Incheon Chamber of Commerce and Industry Announces Survey of 211 Companies

39% of companies in the Incheon area are affected by China's low-price and large-volume offensive, and 80% expect that within 5 years Chinese companies will surpass domestic competitors in technological capability and quality competitiveness.

The Incheon Chamber of Commerce and Industry recently announced the results of a survey titled 'The Impact of China's Low-Price and Large-Volume Offensive on Companies in the Incheon Area,' conducted on 211 companies in the Incheon region.

According to the survey, 39.3% of Incheon companies reported that China's oversupply and expansion of low-priced product exports have affected their sales and export performance, while 42.2% said there is currently no impact but potential damage is expected in the future. On the other hand, 18.5% of companies responded that the impact is minimal or nonexistent.

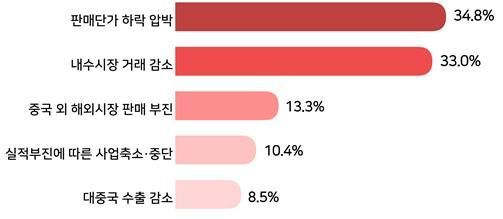

Companies mainly reported experiencing or anticipating damages such as 'pressure to lower selling prices (34.8%)', 'decrease in domestic market transactions (33.0%)', 'poor sales in overseas markets other than China (13.3%)', 'business downsizing or suspension due to poor performance (10.4%)', and 'decrease in exports to China (8.5%)'.

Damage Status and Expectations Due to China's Low-Cost and High-Volume Offensive [Provided by Incheon Chamber of Commerce and Industry]

Damage Status and Expectations Due to China's Low-Cost and High-Volume Offensive [Provided by Incheon Chamber of Commerce and Industry]

The technological capability and quality competitiveness of Incheon companies were found to have either 'narrowed the gap (43.1%)' or 'caught up to a similar level (28.0%)' compared to Chinese competitors. Responses indicating 'maintaining superiority' accounted for 21.3%, followed by 'being surpassed and at a disadvantage compared to Chinese companies (6.2%)' and 'continuing to be at a disadvantage (1.4%)'.

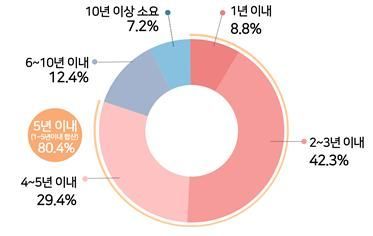

Among companies that responded their technological capability and quality competitiveness are similar to or superior to Chinese competitors (92.4%), 80.4% predicted that Chinese companies will surpass their technological capability and quality competitiveness within 5 years. The remaining respondents expected the surpassing point to be 'within 6 to 10 years' (12.4%) and 'more than 10 years' (7.2%), respectively.

Incheon companies are responding to China's low-price and large-volume offensive with strategies such as 'developing high value-added products and improving quality (33.9%)' and 'pioneering and targeting new export markets (25.1%)'. Additionally, efforts include 'cost reduction such as labor costs (15.4%)', 'securing price competitiveness through local production (8.2%)', and 'market base expansion through product diversification (6.6%)'.

Expected Timeframe for Surpassing Chinese Companies' Technological Capabilities [Provided by Incheon Chamber of Commerce and Industry]

Expected Timeframe for Surpassing Chinese Companies' Technological Capabilities [Provided by Incheon Chamber of Commerce and Industry]

Regarding support policies, companies most frequently selected 'measures to protect domestic industries (34.5%)'. This was followed by 'support for pioneering new markets (24.7%)', 'expansion of research and development (R&D) support (22.9%)', 'expansion of trade finance support (9.0%)', and 'support for utilizing FTA tariff benefits (5.4%)'.

An official from the Incheon Chamber of Commerce and Industry stated, "China's push-out exports are adversely affecting the export conditions and domestic market of domestic companies," adding, "Competition is intensifying especially as the technological and quality levels of Chinese products are also improving."

He continued, "We must establish systems that enable our companies to secure price competitiveness in domestic and international markets through financial and tax support, and expand support for pioneering new sales channels and research and development to respond to China's low-price offensive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)