South Korea's Order Share at 40%... China at 24%

Ship Prices Near All-Time Highs

Top 3 Korean Shipbuilders' Operating Profit Exceeds 800 Billion Won in H1

The upward momentum of the shipbuilding industry, which has entered a 'super cycle' of unprecedented boom, is becoming even steeper. Korean shipbuilders, who have secured orders for 3 to 4 years in advance, have been selectively accepting orders, yet last month they surpassed China in order volume for the first time in 1 year and 5 months.

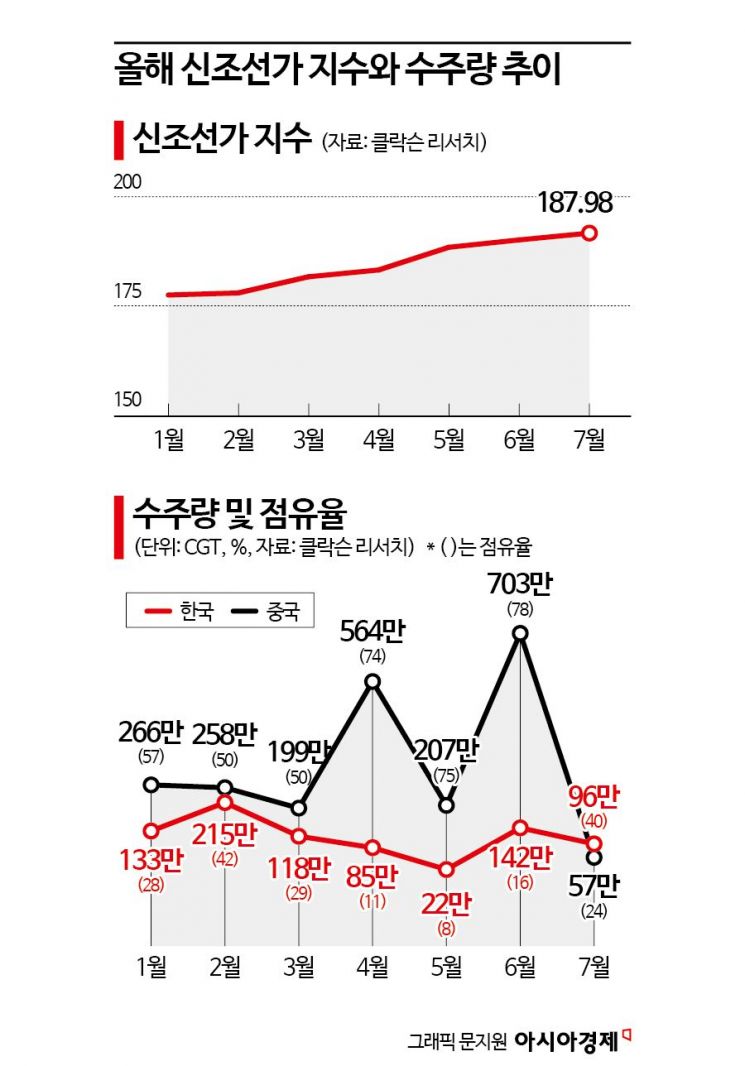

According to Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, out of the global ship orders totaling 2.37 million CGT (Compensated Gross Tonnage) last month, Korea secured 960,000 CGT with 18 vessels, accounting for a 40% market share. China followed in second place with 570,000 CGT and 30 vessels, holding a 24% share. This is the first time since February last year, 1 year and 5 months ago, that Korea has outpaced China in ship order volume. Although China’s cumulative order share from January to July this year stands at 63%, Korea has secured many high value-added vessel types.

The domestic shipbuilding industry has accumulated orders for 3 to 4 years. The backlog of orders stands at 39.12 million CGT, and this year, Korea is pursuing a selective order strategy focused on high value-added vessel types such as liquefied natural gas (LNG) powered and carrier ships. Despite this, Korea is leading China in terms of order volume amid China’s continued volume offensive.

Analysts attribute the increase in order volume partly to the somewhat resolved labor shortage that had troubled the shipbuilding industry for years despite the market rebound. The number of foreign workers at Korea’s three major shipbuilders?HD Hyundai Heavy Industries, Samsung Heavy Industries, and Hanwha Ocean (including subcontractors)?has been counted at about 17,900. This is an increase of approximately 2,700 workers (17.8%) over six months compared to about 15,200 at the end of last year. Additionally, the government has established a system to nurture and supply shipbuilding labor from overseas. The Ministry of Trade, Industry and Energy opened an 'Overseas Shipbuilding Workforce Center' in Serang, Indonesia, which provides Korean language and technical training locally to cultivate excellent shipbuilding personnel and introduce them to domestic shipyards.

With ship prices rising, the shipbuilding industry's profitability is expected to continue for the foreseeable future. According to Clarkson Research, the new ship price index stood at 187.98 as of the end of July. The new ship price index uses January 1998 as the base point (100 points) and reflects the prices of newly built ships. This index has not declined even once over the past 44 months since November 2020.

In the past 1 to 2 years, the Russia-Ukraine war and the Red Sea crisis have caused shortages of LNG carriers and petrochemical carriers (PC ships), driving up new ship prices. The current index is close to the peak of 191.58 recorded during the 2008 super cycle. An industry insider said, "The ship replacement cycle is about 20 to 25 years, and the replacement cycle for ships delivered during the 2008 super cycle is now coming around."

HD Hyundai Heavy Industries, which has been continuing its order rally since early this year, has already exceeded 120.5% of its annual order target. Samsung Heavy Industries has also achieved 51% of its annual target. Hanwha Ocean has not set an annual target but is expected to post strong results. The combined operating profit of the three shipbuilders exceeded 800 billion KRW in the first half of this year alone.

Lee Jaewon, a researcher at Shinhan Investment Corp., analyzed, "This is a shipbuilding industry proven by its performance," adding, "It appears to have entered a super cycle where ship prices are rising and raw material prices are falling, overcoming concerns about a peak-out."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)