Record High Q2 Performance... Stock Price Drops 13% on Earnings Announcement Day

"Concerns Over Peak-Out Due to MUV Decline"

Despite SOOP's record-breaking performance in the second quarter of this year, its stock price continues to decline. This is interpreted as growing concerns over a peak-out (passing the peak) due to a drop in traffic.

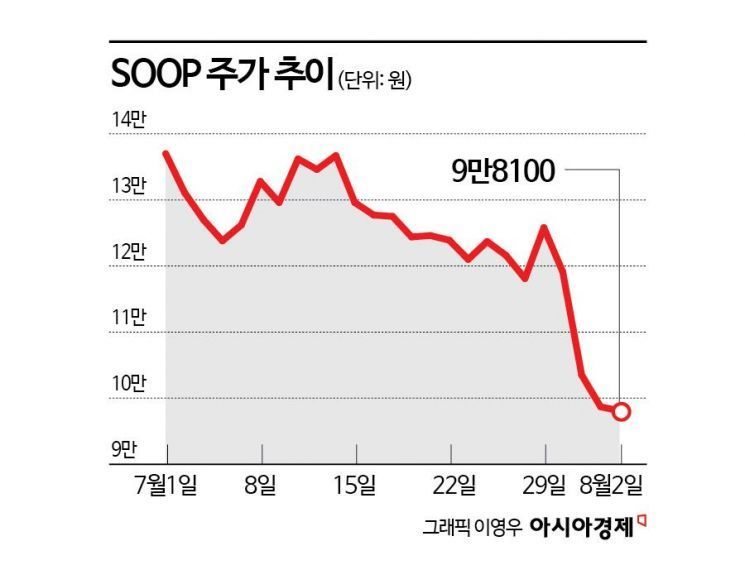

According to the financial investment industry on the 5th, SOOP's stock price recorded 98,100 KRW on the 2nd of this month. This is a 28.39% decrease compared to 137,000 KRW on the 1st of last month, which was the highest closing price this year.

On July 31, SOOP announced that its consolidated sales and operating profit for the second quarter were 106.5 billion KRW and 33.3 billion KRW, respectively. This represents a 23% increase in sales and a 41% increase in operating profit compared to the same period last year. These are the highest quarterly results ever recorded.

However, unlike the strong performance, the stock price is on a downward trend. On the day of the earnings announcement, SOOP's stock price plunged 13.10% compared to the previous trading day. The cause of the sharp decline in stock price is concerns over a peak-out as monthly unique visitors (MUV) decreased compared to the previous quarter. Jaemin Ahn, a researcher at NH Investment & Securities, explained, "The 16% decline in MUV in the second quarter compared to the previous quarter and the possibility of increased marketing costs such as Olympic content sourcing costs in the third quarter led to concerns over a peak-out in second-quarter earnings, causing the stock price to fall."

As a result, some securities firms have lowered their target prices for SOOP. A total of 13 securities firms issued reports on SOOP after the earnings announcement on the 31st of last month. Among them, four firms including Mirae Asset Securities, KB Securities, SangSangIn Securities, and DB Financial Investment lowered their target prices.

Seungho Choi, a researcher at SangSangIn Securities, said, "There is a difference in the timing of profit realization after global-related upfront investments, so the possibility of temporary margin erosion in the second half should be kept open," adding, "Considering this, we have revised down the annual estimated operating profit and partially reflected traffic concerns."

Heeseok Lim, a researcher at Mirae Asset Securities, also said, "It is encouraging that the segment maintaining high growth in operating profit along with profitability improvement, but to achieve re-rating, concerns about traffic decline need to be resolved," adding, "There are still concerns in the market about user churn due to fluctuating traffic." He further added, "It is necessary to show traffic growth globally or traffic recovery domestically in the second half."

However, there are also opinions that such concerns are excessive. The growth potential in overseas markets is high. In June this year, SOOP launched the beta service of its global platform SOOP. It plans to build a gaming and e-sports ecosystem centered on Southeast Asian markets such as Thailand. The strategy also includes expanding platform influence through KBO global broadcasting and securing local streamer partnerships.

Shinhan Investment Corp. raised SOOP's target price from 190,000 KRW to 200,000 KRW. Seokoh Kang, a researcher at Shinhan Investment Corp., emphasized, "SOOP is showing the clearest growth trend within the mega-trend of the influencer economy," adding, "The growth potential in Southeast Asia, where the average age is low, is expected to increase the multiple."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.