Discussion on Strengthening Market Cap Criteria for Listing Eligibility

Review to Shorten KOSPI Delisting Period to 2 Years

Expected Strengthening of Accounting Transparency Reasons

Japan's Delisting Period Less Than 2 Years

US Transfers to Lower Market if Standards Not Met

The reason financial authorities and the Korea Exchange are revising the conditions for delisting zombie companies is that the criteria for maintaining listing are too lenient, and the delisting process takes too long. This has led to criticism that stock market funds are unnecessarily tied up for extended periods. By strengthening the listing maintenance conditions and simplifying the delisting procedures, companies that no longer meet listing eligibility can be swiftly removed from the market. This aims to enhance the soundness of the stock market.

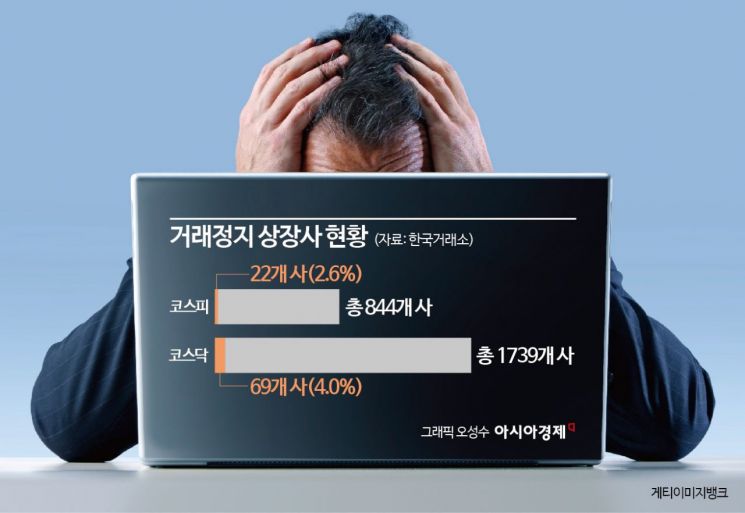

22 KOSPI Zombie Companies Take 4 Years to Delist... KOSDAQ Has Three Times More Zombie Companies

According to the Korea Exchange as of the end of July, a total of 91 stocks have been suspended from trading due to reasons such as delisting causes, audit opinion rejections, and other public interest, investor protection, and market management issues. By market, there are 22 KOSPI-listed companies and 69 KOSDAQ-listed companies. Zombie companies account for 2.6% of the total 844 KOSPI-listed companies and 4.0% of the total 1,739 KOSDAQ-listed companies. This is why the government is considering improving listing eligibility conditions while also promoting the activation of the KOSDAQ market.

First, the listing eligibility conditions will be strengthened compared to the current standards. Raising the market capitalization threshold is being discussed in academia and the financial investment industry. Professor Seong Hee-hwal of Inha University Law School explained, "Market capitalization is a sign of trust from the market or investors," adding, "(If the criteria are strengthened) liquidity will relatively increase, and it will be harder to become a target for stock price manipulation."

Along with this, transparency in accounting, one of the listing eligibility conditions, is also expected to be enhanced. Among the main criteria for the substantive review of listing eligibility is the item 'lack of transparency in accounting.' If a listed company handles accounting opaquely, it is reported to the Securities and Futures Commission (SFC) under the Financial Services Commission, which becomes a reason for the substantive review of listing eligibility. If serious issues are found during the review process, delisting procedures are initiated.

According to a report titled "The Need for Structural Reform of Marginal Companies to Enhance Corporate Dynamism" published by Lee Sang-ho of the Korea Capital Market Institute, chronic zombie companies restrict the use of human and physical resources of normal companies. The researcher stated in the report, "An increase in the proportion of marginal companies distorts price competition structures and adversely affects the value-added creation of normal companies," adding, "It also negatively impacts overall productivity improvement."

In other words, financial authorities and the Korea Exchange intend to ease delisting standards to facilitate the removal of zombie companies. Raising the hurdles for listing conditions ultimately means enhancing corporate value and revitalizing the Korean stock market. It is expected that this will lead to an improvement in the overall health of the Korean stock market.

Japan’s Delisting Process Takes Less Than 2 Years... The U.S. Moves Companies to Lower Markets or OTC

The delisting process is also planned to be significantly shortened. When the delisting process takes too long in the domestic stock market, companies bear high costs, and investors’ funds remain tied up for extended periods. The delisting process in the Japanese market is simpler and clearer than ours. Companies listed on the Japan Exchange must meet minimum criteria such as market capitalization, free float ratio, and average daily trading volume to maintain their listing.

However, even if a company falls short of these criteria, it is not immediately delisted. The Japan Exchange first grants companies a one-year improvement period. If the company still fails to meet the criteria during this period, it may be placed under management for six months before potential delisting. If the company judges it difficult to meet the criteria during the improvement period, it can transfer its listing to lower markets such as Standard or Growth.

The U.S. market similarly has various listing maintenance criteria, including minimum shareholder equity and minimum stock price. The exchange grants companies that fail to meet these criteria an improvement period or a hearing process, and if improvements are not made, the company may be delisted or moved to an over-the-counter (OTC) market.

On the other hand, KOSPI-listed companies are granted up to four years of improvement period when delisting causes arise. Financial authorities and the Korea Exchange have mentioned considering shortening this to two years. For KOSDAQ-listed companies, there are three review rounds when delisting causes occur, and they are considering reducing this to two rounds.

An official from the financial investment industry said, "Simplifying the delisting process will allow the removal of listed companies that cannot properly conduct business activities, thereby revitalizing the capital market," adding, "Furthermore, by clearly distinguishing the characteristics of each market through market restructuring and improving listing maintenance criteria to enhance market soundness, it will contribute to a qualitative leap in the stock market, which has so far expanded only quantitatively."

He also added, "It is also important to reduce the burden on delisted companies and minimize investor losses," emphasizing, "If delisted companies can sufficiently recover and maintain stable trading in the over-the-counter market after delisting, it will enhance overall market trust."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)