Stock Market Correction, Pharmaceutical Bio Remains Steady

Biological Security Act Expected to Pass, Biosimilars in Focus

Biotech Technology Export 'Anticipated'

Stocks in the pharmaceutical and biotechnology sectors are showing strong performance. While the semiconductor sector, which has led the stock market this year, is dragging down the index, securities firms predict that pharmaceutical and biotechnology will take the lead in the market instead of semiconductors. This outlook is based on the recent improvement in the performance of domestic pharmaceutical and biotechnology companies and the expectation of a positive ripple effect if the U.S. Biosecurity Act is passed.

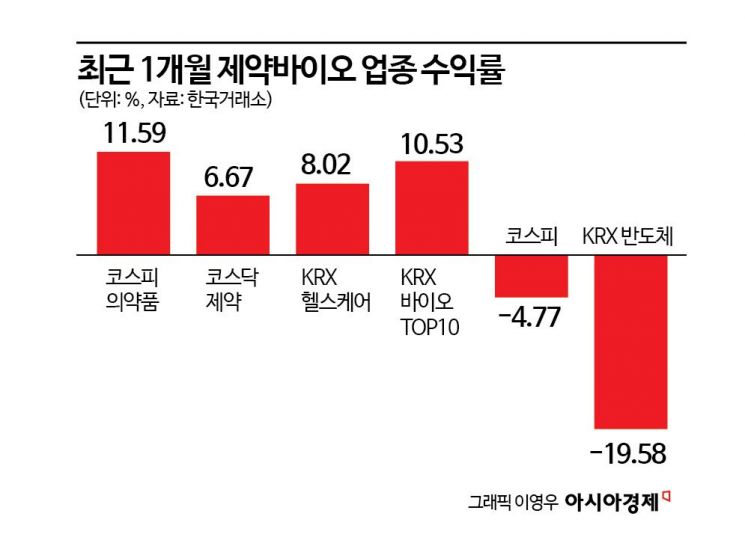

According to the Korea Exchange on the 5th, the KOSPI Pharmaceuticals Index closed at 14,922.15 on the 2nd, rising 11.59% over the past month. This is the highest increase among all KOSPI sector indices. Other pharmaceutical and biotechnology sector indices such as the KRX Bio TOP10 (10.53%), KRX Healthcare (8.02%), and KOSDAQ Pharmaceuticals (6.67%) also recorded performance significantly outperforming the KOSPI (-4.77%).

Recently, domestic and international stock markets have experienced significant volatility due to uncertainties surrounding the U.S. presidential election and concerns about an economic recession. In particular, the market has seen continued selling pressure on semiconductors, which have played a 'leading stock' role since last year, amid concerns that the final demand is insufficient relative to the costs of investments in artificial intelligence (AI). In response, securities firms analyze that the pharmaceutical and biotechnology sector could lead the stock market following semiconductors.

Seungyoung Park, a researcher at Hanwha Investment & Securities, said, "Portfolios need to be diversified from semiconductors to other industries," adding, "Bio, in particular, has the potential to become the leading sector." He referenced past cases such as the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CSA), stating, "We need to focus on 'what the U.S. needs.' After the U.S. passed the IRA, batteries performed well in the domestic stock market, and after the semiconductor law was passed, semiconductors performed well. If the Biosecurity Act, which primarily restricts transactions with Chinese bio companies, is passed within this year, it will raise expectations for domestic bio companies."

Furthermore, Park said, "Donald Trump, the U.S. Republican presidential candidate, is expected to encourage the approval of new drugs to introduce biosimilars and promote competition," adding, "This policy stance will be positive for the domestic healthcare sector, which has a high proportion of biosimilars and where biotech companies’ performance is beginning to emerge after a decade of investment."

Along with favorable macroeconomic changes such as the legislative push for the U.S. Biosecurity Act and interest rate cuts, individual companies’ performances are also improving. Samsung Biologics announced second-quarter results that significantly exceeded market expectations and recently signed a large-scale order contract worth 1.5 trillion KRW. Celltrion’s Jimptetra is expected to begin full-scale sales as it was listed on the prescription formulary of Express Scripts, one of the three major U.S. pharmacy benefit managers (PBMs), starting last month.

Accordingly, Myungyook Gan, a researcher at Mirae Asset Securities, noted, "The performance growth of biosimilar companies is expected to continue," adding, "Additionally, technology exports from major biotech companies can also be anticipated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.