Industry Ministry Petrochemical Crisis Response TF Yet to Propose Measures

Concerns Over Restructuring Delay Amid Q2 Earnings Rebound

Restructuring of domestic petrochemical companies is being delayed. Despite government intervention, no clear measures have been presented for several months. Concerns are being raised that the golden time for restructuring might be missed, even though second-quarter earnings have improved.

According to the industry on the 2nd, the government launched the ‘Petrochemical Industry Competitiveness Enhancement Council’ to discuss comprehensive support measures to strengthen the competitiveness of the petrochemical industry, but a solution has not yet been found. Since there are many companies whose opinions need to be gathered and no agreement has been reached on cost-efficiency measures among companies, comprehensive support measures including mid- to long-term strategies have not been prepared.

An official from the Ministry of Trade, Industry and Energy said, "There are so many petrochemical companies, and upstream and downstream companies want different measures, so there are many factors to review," adding, "We are currently collecting companies’ opinions and preparing to announce measures as soon as possible."

The domestic petrochemical industry has continuously raised the need for business restructuring to respond to rapidly changing external environments. This is due to a structure more vulnerable to external changes because of a portfolio focused on general-purpose products. This year, ethylene demand recovery is sluggish, and with the continued expansion of propylene (PP) supply from China, the recovery of operating rates is expected to be delayed. Furthermore, as Middle Eastern petrochemical facilities begin full-scale operation, the industry’s burden is bound to increase.

Domestic companies plan to pursue business restructuring by selling non-core businesses, but no conclusions have been reached yet. For example, LG Chem, which is promoting the sale of basic material business sectors such as naphtha cracking facilities (NCC), is facing difficulties as no buyer has appeared to purchase the business at an appropriate price. In contrast, global major companies such as Shell and ExxonMobil have secured business competitiveness ahead through restructuring.

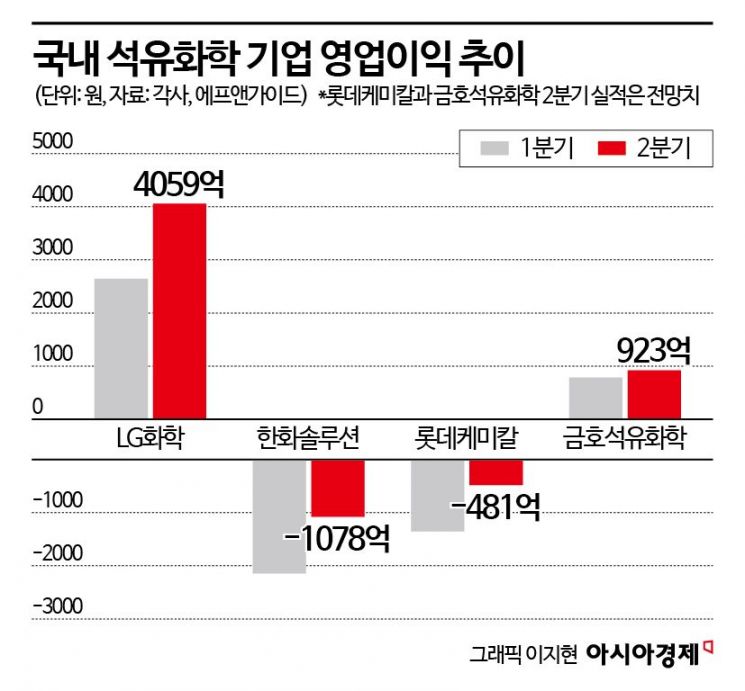

Concerns are also emerging that companies might miss the restructuring timing by resting on the ‘temporary boom’ due to improved second-quarter corporate performance. LG Chem recorded an operating profit of 405.9 billion KRW, an increase of 53.4% compared to the previous quarter. In particular, the petrochemical sector turned profitable in the third quarter as it entered the seasonal peak of front markets such as home appliances. Hanwha Solutions also posted results up 49.74% from the previous quarter, and FnGuide forecasted that Lotte Chemical’s operating loss of 48.1 billion KRW in the second quarter would improve by 64% compared to the previous quarter.

Seong Dong-won, senior researcher at the Overseas Economic Research Institute, emphasized, "The self-sufficiency rate of overseas general-purpose products is continuously expanding, and under a high oil price environment, the competitiveness of domestic general-purpose products is inevitably placed at a disadvantage," adding, "An active business structure shift to high value-added products is urgently needed to secure sustainable competitiveness in the mid- to long-term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.