"Need to Lower Interest Rates Up to 4% Remains"

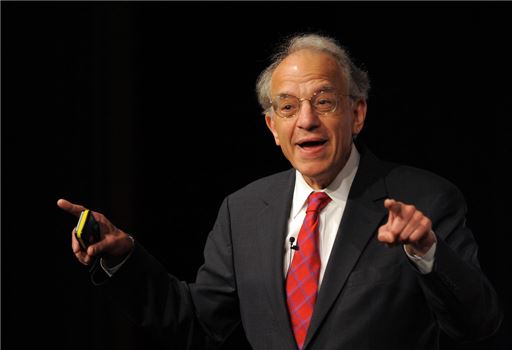

Jeremy Siegel, a world-renowned investment strategist and professor at the Wharton School of the University of Pennsylvania, revised his statement within three days regarding the need for the U.S. Federal Reserve (Fed) to implement an emergency interest rate cut. However, he maintained his previous stance that a swift rate cut is necessary.

On the 8th (local time), Professor Siegel told CNBC in an interview, "I no longer believe an emergency rate cut is necessary."

On the 5th, amid a global stock market plunge triggered by concerns over a U.S. economic recession due to an employment shock, he urged in an interview with CNBC that the Fed should cut rates by 0.75 percentage points through an emergency rate cut and also lower rates again in September. The Fed decided to keep the benchmark interest rate unchanged at 5.25-5.5% as of the 31st of last month.

However, concerns about a cooling labor market, which had been cited as a cause for the expected recession, eased as the U.S. Department of Labor reported that new weekly unemployment claims last week fell short of both expert forecasts and the previous week's revised figures. Supported by this, the Nasdaq index rose 2.87%, and all three major U.S. stock indices rebounded simultaneously.

Although Professor Siegel said the need for an emergency rate cut has disappeared, he still emphasized the need to lower rates quickly, saying, "I hope it is lowered to 4% as soon as possible." He added, "I don't think the situation is collapsing, but according to all standards and monetary rules, the rate should be below 4%."

The market expects the Fed to cut rates by 0.25 percentage points in September and reduce rates by a total of 1 percentage point by the end of this year. However, concerns about the pace of the Fed's rate cuts remain.

Professor Siegel said, "Emergency rate cuts are not Jerome Powell Fed Chair's style," but added, "Chairman Powell acts too slowly, especially during rate hikes. I hope he does not repeat the same mistakes during rate cuts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.