Retention of 20-30% of Sales for Promotion Participation

Retention Settled Only After Promotion Ends

Many Sellers Have Accumulated Hundreds of Millions in Retention Over Years

Suspected That Tmep Funds Were Used for Circular Financing

The government has estimated the unpaid sales proceeds from Tmon and Wemakeprice (TMEP) for June and July to be over 800 billion KRW, but sellers say the amount will far exceed the trillion KRW mark. This is because the government’s estimate of unpaid funds likely includes only a portion of the ‘reserve funds.’

On the 8th, according to the distribution industry and affected TMEP sellers, TMEP has been operating a ‘deal settlement reserve fund’ system. TMEP settlements are broadly divided into two types: seller settlements and deal settlements. Seller settlements generally refer to sellers joining the platform, generating sales, and receiving settlements.

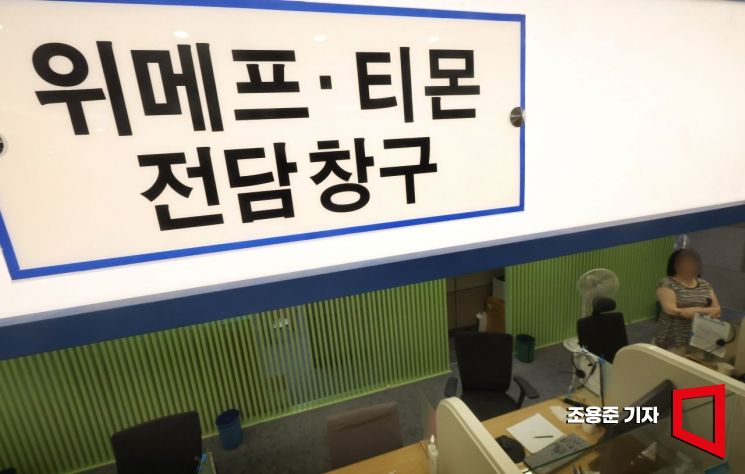

As consumer payment cancellations related to Tmon and Wemakeprice, payment gateway (PG) companies affiliated with card companies, begin in earnest, refunds are expected to be processed sequentially starting as early as the 1st. On this day, a dedicated counter for victims of the delayed settlement of sales proceeds from Wemakeprice and Tmon has been set up at the Financial Support Center of the Financial Supervisory Service in Yeouido, Seoul. Photo by Jo Yongjun jun21@

As consumer payment cancellations related to Tmon and Wemakeprice, payment gateway (PG) companies affiliated with card companies, begin in earnest, refunds are expected to be processed sequentially starting as early as the 1st. On this day, a dedicated counter for victims of the delayed settlement of sales proceeds from Wemakeprice and Tmon has been set up at the Financial Support Center of the Financial Supervisory Service in Yeouido, Seoul. Photo by Jo Yongjun jun21@

The problem lies with deal settlements. Deals refer to discount events or promotions. To participate in a deal, sellers must set aside 20-30% of their sales as reserve funds. These reserve funds can be settled once the deal ends. For example, if a seller participates in a one-year deal and generates 100 million KRW in sales each month, the seller receives settlements of 70 million KRW each month after deducting 30 million KRW as reserve funds. The accumulated reserve funds of 360 million KRW over the year can be settled the month after the deal ends.

Although sellers must accumulate reserve funds, deal settlements were popular among them. Participating in events increases product exposure frequency, enhancing seller recognition. Since discounts are applied to products, sales increase, boosting revenue. Also, deal settlements have a settlement cycle about 30 days shorter than the seller settlements’ maximum 70-day cycle, which is advantageous. As a result, many sellers have continued deals for years, accumulating reserve funds ranging from tens of millions to billions of KRW.

It is highly likely that these reserve funds were used for TMEP’s ‘circular financing’ of settlement funds. Since reserve funds are only settled when sellers request deal termination, there is effectively no settlement cycle. Even if sellers request deal termination, TMEP is presumed to have used cash collected by encouraging other sellers to participate in deals to cover these payments.

This pattern was commonly observed among sellers who participated in deals before this incident occurred. Mr. Lee, who received a deal participation proposal from Tmon in May, said, “There were more than a few suspicious things.” Having sold household goods such as towels on Tmon for over 10 years, he explained, “I participated in deals from May to July, but strangely, 25% discount coupons were recklessly distributed in those deals. The discount coupons were structured so that sellers bore 7% and Tmon bore 18%, which means Tmon was operating at a loss.”

Mr. Lee added, “Thanks to the discount coupons, I generated 100 million KRW in sales over three months with towels, which are not high-priced products, but this whole mess happened in the end. Tmon had no cash to cover circular financing immediately, so they deliberately committed fraud,” expressing his indignation.

Meanwhile, the government has currently estimated the unpaid sales proceeds from TMEP at 274.5 billion KRW. Including transactions from June to July, this is expected to increase more than threefold to at least 800 billion KRW. Adding the reserve funds accumulated over several years, the unpaid sales proceeds are expected to far exceed the trillion KRW mark.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.