The outstanding balance of household loans at major commercial banks increased by more than 6 trillion won in just one month. Although banks responded by raising household loan interest rates under pressure from financial authorities, loan demand surged due to expectations of rising housing prices. As a result, there are speculations that additional loan regulation measures may be introduced.

Household Loan Growth Continues Amid Housing Price 'Fluctuations'

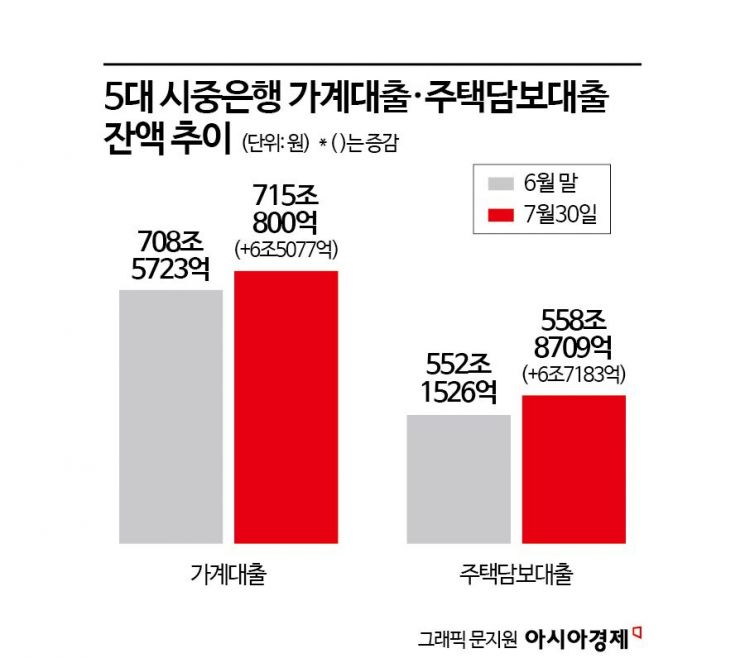

As of the 30th of last month, the outstanding balance of household loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) was recorded at 715.08 trillion won. This represents an increase of 6.5077 trillion won compared to the end of June (708.5723 trillion won). Compared to the beginning of this year, it has grown by 19.7657 trillion won.

Household loans have been increasing by more than 5 trillion won on average each month: 693.5684 trillion won in March, 698.003 trillion won in April, 703.2308 trillion won in May, and 708.5723 trillion won in June.

In particular, the increase in mortgage loans is driving this trend. The outstanding balance of mortgage loans, which had been increasing by an average of 5 trillion won since March, jumped significantly from 552.1526 trillion won at the end of June to 558.8709 trillion won as of the 30th of last month, an increase of 6.7183 trillion won.

The continuous rise in household loans is attributed to a clear recovery in the real estate market. According to the Korea Real Estate Board, the apartment sale prices in Seoul during the fourth week of last month rose by 0.30% compared to the previous week, marking the 18th consecutive week of increase. In fact, 2.94 million people applied for the unranked subscription (one household) for Lotte Castle in Dongtan held on the 29th and 30th of last month. Recently, the positive trend has been spreading beyond Seoul to key areas in the metropolitan area.

Especially, the increase in high-priced apartment transactions in Seoul and the metropolitan area is seen by banks as a factor continuously expanding loan volumes. According to a survey by Woori Bank's Asset Management Consulting Center on the Seoul apartment sales volume and transaction ratio from the Ministry of Land, Infrastructure and Transport, the proportion of apartment sales exceeding 1.5 billion won in the first half of this year was 20.45%. This is the first time since the real transaction data was made public in 2006 that the semiannual ratio of apartment sales exceeding 1.5 billion won in Seoul has surpassed 20%.

Interest Rate Hikes Expected to Continue... Possibility of Additional Regulations

As the household loan trend remains concerning, financial authorities have tightened household loan regulations. Accordingly, the five major banks simultaneously raised loan interest rates by around 0.2 to 0.3 percentage points this month to slow the pace of household loan growth.

KB Kookmin Bank raised mortgage loan interest rates by 0.2 percentage points on the 29th of last month. Shinhan Bank also increased mortgage and jeonse deposit loan rates by up to 0.3 percentage points on the same day. Woori Bank and NH Nonghyup Bank raised installment-type mortgage loan rates by 0.2 percentage points on the 24th of last month, and Hana Bank raised mortgage loan rates by 0.2 percentage points earlier last month.

Internet-only banks, which had competed on interest rate competitiveness, also joined this trend. K Bank raised apartment mortgage loan rates by up to 0.1 percentage points per product on the 30th of last month. This is the third rate hike. K Bank had previously raised rates on the 9th and 23rd of last month. Kakao Bank also raised mortgage loan rates by 0.1 percentage points on the 26th of last month.

Despite the interest rate hikes, household loans have not been curbed, leading to speculation within the banking sector that authorities may impose additional regulations. A representative from a commercial bank said, "Since interest rate hikes alone cannot suppress the real estate market, we expect that in August, stricter management of loans may be applied to all except actual buyers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.