[Timef Rehabilitation Application]

On the 2nd, Representatives Ryu Gwangjin and Ryu Hwahyeon to Attend Rehabilitation Court Hearing

Preliminary Investigator Appointment May Allow Due Diligence

Legal Judgments and Policy Factors Also Considered

Key Issue: Going-Concern Value > Liquidation Value Evaluation

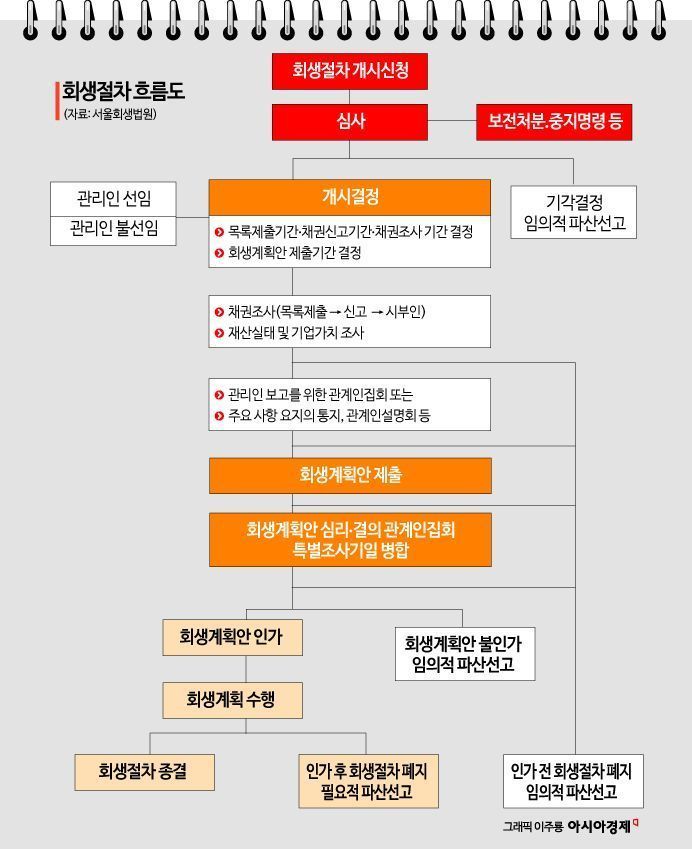

On the 2nd, Timon·Wemakeprice (Timf), which caused a 1 trillion KRW-scale settlement and refund delay crisis, came under the jurisdiction of the court starting with the hearing of Timon CEO Ryu Gwang-jin and Wemakeprice CEO Ryu Hwa-hyun by the Seoul Rehabilitation Court Division 2 (Chief Judge Ahn Byung-wook). When a company enters rehabilitation proceedings, a comprehensive payment prohibition order freezes claims, rendering civil lawsuits meaningless. Currently, commercial creditors have no choice but to wait for the court's decision on rehabilitation or bankruptcy to recover their unpaid funds.

The commencement of rehabilitation is a procedure where the court provides a ‘legal shield’ by freezing claims and helps the company to recover by generating sales and cash flow. It is usually decided within a month after the representative's hearing. However, in cases like the Timf incident with significant social impact, an additional due diligence process by an investigation committee (accounting firm) may be added. At this stage, called ‘pre-commencement investigator appointment,’ if the liquidation value is found to be higher than the going concern value, Timf will proceed to bankruptcy. Of course, even here, a ‘pre-approval merger and acquisition (M&A)’ process remains. If a buyer appears willing to purchase Timf at a liquidation price far below market value, part of the acquisition price may be used to repay debts.

However, at present, regardless of whether rehabilitation or bankruptcy is decided, it is practically impossible for sellers on the platform to recover 100% of their transaction payments. In the case of rehabilitation, the company may have some debts forgiven, making it difficult for unsecured commercial creditors to receive repayment priority. If bankruptcy is filed, Timf's shares will become worthless, blocking any path to recover funds.

