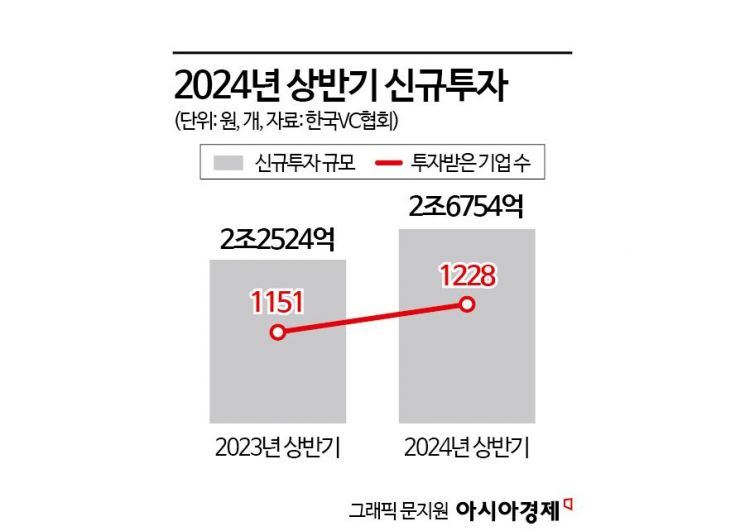

Investment of 2.6754 trillion KRW in 1,228 Companies

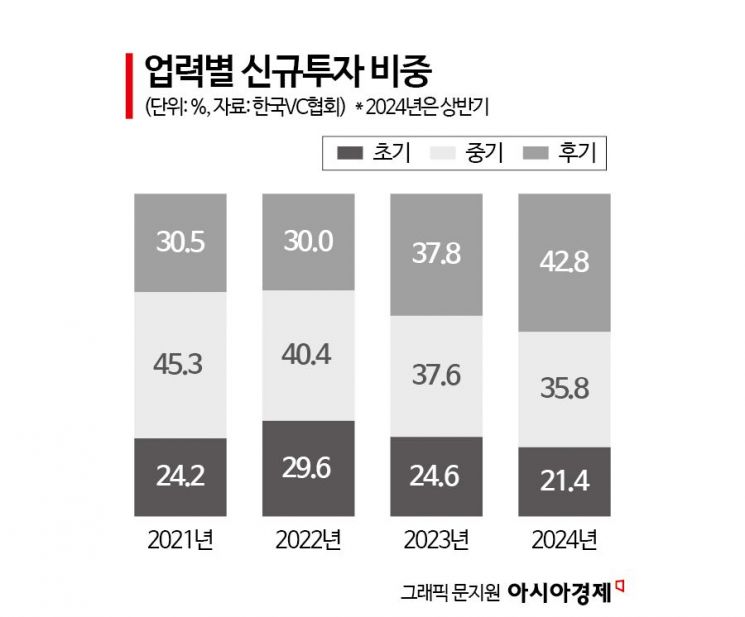

Early-Stage Investment Decreases, Late-Stage Investment Increases

"Conservative Investment Considering Market Conditions"

The scale of new investments by domestic venture capital (VC) firms in the first half of this year increased compared to the same period last year. However, since the proportion of early-stage investments has decreased and a conservative investment trend has been confirmed, it is difficult to say that the long-frozen venture investment market's harsh winter has thawed.

According to the Korea VC Association's Venture Investment Information Center on the 31st, a total of 1,228 companies received new investments in the first half of this year, with new investments amounting to 2.6754 trillion KRW, an 18.8% increase compared to the same period last year. The annual new investment scale recorded 7.6802 trillion KRW in 2021, 6.764 trillion KRW in 2022, and 5.3977 trillion KRW last year, showing a gradual decline, but the improvement seen in the second half of last year was also confirmed in the first half of this year.

Looking at the total investment resources, 109 new funds were formed in the first half of this year, with new commitments increasing by 20.3% year-on-year to 2.3504 trillion KRW. In terms of scale, Smilegate Investment's 'Smilegate Innovation Growth Fund' was the largest at 265.2 billion KRW, followed by funds from Stonebridge Ventures (250.5 billion KRW) and SBVA (188.7 billion KRW). Thus, the number of operating funds and the amount in the first half of this year reached 2,019 and 58.4528 trillion KRW, respectively, up from 1,817 and 53.0542 trillion KRW in the same period last year.

By industry, the largest share of new investments in the first half was in Information and Communication Technology (ICT) services at 32.1% (859.9 billion KRW). This was followed by ▲Bio & Medical (15.7%, 420.8 billion KRW) ▲Electricity, Machinery & Equipment (14.1%, 377.1 billion KRW) ▲Distribution & Services (12%, 322.3 billion KRW) ▲ICT Manufacturing (7.5%, 201.1 billion KRW), in that order.

However, many in the industry expressed the view that the investment market atmosphere has not fully improved. Previously, the venture investment market peaked in 2021, supported by low-interest rate policies, but has been in a harsh winter for several years due to factors such as the U.S.-led high-interest rate trend, declining corporate valuations, and reduced initial public offering (IPO) sizes. A VC official said, “Rather than making new investments because the market environment has improved, many investments were inevitably executed as part of fund plans that had been postponed,” adding, “There were cases where funds were formed recently after delaying capital deployment due to market conditions and the circumstances of limited partners (LPs), even after selecting investee companies through the capital contribution business.”

Accordingly, a stable investment trend focusing more on 'later stages rather than early stages' was also confirmed. In the first half of this year, the share of new investments by company age was highest in the later stage at 42.8%, followed by mid-stage at 35.8%, and early stage at 21.4%. While the proportion of early-stage investments has been decreasing annually since 29.6% in 2022, the share of later-stage investments has continued to increase since 2022 (30%). Although the basic goal of VCs is to invest 'venture capital' in early-stage companies with growth potential, they cannot ignore the possibility of exit since they must manage the investment funds of multiple limited partners (LPs).

Industry insiders believe that with interest rate cuts in the second half of the year, more adventurous investment cases should appear to judge the market as 'activated.' Currently, there are many companies with sufficient growth potential but unable to receive investments because profitability is not yet confirmed. Gu Taehun, CEO of Big Bang Ventures, said, “When operating a fund, the investment period is set, and the investment plan is made accordingly. Since the market atmosphere is not good now, many VCs have been holding onto investment resources and only executed some investments through a 'selection process' for surviving companies.”

Gu added, “When VC pre-investments in companies with potential are actively executed, it can be seen as a signal that the market atmosphere is beginning to improve,” but “the current selection atmosphere itself can be seen as still hesitant to invest based solely on a company's potential. By examining the actual details such as how much new investment has been made in companies with potential, one can gauge the real market atmosphere,” he added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.