KB Sonbo, Shinhan Life, NH Nonghyup Saengmyeong Excluded, Poor Performance

Some Small and Medium Insurers Continue Deficits... Holding Companies Inject Funds

Insurance Company Acquisitions Likely to Become More Difficult in M&A Market

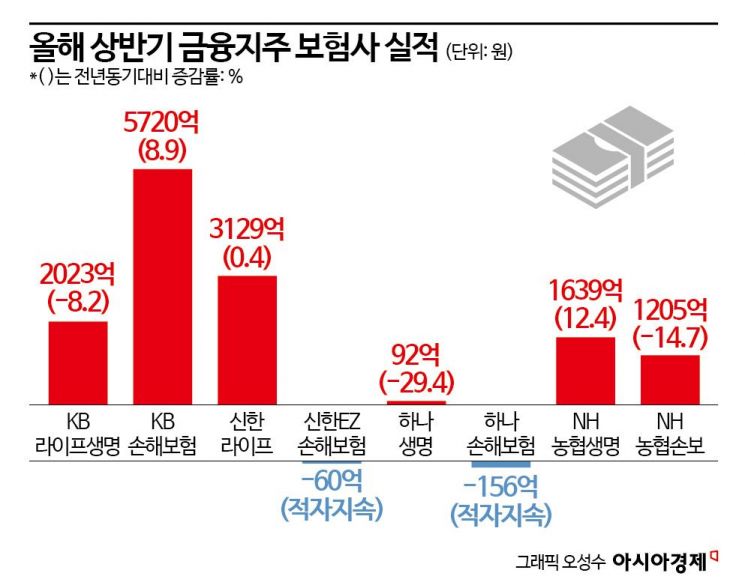

The financial performance of insurance affiliates under financial holding companies diverged in the first half of this year. Except for some large companies that solidly support the financial holding companies' results, most showed weaker performance or continued losses compared to the same period last year. Concerns have been raised that there may be calls for caution regarding the mergers and acquisitions (M&A) strategies of financial holding companies aiming to strengthen their non-bank portfolios.

According to the financial sector on the 29th, KB Life Insurance, an insurance affiliate of KB Financial Group, posted a net profit of 202.3 billion KRW in the first half of this year, down 8.2% from the same period last year. During the same period, the new contract insurance contract margin (CSM), an indicator of growth for insurance companies, sharply declined by 21.4% to 227 billion KRW from 289 billion KRW in the previous year. A KB Life Insurance official explained, "The net profit decreased due to the base effect of gains and losses on financial asset valuations and foreign exchange derivatives."

KB Insurance's net profit for the first half of this year was 572 billion KRW, an 8.9% increase compared to the same period last year. This is the highest performance on record for the first half. Despite unfavorable domestic and external conditions such as high interest rates and worsening loss ratios in automobile insurance, profits increased due to accounting issues and other factors. A KB Insurance official stated, "Despite the expansion of losses on oil derivatives due to rising market interest rates, net profit increased due to the reversal of reserves related to changes in the method of provisioning for incurred but not reported (IBNR) losses." IBNR refers to the amount for which an insurance company has an obligation to pay insurance claims due to occurred accidents but has not yet been claimed by the policyholder. The insurance company sets aside reserves for this and recognizes it as a liability, which is later reversed.

Shinhan Life Insurance, an insurance affiliate of Shinhan Financial Group, recorded a net profit of 312.9 billion KRW in the first half of this year, a slight increase of 0.4% compared to the same period last year. During the same period, insurance profit increased by 28.6%, but financial profit decreased by 48.8%. A Shinhan Life official said, "Financial profit decreased due to the disappearance of gains from the disposal and valuation of securities last year, but net profit grew as amortization gains from CSM increased with new contract growth."

Shinhan EZ Insurance, a digital non-life insurance company under Shinhan Financial Group, posted a loss of 6 billion KRW in the first half. The deficit widened by 4.7 billion KRW compared to last year. The increase in costs due to the construction of a next-generation IT system is analyzed as the cause. Shinhan EZ Insurance has continued to incur losses for two consecutive years since its launch in 2022.

Hana Life Insurance, an insurance affiliate of Hana Financial Group, recorded a net profit of 9.2 billion KRW in the first half of this year, down 29.4% from the same period last year. Although it earned 15.7 billion KRW in the insurance sector, investment losses amounted to 3.3 billion KRW, turning into a deficit compared to the first half of last year. The company explained that ongoing high interest rates caused valuation losses in overseas investments and losses in investments due to provisions for domestic project financing (PF) bad debts.

Hana Insurance posted a net loss of 15.6 billion KRW in the first half of this year. The deficit continued following last year. Increased costs for IT infrastructure construction to sell long-term insurance and worsening loss ratios in automobile insurance were factors.

NH Nonghyup Life Insurance, an insurance affiliate of NH Nonghyup Financial Group, posted a net profit of 163.9 billion KRW in the first half of this year, up 12.4% from the same period last year. During the same period, new contract CSM surged by 307.7 billion KRW to 576.7 billion KRW compared to the previous year. The increase in sales of protection-type insurance improved insurance profits.

NH Nonghyup Insurance's net profit for the first half of this year was 120.5 billion KRW, down 14.7% from the same period last year. Due to continued abnormal weather phenomena, natural disaster damage was greater than last year. It is analyzed that the loss ratio of Nonghyup Insurance, which has a high proportion of policy insurance such as crop disaster insurance and livestock disaster insurance, increased.

Insurance companies remain core affiliates that solidly support the financial holding companies' performance, which is still centered on banks. However, small and medium-sized insurance companies, excluding large insurers with solid performance bases, may instead become burdens. This is because uncertainties about the core insurance business have increased due to aging and worsening economic conditions, and investment factors such as the expansion of the silver industry and digital transformation have increased. In fact, on the 26th, Hana Financial Group decided to inject 200 billion KRW into Hana Life Insurance and about 100 billion KRW into Hana Insurance.

As insurance company listings gradually accumulate in the M&A market, buyers are expected to approach more cautiously. Woori Financial Group, which is currently attempting to acquire Dongyang Life Insurance and ABL Life Insurance to expand its non-bank sector, is also expected to conduct the ongoing due diligence more conservatively. Lee Sung-wook, Chief Financial Officer (CFO) of Woori Financial Group, said at the earnings conference call held on the 25th, "We will not overpay during the M&A process," and added, "Regarding the capital increase concerns investors have about our current insurance business entry, we are not considering it."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)