Basis for Determining Repayment Intent in Rehabilitation Applications

Concerns Raised Over Potential Abuse of Court Receivership

Unclear Justification for Debt Reduction Before M&A

However, New Share Issuance and Large-Scale Capital Reduction Methods

No Real Benefit for Major Shareholders from Rehabilitation

Prosecutors have continued their search and seizure operations on TMON and WEMAKEPRICE (Timep) for the third day, with one clue supporting the intentionality of fraud charges being the ‘sudden corporate rehabilitation application.’ This is because the sudden filing for rehabilitation procedures with the court by TMON and WEMAKEPRICE occurred less than half a day after Koo Young-bae, CEO of Qoo10, promised to contribute 80 billion won of personal funds, raising suspicions about the intention behind the move. The legal community is raising concerns that the court receivership system might have been abused to pursue ‘debt relief first, followed by mergers and acquisitions,’ while deliberately delaying payment settlements.

According to the prosecution on the 6th, the Seoul Central District Prosecutors’ Office’s dedicated investigation team for TMON and WEMAKEPRICE (led by Chief Prosecutor Lee Jun-dong) conducted intensive search and seizure operations on Koo Young-bae, CEO of Qoo10, and TMON headquarters on the 1st, 2nd, and 5th. The search warrants for the management included allegations of ‘10 trillion won fraud and 40 billion won embezzlement.’ On the 2nd, Lee Si-jun, CFO of Qoo10 Group, was also summoned for focused questioning on the company’s management status and cash flow.

The prosecution’s investigation is broadly divided into two parts: fraud charges requiring proof of intent, and embezzlement and breach of trust suspicions related to the use of unpaid settlement funds. For the fraud charge to be established, it must be proven that ‘the party knowingly deceived the other by entering into a transaction without the intention or ability to fulfill the agreed obligations at the time of the transaction.’ The prosecution particularly views the corporate rehabilitation application itself as a temporary ‘loss of repayment ability,’ making it one of the clues to examine intent. A prosecution official explained, “Whether the rehabilitation application was considered from the time of selling goods or if there was no intention to repay, it can be significant when judging intent.” A lawyer specializing in corporate restructuring said, “If the company argued that the rehabilitation application was made with the intention to operate the company and repay debts to avoid liability for fraudulent intent, it could be interpreted as abusing the rehabilitation procedure.”

In fact, once corporate rehabilitation procedures begin, not only are debts to financial institutions deferred, but payments owed to subcontractors and business partners can also be postponed. This creates an effect where ‘income continues but expenses disappear,’ making it easier to shed bad assets and facilitate M&A.

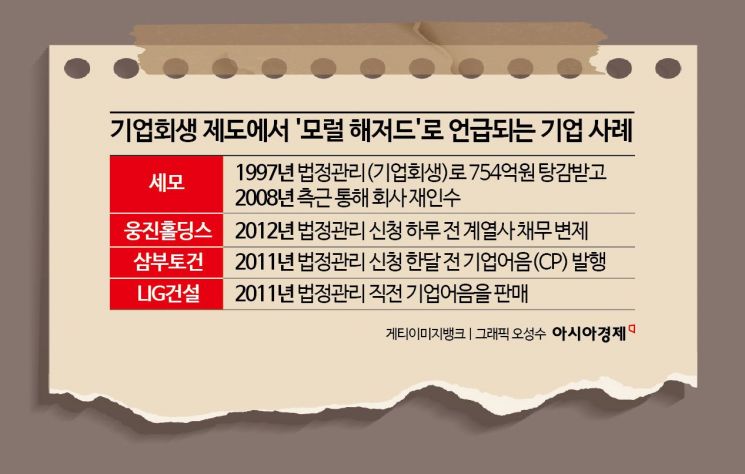

For this reason, controversies over major shareholders abusing the corporate rehabilitation system and moral hazard have persisted. In the case of Semo Group (2008), the company received debt relief through court receivership and reacquired the company through related parties nine years later, causing significant controversy and leading to amendments in the Integrated Bankruptcy Act, known as the ‘Semo Prevention Act.’ Companies such as Woongjin Holdings (Seoul Central District Court Bankruptcy Division 3, 2012), Sambu Construction (Seoul Central District Court Bankruptcy Division 4, 2011), and LIG Construction (Seoul Central District Court Bankruptcy Division 3, 2011) were criticized for moral hazard by repaying affiliate debts or issuing commercial papers (CP) before filing for court receivership. In the case of Timep, before the ‘refund chaos’ in July, a large number of gift certificates sold were also used like CPs for short-term corporate financing.

However, from CEO Koo’s perspective, there is also a view that the benefits gained from intentionally abusing the rehabilitation system are not significant. Typically, M&A conducted during corporate rehabilitation procedures take the form of paid-in capital increases with new shares rather than selling existing shares. Since the existing major shareholders’ shares are largely diluted through share reduction, the profits gained from sales are minimal. If debts cannot be fully repaid in cash, debt-to-equity swaps are sometimes made. This process often changes the governance structure. Currently, Qoo10 has proposed a self-rescue plan to reduce 100% of TMON and WEMAKEPRICE shares and convert the sellers into major shareholders of the merged public platform. On the 30th of last month, in response to a question from Kang Min-guk, a member of the People Power Party, during a National Assembly inquiry about ‘why the corporate rehabilitation procedure was filed after the press release,’ CEO Koo stated, “The representatives of each company (TMON and WEMAKEPRICE) said they had no choice but to do so (apply for rehabilitation), so I respected that.” CEO Koo is the CEO of Singapore-based Qoo10, the controlling company of TMON and WEMAKEPRICE, holding 42.77% of common shares.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)