Coin Developer Without Arms Unable to Withdraw Funds

Pulls Out Hands from Behind Back and Executes Rug Pull Live

Fraud, Opacity, and Risks Rampant in Cryptocurrency Industry

Cases of so-called 'coin scams,' where investors are lured with the bait of cryptocurrency (coin) listings and then liquidity is siphoned off before the perpetrators disappear, are rampant both domestically and internationally. Recently, overseas, there was even an incident where a coin investor who boldly claimed on live broadcast, "I was born without arms and cannot commit fraud," shamelessly carried out a scam on air.

Investors Flipped Over the Bizarre 'Son Coin' Scam

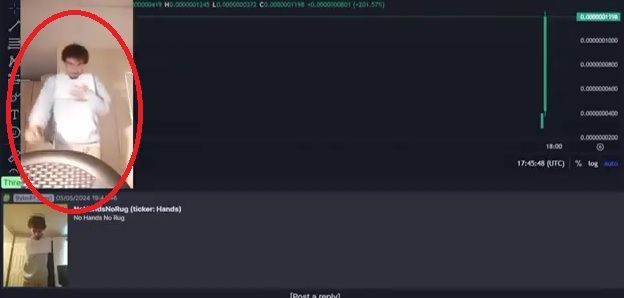

The developer of the controversial 'Son Coin.' After cleverly crossing both arms behind his back, he garnered investors' enthusiasm through a live broadcast.

The developer of the controversial 'Son Coin.' After cleverly crossing both arms behind his back, he garnered investors' enthusiasm through a live broadcast. [Image source=Online community capture]

This incident, which attracted attention in the coin industry, is known as the 'No hands No rug' scam. Literally translated, it means "No hands, so no rug pull." A rug pull is a coin term referring to a scam technique where the developer suddenly cashes out their share of the investment funds raised during the coin listing. As the developer's liquidity that supported the coin's value is withdrawn, the coin's price plummets, and the developer then disappears.

Rug pulls are especially rampant in the meme coin sector. Due to the prevalence of rug pulls, one coin developer in May claimed, "I have no arms, so I cannot rug pull (on the computer)," promising a transparent coin listing. This developer appeared live on broadcast, standing without arms and holding a paper with "No hands No rug" written on it, supported by his chin.

A developer who reveals hidden arms and inputs the rug pull key the moment a coin is listed. [Image source=Captured from online community]

A developer who reveals hidden arms and inputs the rug pull key the moment a coin is listed. [Image source=Captured from online community]

Investors were thrilled by the developer's passion(?) and sincerity. The developer's coin was named Son (HANDS). Son quickly gained massive investment through word of mouth, and at its peak, its market capitalization reached about $550,000.

At that moment, the developer suddenly revealed the two arms hidden behind his back and quickly approached the computer. He pressed a single keyboard button to execute the prepared rug pull command, and as the liquidity allocated to him was withdrawn, the Son coin's market capitalization dropped by about $530,000. All investors except the developer effectively lost almost all their investments.

Meme Coins Rife with Scams, Opacity, and Investment Risks

Traces of the "rug pull" involving Son Coin still remain on price tracking sites. Small-scale coins either steal investment funds under the pretense of listing or execute a rug pull by withdrawing liquidity the moment the coin is listed.

Traces of the "rug pull" involving Son Coin still remain on price tracking sites. Small-scale coins either steal investment funds under the pretense of listing or execute a rug pull by withdrawing liquidity the moment the coin is listed. [Image source=Captured from online community]

Son coin is now remembered as a 'legend' of meme coin scams. Even now, coin price tracking sites retain records of Son coin's rug pull, attracting many netizens who leave comments. Son coin is one of the most dramatic examples showing the widespread scams, risks, and opacity in the cryptocurrency industry.

In South Korea, coin scams have already become a serious financial crime. Every year, incidents occur where billions of won are taken through coin listing scams. In April, the Gimpo Police Station in Gyeonggi Province sent a 20-year-old A, a coin company sales agent, to the prosecution without detention.

A is suspected of collaborating with B, the representative of a coin company, from March 2021 to July of the following year to promote an investor coin business, deceiving about 30 investors and causing or aiding losses of approximately 3 billion won.

As a result, financial authorities are strengthening regulations on cryptocurrencies. Especially since the implementation of the Act on the Protection of Virtual Asset Users on the 19th, the Financial Supervisory Service can now inspect whether virtual asset service providers comply with user protection obligations.

Through investigations by financial authorities and law enforcement agencies, those found to have engaged in unfair trading practices can face criminal penalties including up to life imprisonment, fines amounting to 3 to 5 times the illicit gains, and administrative sanctions such as surcharges amounting to twice the illicit gains.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.