Delayed Settlement Causes Loan Repayment Issues

Some Sellers Suffer Tens of Billions in Losses

Concerns Over Chain Bankruptcies Among Suppliers

On the 29th, at the Wemakeprice (WEMAKEPRICE) headquarters in Gangnam-gu, Seoul, Jeong Mo (35), a seller, sat on a chair in an empty 70-pyeong office, gazing out the window with tears in his eyes. Jeong had been selling household goods such as cleaning supplies on the e-commerce platforms Wemakeprice and TMON. However, with 200 million KRW in sales proceeds from May not settled by the end of this month, he is facing the threat of business closure.

The advance settlement loans he had received before the settlement also became shackles. Jeong had been borrowing funds from commercial banks at an interest rate in the 6% range. Since it takes about two months for TMON and Wemakeprice to settle sales proceeds, he had been using loans to cover delivery payments. The loan was repaid immediately upon receipt of the sales proceeds. However, with the settlement of payments for May, June, and July now uncertain, Jeong is at risk of becoming a credit delinquent.

Jeong said, "I even used all my insurance policy loans to prepare for loan repayments and employee salaries," adding, "The employees try to smile and say we can get through this, but my heart is torn."

On the 29th, sellers gathered at the Wemakeprice building in Gangnam-gu, Seoul, sharing their damage situations.

On the 29th, sellers gathered at the Wemakeprice building in Gangnam-gu, Seoul, sharing their damage situations. [Photo by Lee Ji-eun]

Sellers facing bankruptcy due to the TMON and Wemakeprice crisis have come forward urging a resolution to the delayed sales proceeds settlement. There are concerns that if they do not receive payments on time, a chain of bankruptcies including suppliers could occur. Furthermore, the impact on the financial sector that provided advance settlement loans to sellers is also expected to be significant.

As of May, the financial authorities identified unsettled sales proceeds amounting to 109.7 billion KRW for TMON and 56.5 billion KRW for Wemakeprice, totaling 166.2 billion KRW. The unsettled amount is expected to increase further when including June and July.

The individual damage amounts for sellers range from tens of millions to several billion KRW. Kim Mo (45), a seller who has been selling agricultural products on TMON and Wemakeprice, has not received 530 million KRW in sales proceeds as of May. Including June and July, the damage amount rises to 730 million KRW. Kim tearfully said, "There are sellers around me who have suffered damages of up to 1.7 billion KRW," adding, "Everyone is worried that suppliers will pressure them for payment, so they do not openly talk about the damage."

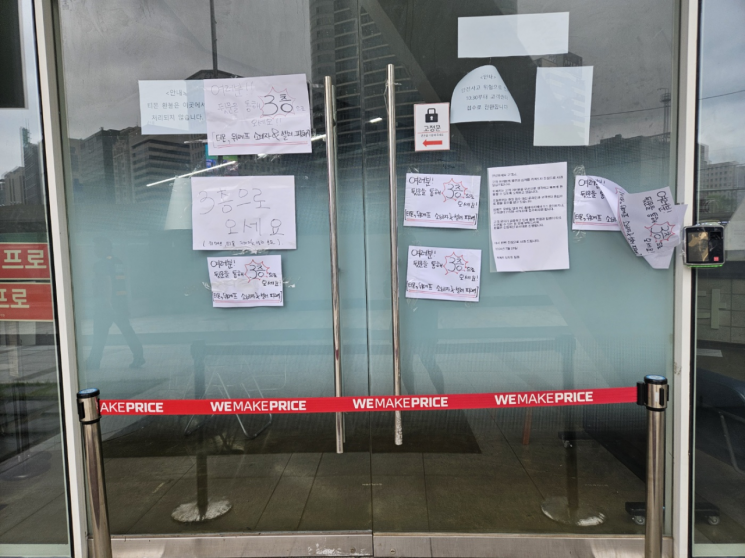

On the 29th, notices written by the victims were posted on the entrance door of the Wemakeprice building in Gangnam-gu, Seoul.

On the 29th, notices written by the victims were posted on the entrance door of the Wemakeprice building in Gangnam-gu, Seoul. [Photo by Lee Ji-eun]

If the situation prolongs, there are concerns it could lead to a chain of bankruptcies among suppliers. The majority of sellers on TMON and Wemakeprice are small and medium-sized enterprises. If they fall into financial distress, the companies supplying products to these sellers are likely to fail to pay delivery fees on time.

Im Mo (52), a seller who has been selling beverage supplies on Wemakeprice, emphasized, "If we go bankrupt, it will cause a domino effect where the companies we supplied will also fail to receive payments," adding, "This is not an issue that will end with only sellers suffering."

The financial sector is also expected to suffer considerable damage. So far, three commercial banks including KB Kookmin Bank have provided advance settlement loans to e-commerce platform vendors. These products offer loans ranging from about 10 days to over 60 days in line with the e-commerce platform’s sales proceeds settlement cycle, with repayment scheduled upon receipt of settlement funds. The banks have charged an annual interest rate of 6% on these loans.

Meanwhile, as the scale of damage rapidly expands, the Financial Services Commission has stepped in to contain the situation through funding. On the 29th, the Financial Services Commission held a 'TMON and Wemakeprice Settlement Delay Damage Company Financial Support Meeting' and announced plans to extend loan and guarantee maturities for affected companies by up to one year. Additionally, to minimize damage to small business owners, they decided to inject emergency funds totaling at least 560 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.