The cumulative subscription amount for government bonds for individual investors issued since June this year is expected to exceed 1 trillion won this month.

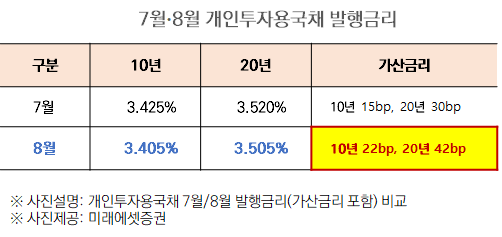

According to Mirae Asset Securities on the 5th, the subscription for individual investor government bonds for August will be held for three days from 9:00 to 15:30 from the 12th to the 14th. This is the third issuance since the first issuance in June. The planned issuance amount is 150 billion won for the 10-year bond and 50 billion won for the 20-year bond, totaling 200 billion won. The interest rates (pre-tax) are a 10-year bond coupon rate of 3.185% with an additional rate of 0.22%, resulting in a 3.405% yield if held to maturity, and a 20-year bond coupon rate of 3.085% with an additional rate of 0.42%, resulting in a 3.505% yield if held to maturity. For the 10-year bond, the pre-tax yield at maturity is about 40% (an average annual yield of 4.0%), and for the 20-year bond, about 99% (an average annual yield of 5.0%).

The difference from the previous two issuance plans lies in the additional interest rate. Government bonds for individual investors have the advantage of receiving compound interest by adding an additional rate to the coupon rate if held to maturity. In June and July, the additional rates were 0.15% for the 10-year bond and 0.30% for the 20-year bond, but in August, the additional rates increased by 0.07 percentage points and 0.12 percentage points to 0.22% and 0.42%, respectively.

The reason for the increase in the additional interest rate is the decline in government bond market interest rates. Recently, as the U.S. Federal Reserve (Fed) indicated that it might discuss a rate cut next month, highlighting conditions for a rate reduction, the Korean 3-year treasury bond and the U.S. 10-year treasury bond have shown a downward trend, falling below 3% and 4%, respectively. A representative from Mirae Asset Securities explained, "In other words, in August, the situation arose where a lower coupon rate than in July had to be offered," adding, "Therefore, the Ministry of Economy and Finance raised the additional interest rates by 0.07 percentage points and 0.12 percentage points compared to July, presumably to allow individual investors to achieve similar yields at maturity as in July by adjusting the issuance conditions."

Since sales began in June this year, government bonds for individual investors have accumulated subscriptions of about 746 billion won (as of the 16th of last month), and the cumulative subscription amount is on the verge of surpassing 1 trillion won within three months.

Subscriptions for government bonds for individual investors can be made at Mirae Asset Securities branches nationwide or through their website and mobile app.

Mirae Asset Securities is conducting an event for government bonds for individual investors. Customers who subscribe to a total of 10 million won or more in July and August will receive mobile gift certificates, and if individual investor government bond subscribers additionally purchase U.S. bonds or domestic over-the-counter bonds, they will receive investment support funds of up to 150,000 won based on the net purchase amount. This event will end at the end of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)