130,000 Payment Cancellations Reported to Card Companies... 55 Billion Won Scale

"Actual Refund Takes 2-3 Weeks"

PG Company First Responsibility Debate vs Financial Sector Responsibility Sharing Debate

"Both the card companies and PG (Payment Gateway) companies seem to be passing the buck and just watching each other."

"It's frustrating that no one is making a clear promise to refund for sure."

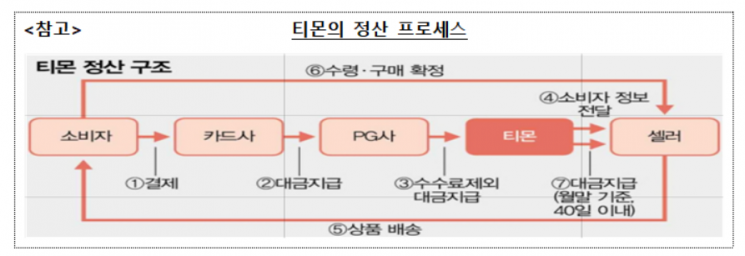

As the payment cancellation and refund procedures are delayed in connection with the T-mep (Timon·Wemakeprice) unsettled payment incident, consumers are expressing their frustration. Card companies say that additional verification from PG companies regarding whether the goods were undelivered is needed for customer card payment cancellation requests, causing delays. PG companies feel burdened by refunds as they have to handle the situation on their own without fully recovering the canceled payment amounts from Timon and Wemakeprice.

On the 29th, as the 'Unsettled Sales Payment Incident' of Wemakeprice and Tmon continues, citizens are passing by the Tmon building in Gangnam-gu, Seoul. Photo by Jo Yongjun jun21@

On the 29th, as the 'Unsettled Sales Payment Incident' of Wemakeprice and Tmon continues, citizens are passing by the Tmon building in Gangnam-gu, Seoul. Photo by Jo Yongjun jun21@

Card and PG Companies Receive Payment Cancellation and Refund Requests... Actual Refund Cases Are Few

According to the financial sector on the 1st, currently nine card companies (Shinhan, Samsung, KB Kookmin, Hana, Hyundai, Lotte, BC, NH Nonghyup, Woori) related to the T-mep incident

are receiving objections, installment contract withdrawals, and defense rights applications from customers. Some card companies inform customers that "due to the large volume of requests, it may take an average of 2 to 3 weeks to complete." Some card companies also state that "we are sequentially processing requests after requesting fact verification from PG companies." As of the 28th, about 130,000 complaints and objections related to Timon and Wemakeprice have been received through card companies, amounting to approximately 55 billion KRW.

There are 11 PG companies involved in this incident (Naver Financial, Kakao Pay, NICE Payments, Danal, Toss Payments, NHNKCP, NHN Payco, Smartro, KG Inicis, KICC, Hecto Financial). All of them are accepting customer payment cancellation requests separately through their own websites, apart from card company submissions.

Although refund applications are flooding into card and PG companies, smooth refund measures have not yet been implemented. In social networking service (SNS) group chats where thousands of T-mep victims gather, news of refunds mainly comes from large fintech companies such as Naver Pay, Kakao Pay, and Toss Pay, while cases of refunds from small and medium PG companies or card companies are almost nonexistent. However, even large fintech companies quickly refund their own '00 Money,' but refunds for card or bank transfer payments are still delayed.

Who Bears the Loss... Card and PG Companies Watching Each Other

Card companies said that refund procedures may not proceed smoothly until PG companies confirm whether payment cancellation is possible. In the early stages of the T-mep incident, PG companies blocked the payment cancellation request function, preventing smooth refunds, and recently, as Timon and Wemakeprice entered corporate rehabilitation (court receivership) procedures, fact verification related to payment cancellations has slowed down. A card industry official said, "The Financial Supervisory Service has dispatched an inspection team to Timon and Wemakeprice to analyze delivery and transaction-related electronic data," adding, "Once the data is secured, we expect the refund process to speed up."

PG companies are currently cross-checking payment cancellation details identified by themselves and card companies with data from Timon and Wemakeprice to select refund recipients. Wemakeprice delivered information related to general goods delivery, excluding gift certificates and travel products, to each PG company the previous afternoon. Timon is also scheduled to deliver related information to each PG company on the morning of the day. A PG industry official said, "We will proceed with the refund process as quickly as possible to minimize customer damage," adding, "At this point, we do not know how long it will take to complete normal refunds."

