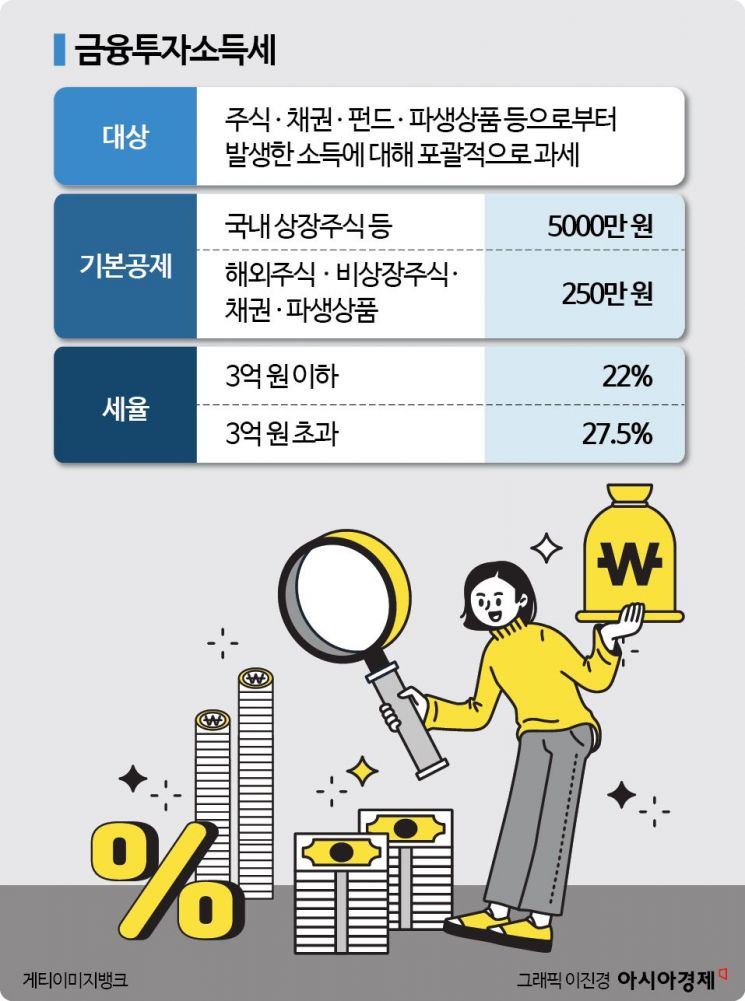

The Fin-Income Tax broadly taxes income generated from stocks, bonds, funds, and derivatives. However, for domestic listed stocks, income up to 50 million KRW is exempted. For overseas stocks, unlisted stocks, bonds, and derivatives, taxes are imposed on income exceeding 2.5 million KRW. Jin, the policy chief, criticized the abolition of the Fin-Income Tax as a 'tax cut for the wealthy,' arguing that assuming a 10% investment return, one would need to invest 500 million KRW in cash to earn 50 million KRW, thus qualifying as 'wealthy.' Han, the leader, explained that he opposes the Fin-Income Tax introduction because the tax rate on private equity fund redemptions would decrease.

However, dividend income received while holding private equity funds is subject to comprehensive financial income taxation, so even if the Fin-Income Tax is implemented, the highest tax rate of 49.5% may apply depending on the case. Furthermore, Kim Woo-cheol, a professor of taxation at the University of Seoul, stated, "Private equity funds, which are considered dividend income, need to be normalized." Professor Kim emphasized, "Private equity funds do not receive dividends annually without risk; it is investment income, not dividends." This means that the current imposition of up to 49.5% tax on private equity funds is unreasonable.

Impact on the Domestic Capital Market?

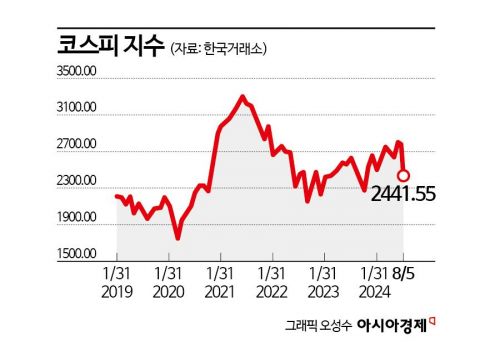

Han, the leader, expressed concern about the introduction of the Fin-Income Tax on the 7th, saying, "Events that become major negative factors have a significant psychological impact on stock prices, usually starting to influence six months in advance." Kim Sang-hoon, policy chief of the People Power Party, said on the 9th, "The abolition of the Fin-Income Tax itself can act as a very symbolic signal to drive the domestic stock market." He analyzed that merely announcing the abolition of the Fin-Income Tax would help the domestic capital market.

Opponents of abolishing the Fin-Income Tax called it an 'excessive fear.' Im Kwang-hyun, a Democratic Party lawmaker, said in a phone interview regarding concerns that 'big players' would exit the market, "Institutional investors are corporations, so they pay corporate tax, and foreign investors do not pay taxes in our country, so they are not subject to the Fin-Income Tax." Kang Sung-jin, a professor of economics at Korea University, told Asia Economy, "Implementing the Fin-Income Tax will not cause a perfect storm," emphasizing, "If the stock market fluctuates because of it, it cannot be considered a country. It is just a matter of fine-tuning."

When Will It Be Introduced?

Regarding the timing of the Fin-Income Tax introduction, some Democratic Party lawmakers supported a delay, while some People Power Party lawmakers spoke about the necessity of implementation. Lee So-young, a Democratic Party lawmaker, said the day before, "Currently, market conditions are very difficult for ordinary investors to achieve long-term profits," and "There is a greater need to revise the 'shareholder protection system' than to implement the Fin-Income Tax."

Kim Woong, a People Power Party lawmaker, said on the 7th on CBS Radio's

Why No Forum?

Han, the leader, said at a meeting with reporters on the 7th, "Usually, I try to match the level of former leader Lee Jae-myung, but matching levels in front of people's livelihoods is not very meaningful, so I said I would hold a forum," adding, "(But) when I actually said that, the Democratic Party ran away saying they would not participate in the forum. I think the Democratic Party lacks political confidence in pushing the Fin-Income Tax."

Several Democratic Party lawmakers have shown an atmosphere of "refraining from responding to the forum proposal aimed at changing the situation." One senior lawmaker claimed, "They have not even presented alternatives to the livelihood recovery support fund," and "This is an attempt to divert attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.