As the delay in seller settlements by TMON and WEMAKEPRICE causes increasing harm to consumers, purchasing customers visited WEMAKEPRICE headquarters in Samseong-dong, Seoul on July 25 and are waiting in the lobby to apply for refunds being handled by two employees. Photo by Heo Younghan younghan@

As the delay in seller settlements by TMON and WEMAKEPRICE causes increasing harm to consumers, purchasing customers visited WEMAKEPRICE headquarters in Samseong-dong, Seoul on July 25 and are waiting in the lobby to apply for refunds being handled by two employees. Photo by Heo Younghan younghan@

In Case of Bankruptcy ① Pre-approval M&A is the Only Way Out

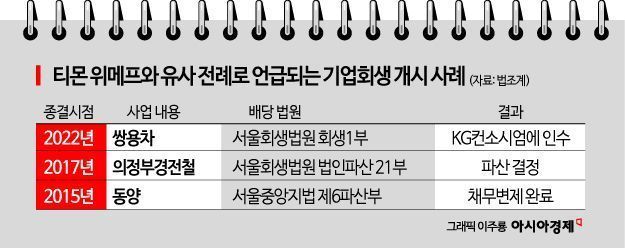

Legal circles speculate that Timf could follow the path of the Uijeongbu Light Rail Transit project (Seoul Rehabilitation Court Corporate Bankruptcy Division 21, 2017), which was declared bankrupt due to a 360 billion KRW deficit and deemed unrecoverable through rehabilitation. As of 2022, Timon's cash and cash equivalents stood at 8 billion KRW, with accumulated losses reaching 1.2644 trillion KRW. Wemakeprice had 7.1 billion KRW in cash and cash equivalents last year, with accumulated losses of 755.9 billion KRW.

Choi Sung-il, a lawyer at Law Firm Class who has served as a bankruptcy trustee multiple times, said, “The Uijeongbu Light Rail Transit was a national project with strong policy incentives to save it, but without institutional changes, there was no way to recover the increasing deficits. Ultimately, the existing operator was bankrupted, and the system was changed to enable profitability.” He added that unless structural issues like delayed settlements or commingling of customer funds are fixed, it is difficult for the court to sustain an e-commerce company with problematic business structures.

Similar precedents include Dongyang (Seoul Central District Court Bankruptcy Division 6, 2015), which had 37,000 creditors at the time of rehabilitation filing, and Ssangyong Motor (Seoul Rehabilitation Court Rehabilitation Division 1, 2022), acquired by the KG consortium during rehabilitation. Both cases involved many small creditors and numerous innocent victims upon bankruptcy, similar to Timf. The fact that the company would be attractive in the M&A market during rehabilitation due to pricing merits is also comparable to Ssangyong Motor.

However, Ssangyong Motor had a solid revenue model based on parts suppliers, making it easier to find buyers. In contrast, e-commerce platforms like Timf face many alternative platforms, reducing their attractiveness as acquisition targets. In the case of M&A, the structure usually involves converting the remaining value after creditor repayment rates into equity, but even then, the amount commercial creditors can recover is minimal.

② Investigator Report's Valuation is Key… ③ Creditor Council Coordination is Also a Challenge

The crucial factor is the investigation report prepared by the accounting firm evaluating Timf. If the liquidation value is deemed higher, bankruptcy will be decided; if the going concern value is higher, rehabilitation will be chosen, and based on this, specific self-rescue plans and M&A strategies will be developed. Starting from the hearing, the court will focus on confirming Timf's working capital, the proportion of public claims, and the extent of accounts receivable secured. These aspects will also be included in the investigation report prepared by court-appointed investigators.

Jo Dong-hyun, a corporate restructuring and rehabilitation/bankruptcy expert at Law Firm Barun, said, “Lawyers do not assign value themselves. Ultimately, the key is whether the accounting firm judges the going concern value to be higher than the liquidation value.” Another corporate restructuring specialist lawyer noted, “From the court's perspective, legal and policy considerations are unavoidable. If the company had active sales activities, the court might decide that debt restructuring to save the company would help preserve the industrial ecosystem.”

Even if the rehabilitation plan is approved, many risks remain. When the creditor council is formed, it is difficult to reach an agreement between senior secured creditors holding Timf's collateral and small business commercial creditors. Secured creditors may prefer liquidation and enforcement of collateral, making interest coordination challenging.

Park Jong-mo, a lawyer at Law Firm Sayu representing some small business victims of Timf, said, “Before the creditor council is formed, the most important thing for creditors is to file their claims on time.” He added, “After the rehabilitation commencement order, a list of creditors will be submitted, and if claims are not listed timely, they may be extinguished, effectively eliminating any means of repayment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.