However, PG companies feel burdened because Timon and Wemakeprice have limited financial capacity, and their assets and claims are frozen due to the corporate rehabilitation procedure. They have to pay refunds first with their own funds and later recover the money by claiming indemnity. The PG industry side argues that it is unfair for PG companies alone to bear the losses from this incident and demands that card companies share some of the burden.

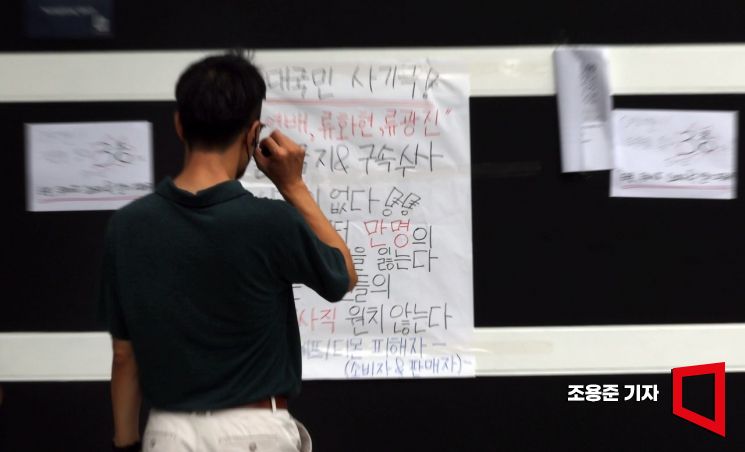

On the 29th, as the 'Unsettled Sales Payment Incident' of Wemakeprice and TMON continues, a citizen is looking at a large poster put up by the victims in front of the Wemakeprice headquarters on Yeongdong-daero, Gangnam-gu, Seoul.

On the 29th, as the 'Unsettled Sales Payment Incident' of Wemakeprice and TMON continues, a citizen is looking at a large poster put up by the victims in front of the Wemakeprice headquarters on Yeongdong-daero, Gangnam-gu, Seoul.

Financial Authorities: "PG Companies Are Primarily Responsible"... Possibility of Financial Sector Sharing Later

The financial authorities hold the position that PG companies bear primary responsibility for the refund procedures. According to Article 19 of the Specialized Credit Finance Business Act (SCFBA), "Payment gateway companies must comply when credit card members request transaction cancellations or refunds." Park Sang-won, deputy director of the Financial Supervisory Service, said, "PG companies received payment fees from Timon and Wemakeprice, so they must bear the related risks," adding, "Most of the 11 major PG companies are subsidiaries of large corporations with capital of around 200 to 300 billion KRW." Lawyer Jeon Sang-beom of Logos Law Firm said, "The legal provisions regarding PG companies' obligations were added in 2015, and as e-commerce became active, regulation became necessary, leading to the law's revision. PG companies must be regulated according to the wording," adding, "Looking at the provisions alone, PG companies must bear primary responsibility when such incidents occur."

There are counterarguments that financial authorities should not only hold PG companies responsible but also take a more active role in resolving the situation. Seo Ji-yong, professor of business administration at Sangmyung University, said, "The provisions in the SCFBA mean that when a normal transaction occurs, money should be received and cancellations processed, but it is not appropriate to force this in the current situation where Timon and Wemakeprice are caught in a delayed settlement incident," adding, "It is one thing for authorities to encourage PG companies as sizable businesses to undertake unpleasant tasks for consumers, but it is not right to approach this as a mandatory obligation under the SCFBA." A representative of a large PG company said, "It feels like the authorities are forcing PG companies to bear the losses to settle the incident," adding, "Timon and Wemakeprice have been in capital erosion since 2015, and the financial authorities must have regularly received related reports, so isn't there also responsibility for their management and supervision negligence?"

At a recent emergency inquiry on the T-mep incident held by the National Assembly's Political Affairs Committee, Financial Supervisory Service Governor Lee Bok-hyun responded to Democratic Party lawmaker Yoo Dong-soo's remark that "card companies should also step up (to resolve the incident)" by saying, "We will further encourage the financial sector to take more initiative in protecting consumers and sellers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.