KRX Construction Index Up 4% from Last Month... KOSPI Down 1%

"Seoul-Centered Real Estate Investment Sentiment Recovers vs. Provinces Still Sluggish"

Construction stocks, which had been experiencing a sluggish trend, have started to rebound. This is interpreted as growing expectations for construction stocks as negative factors that had been suppressing stock prices, such as the US interest rate cuts and rising housing prices centered around Seoul, have eased. However, some opinions suggest that it is still too early to buy construction stocks since the housing price increase is limited to certain areas.

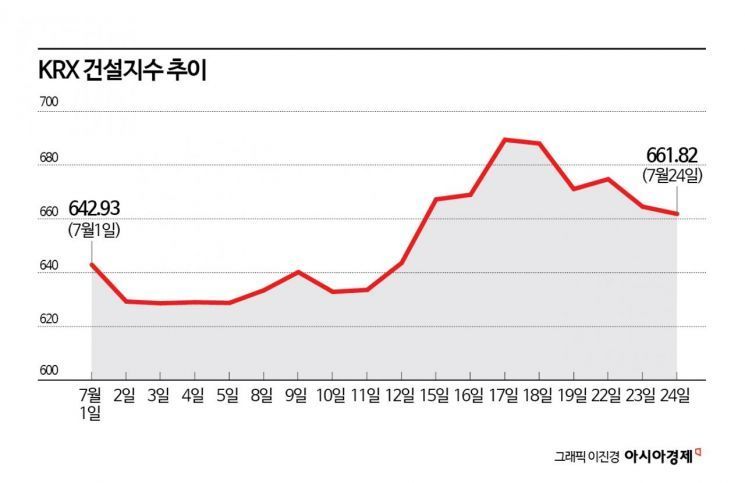

According to the Korea Exchange on the 25th, the KRX Construction Index recorded 661.82 the previous day, rising 3.71% compared to the end of last month. During the same period, the KOSPI fell by 1.40%. By individual stocks, construction stocks also outperformed the KOSPI. GS Construction rose 18.16%, Daewoo Construction 7.93%, Gyeryong Construction 9.29%, and DL E&C 0.77%.

The rise in construction stocks was influenced by expectations of US interest rate cuts, the Czech nuclear power plant contract, and reconstruction demand in Ukraine. The US June Consumer Price Index (CPI) came in below market expectations, increasing hopes for a base interest rate cut. Along with this, the possibility of former President Donald Trump winning the US presidential election, who advocated for an early end to the Russia-Ukraine war, has heightened interest in construction stocks, which are considered reconstruction stocks.

The recovery of housing prices is also cited as a positive factor. According to the "June Nationwide Housing Price Trend Survey" released by the Korea Real Estate Board, the nationwide housing sales price index rose 0.04% compared to the previous month. This is the first monthly increase in housing prices in seven months since November last year (0.04%). Additionally, housing price outlooks are improving. According to the "July Consumer Sentiment Survey" released by the Bank of Korea, the housing price outlook Consumer Sentiment Index (CSI) was recorded at 115. It rose 7 points from 108 in June, marking the highest level since November 2021 (116).

Researcher Park Sera of Shin Young Securities explained, "With interest rate concerns easing and the domestic real estate market clearly recovering, factors enabling continuous increases in return on equity (ROE), such as profit improvement and overseas order growth, are becoming noticeable. Real estate prices and investment sentiment centered on Seoul are recovering, improving the domestic construction order environment."

However, there is also analysis that investing in construction stocks is premature. The real estate environment has not fully improved, as apartment prices are falling in regions other than Seoul. Researcher Kim Seungjun of Hana Securities said, "In provincial areas, apartment prices are declining, and concerns about liquidity reduction due to an increase in unsold units after completion are growing as unsold units have not been resolved. These issues are not only relevant to small and medium-sized companies in the provinces but also affect large companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)