Signs of Economic Recession Amid Prolonged High Interest Rates

Q2 US GDP Growth Forecasted at 2%

Employment Slows, Unemployment Steadily Rises

Delinquencies Increase, Consumer Sentiment Hits Bottom

Federal Reserve Likely to Cut Base Rate in September

Some Argue "Need Faster Cuts... Emphasizing the Three Rules"

Signals of a U.S. economic recession due to prolonged high interest rates are becoming more pronounced. This is because low growth rates are expected to continue into the second quarter following the first quarter. Employment is slowing down, unemployment is rising, and although inflation is somewhat controlled, consumer sentiment is freezing. While the Federal Reserve (Fed) is widely expected to cut the benchmark interest rate in September, some argue that an earlier cut is necessary.

Will the U.S. also continue low growth?

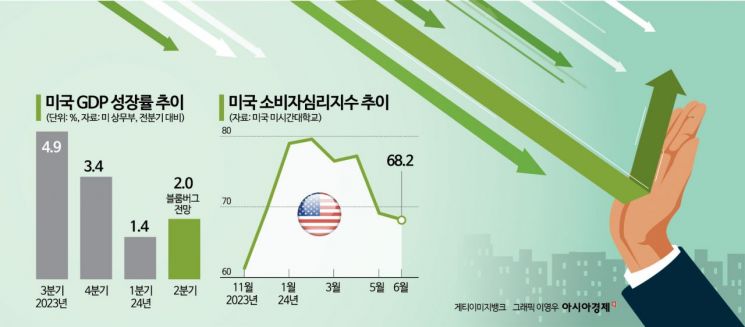

On the 25th (local time), as the U.S. Department of Commerce is set to announce the 2024 second-quarter Gross Domestic Product (GDP, preliminary estimate) growth rate, Bloomberg predicted 2.0% quarter-on-quarter growth, while CNBC forecasted 2.1%. The first-quarter GDP growth rate was 1.4%. Considering that the GDP growth rates for the third and fourth quarters of last year were 4.9% and 3.4%, respectively, this means the U.S. is experiencing low growth in the 1-2% range for two consecutive quarters. Bloomberg explained that “the growth rates for the first and second quarters of 2024 are the slowest since 2022.”

The labor market is losing momentum. According to the U.S. Department of Labor, nonfarm payroll employment in June increased by only 206,000, significantly below the 12-month average increase of 220,000. The unemployment rate for the same month was 4.1%, exceeding market expectations of 4.0%, marking the highest level since November 2021. Anna Wong of Bloomberg Economics forecasted that the U.S. unemployment rate will rise to 4.5% by the end of the year.

Companies Struggling Amid Prolonged High Interest Rates

It is diagnosed that companies are struggling due to the prolonged high interest rates. According to this month’s Fed Beige Book (economic assessment report), business activity stagnated or declined in 5 of the 12 Federal Reserve districts, an increase of 3 districts compared to the previous report. Avremi Sheinfeld, who operates a kosher restaurant in Brooklyn, New York, told Bloomberg, “Due to the high interest rates on credit card debt, profitability has worsened, forcing us to reduce employees’ working hours.”

Household Loan Delinquencies... Housing Prices Soaring

The University of Michigan’s monthly U.S. Consumer Sentiment Index stood at 68.2, the lowest since November last year (61.3). This is said to be related to the $3.4 trillion increase in U.S. household debt since COVID-19. Some households are reportedly struggling with repayments. Fed Director Lisa Cook said in a speech in New York on the 25th of last month, “Credit card delinquency rates are on the rise, and the rate at which auto loans are turning into delinquencies has reached its highest level in 13 years.”

Mortgage rates are hovering around 7%, more than double what they were three years ago. High mortgage rates cause a shortage in housing supply, fueling price increases. The U.S. House Price Index released by the Federal Housing Finance Agency recorded an all-time high of 424.3 in April.

Almost all economic indicators point to a U.S. economic recession. Some market participants see the prolonged high interest rates as the main cause of the recession, given that inflation is being controlled. According to the Chicago Mercantile Exchange (CME) FedWatch Tool, the futures market fully reflects a 100% probability of a rate cut in September.

September Cut Is Too Late... “It Should Be in July”

However, there are calls to lower the benchmark interest rate sooner than that. William Dudley, former president of the New York Federal Reserve Bank, recommended in an op-ed that “the Fed should cut the benchmark interest rate at the monetary policy meeting scheduled for next week.” Dudley has been known as a representative hawk who advocated maintaining high interest rates for longer.

However, he revealed that he changed his stance as the “Rule of Three” recession signal became more prominent. The Rule of Three means that if the three-month average unemployment rate rises by 0.5 percentage points compared to the lowest point in the previous 12 months, the risk of recession increases. Recently, this indicator has risen by 0.43 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)