Anbang Insurance Bankruptcy Proceedings Begin Amid 380 Trillion KRW Assets

Sale of Dongyang and ABL Life, Affiliates of Anbang's Major Shareholder, Accelerates

Woori Financial's Due Diligence Completed... Full-Scale Bidding Expected to Follow

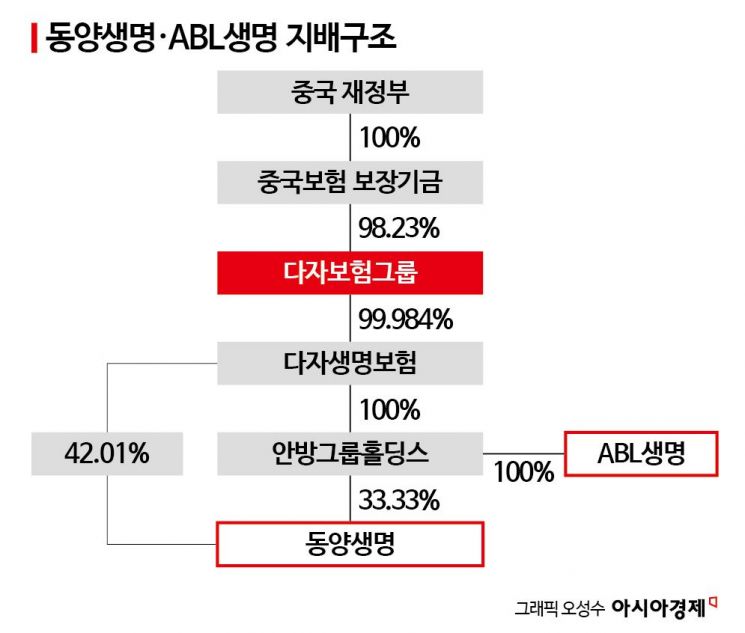

As China’s Anbang Insurance, which once had assets worth 2 trillion yuan (approximately 380 trillion won), officially enters bankruptcy proceedings, noticeable changes are emerging in the domestic insurance company merger and acquisition (M&A) market. Both Tongyang Life Insurance and ABL Life Insurance, which Woori Financial Group is pursuing to acquire, are subsidiaries of Dajia Insurance Group, the major shareholder of Anbang Insurance, raising expectations that sales could accelerate during the group’s asset liquidation process.

According to financial authorities on the 7th, Woori Financial Group completed due diligence for the acquisition of Tongyang Life and ABL Life, which had been conducted for about a month until the previous day. To strengthen its non-banking affiliates, Woori Financial signed a non-binding memorandum of understanding (MOU) with Dajia Insurance at the end of June and is working on acquiring the two life insurers as a package. With due diligence completed, it is expected that Woori Financial will soon begin serious price bidding. A Woori Financial official said, "There is no decision yet on the next steps after due diligence."

Recently, the Chinese government approved bankruptcy proceedings for Anbang Insurance, once one of the country’s largest insurers, creating a somewhat favorable market atmosphere for Woori Financial. Dajia Insurance Group was established by Chinese regulators to restructure Anbang Insurance, and after the bankruptcy process is completed, liquidation procedures will follow. Therefore, the sale of Tongyang Life and ABL Life shares held by Dajia Insurance and Anbang Group Holdings is essential. If Woori Financial is not in a hurry to acquire, it could gain a 'buyer’s advantage.'

To calm concerns, Tongyang Life and ABL Life issued press releases on the 5th and 6th, respectively, clarifying that "Anbang Insurance’s liquidation does not directly or indirectly affect our company." Anbang Insurance acquired Tongyang Life for 1.1319 trillion won in 2015 and ABL Life (formerly Allianz Life) for 3.5 billion won in 2016. However, after Wu Xiaohui, the former chairman and grandson-in-law of Deng Xiaoping, was arrested on corruption charges, Anbang Insurance’s assets were transferred to China’s Dajia Insurance, making the two insurers subsidiaries of Dajia Insurance. Although there is no direct equity relationship with Anbang Insurance, they inevitably face impacts during Anbang’s bankruptcy and Dajia’s liquidation process.

The labor unions of Tongyang Life and ABL Life have also taken action. At the end of last month, the two unions held a press conference at the Government Seoul Office, criticizing the 'asset stripping' behavior of Chinese capital and demanding employment stability and guarantees of independent management after acquisition from Woori Financial, which newly joined the acquisition process.

Despite the prevailing atmosphere, Woori Financial has stated it will not push the acquisition recklessly. Lee Sung-wook, Woori Financial’s Chief Financial Officer (CFO), said during the recent first-half earnings conference call, "We will not overpay in the insurance company M&A process." This was a clear line drawn in response to concerns from Woori Financial investors that a rights offering might be pursued to fund the insurance company acquisition.

The domestic insurance M&A market is also somewhat favorable to Woori Financial. With the failed sales of KDB Life Insurance last year and Lotte Non-Life Insurance and MG Non-Life Insurance this year, buyers have become scarce. Hana Financial Group, which was active in acquiring insurance companies last year, is rumored to have halted additional insurance acquisitions after recently injecting funds in the 300 billion won range into its insurance subsidiary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.