Is the Super Yen Era Ending?

Japan Raises Interest Rates After Trump's Criticism

Safe Asset Demand Surges After Biden's Resignation

Japan's 'Absolute Resignation Man' "Asset Decline Due to Yen Depreciation"

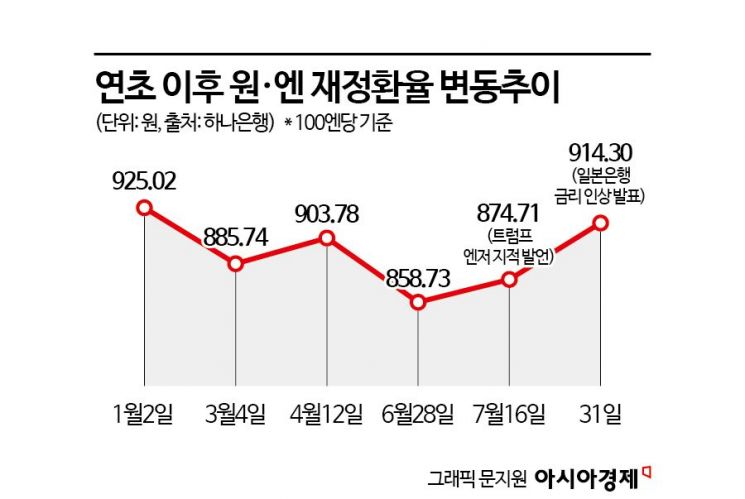

Since April, the won-yen exchange rate had remained in the 800-won range per 100 yen, but with the Bank of Japan's interest rate hike announcement pushing it past the 900-won mark, expectations are growing that the 'super yen depreciation' phenomenon will come to an end. After former U.S. President and Republican presidential candidate Donald Trump stated that "the prolonged yen depreciation is becoming a burden on the U.S. economy," the yen's value continued to rise. With the Bank of Japan (BOJ) actually raising interest rates, the direction of the yen is expected to change significantly depending on the U.S. presidential election results. As the BOJ is increasingly likely to implement further rate hikes, an environment has been created where the yen's appreciation trend is expected to continue for some time.

Trump Points Out "Yen Too Low Against Dollar," Yen Value Rises

On the 31st of last month, in the Seoul foreign exchange market, the won-yen re-exchange rate surged to 914.30 won per 100 yen, a sharp increase of 8.18 won from the previous session. On that day, the BOJ announced it would raise the policy interest rate from the previous 0?0.1% to 0.25%, pushing Japanese interest rates to their highest level in 15 years and significantly boosting the yen's value.

Considering that at the end of June the yen's value had fallen to the 850-won range per 100 yen, this represents a rapid increase of more than 6.4% in a short period. The yen's value against the dollar, which was 161.71 yen per dollar at the beginning of last month, also dropped to 150.03 yen on that day.

The U.S. presidential election acted as a factor putting upward pressure on the yen's appreciation, fueling the rise in the yen's value. According to Bloomberg News, former President Trump said in an interview with Bloomberg Businessweek released on the 16th of last month, "The gap between the dollar, yen, and yuan is unbelievable," adding that "(the yen depreciation) is a disaster for the U.S. manufacturing sector." The foreign exchange market reacted sensitively, with the yen's value surging before and after this statement. If Trump wins the November election and takes office, the likelihood of the U.S. pressuring for yen appreciation will increase significantly.

Due to the prolonged yen depreciation causing soaring prices, Japanese political circles have also been pressuring the BOJ for yen appreciation ahead of the Liberal Democratic Party (LDP) leadership election in September. Motegi Toshimatsu, the LDP's second-in-command, stated last month that "the policy of normalizing monetary policy, including considering gradual rate hikes, should be presented more clearly," urging for yen appreciation.

'Absolute Resignation Man' Who Saved 100 Million Yen Eating Only Rolled Omelets... "Yen Depreciation Reduced the Value of Money"

A diet photo posted on social media (SNS) by Zettai Taishaman (絶?仕事?めるマン), a famous Japanese FIRE family influencer. [Image source=X (formerly Twitter)]

A diet photo posted on social media (SNS) by Zettai Taishaman (絶?仕事?めるマン), a famous Japanese FIRE family influencer. [Image source=X (formerly Twitter)]

In fact, public dissatisfaction with the prolonged super yen depreciation phenomenon is high in Japan. The long-term yen depreciation has caused import prices to rise sharply and the prices of daily necessities to soar, reducing household consumption capacity and diluting the value of hard-earned savings.

According to Nihon Keizai Shimbun (Nikkei), a famous Japanese investment influencer known as 'Zettai Taishaman (絶?退社マン)' expressed on his X (formerly Twitter) account that the value of the 100 million yen he had saved had significantly dropped due to the yen depreciation, saying, "I regret what I have been saving so hard for 21 years. It was truly a meaningless life."

Zettai Taishaman is known in Japan as a FIRE (Financial Independence, Retire Early) investor influencer who saved 100 million yen (approximately 894 million won) by the age of 45 through extreme consumption reduction and saving. He promoted saving money by eating simple side dishes like rolled omelets and soft tofu with rice, and published a book featuring photos of his diet and saving methods, which attracted attention.

According to the "Labor Statistics Survey" published by Japan's Ministry of Health, Labour and Welfare in March, the average real wages of Japanese workers have declined for 24 consecutive months. Due to rising import prices and soaring prices of daily necessities, wage increases have not kept pace. In response, the Japanese government raised the minimum wage for fiscal year 2024 by 5%, or 50 yen (about 450 won), to an all-time high of 1,054 yen (about 9,479 won) per hour. The 5% increase is the highest in 33 years since 1991.

Exchange Rate Volatility Increases After Biden's Withdrawal... Reflecting Growing Anxiety

Aside from former President Trump's comments on yen depreciation and the BOJ's policy rate hike, political variables surrounding the U.S. presidential election are also boosting the value of the yen, which is classified as a safe-haven asset. The U.S. presidential race has shifted as Vice President Kamala Harris, the Democratic Party's emerging candidate, has gained support, changing the previously expected atmosphere of Trump's certain victory.

According to a poll conducted by Ipsos on 1,200 U.S. adults from the 26th to 27th of last month (local time), the favorable rating for Vice President Harris was 43%. This is an 8 percentage point increase compared to 35% in the same survey a week earlier. Trump's favorability rating was 36%, slightly down from 40% recorded a week earlier after the Republican National Convention.

On the 21st of last month, President Biden announced his withdrawal from the presidential race and expressed support for Vice President Harris, plunging the U.S. presidential election into an unpredictable situation. Since Biden's announcement of his decision not to seek re-election, Harris has effectively become the presidential candidate and, within a week of campaigning, her campaign raised $200 million (approximately 277.1 billion won), with 170,000 new donors joining.

Before Harris's emergence, the U.S. presidential election outcome was almost expected to be a Trump victory, but now it is considered to be shrouded in uncertainty. As political volatility increases, demand for the yen as a safe-haven asset is also expected to continue growing for some time.

Shin Yoon-jung, a researcher at Kyobo Securities, said, "In the medium to long term, the trend of yen appreciation will continue due to the Japanese government's shift in stance on yen depreciation, expectations for domestic demand recovery, and dollar weakness," adding, "It is important to note that in the second half of the year, the pressure for yen appreciation due to increased demand may be greater than expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)