As hospital admissions and surgeries at university hospitals nationwide sharply declined due to conflicts between the medical and government sectors, the pharmaceutical and bio industries, which were expected to suffer performance hits, have continued their growth trend into the second quarter. Since the conflicts began in earnest at the end of February, it was anticipated that the actual impact would become evident from the second quarter, but the industry appears to have overcome these concerns.

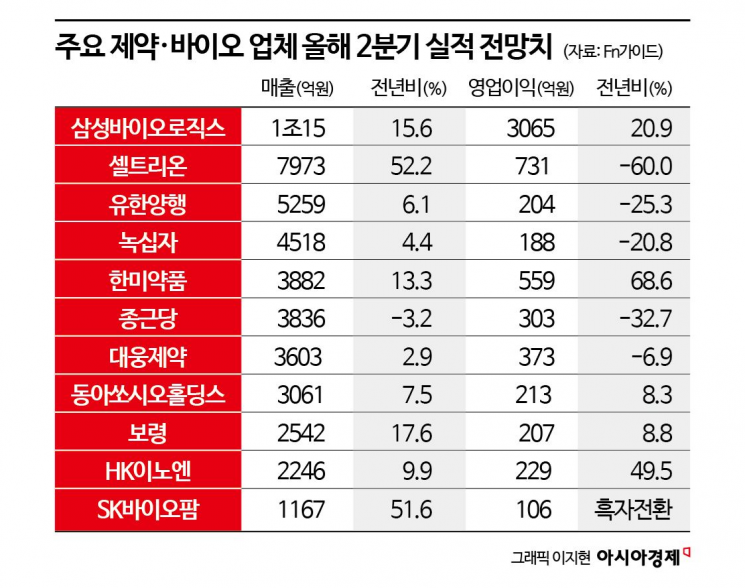

According to the industry on the 24th, following Samsung Biologics' announcement of its second-quarter earnings, a series of earnings reports are expected to follow. Samsung Biologics, which recorded annual sales of 4 trillion won last year, is estimated to have achieved quarterly sales of 1 trillion won in the second quarter of this year. According to FnGuide, securities firms forecast sales of 1.0015 trillion won and operating profit of 306.5 billion won, representing increases of 15.62% and 20.93% respectively compared to the same period last year. SK Biopharm is also expected to continue its performance growth, having successfully turned a profit thanks to strong U.S. sales of its epilepsy treatment Xcopri. Following its first quarterly profit without technology export achievements in the fourth quarter of last year, there is optimism that it will achieve an annual profit turnaround as well.

Since these companies do not sell their pharmaceuticals domestically, there is little correlation between the medical-government conflicts and their performance. However, pharmaceutical companies focusing on domestic sales are also estimated to have experienced no significant sales impact. Hanmi Pharm stands out the most, with expected second-quarter sales of 388.2 billion won and operating profit of 55.9 billion won, representing growth of 13.3% and 68.6% respectively compared to the same period last year. Hyemin Heo, a researcher at Kiwoom Securities, analyzed, "Sustained growth of high-margin products Rosuzet and Amozaltan is expected," adding, "Since they possess cardiovascular treatments, the impact of the medical strike was likely limited."

Companies specializing in intravenous fluids, which were expected to be directly hit by the decrease in hospital admissions and surgeries, also appear to have been largely unaffected. HK Innoen is expected to see sales growth as intravenous fluid sales increase, alongside growth in best-selling products such as K-CAB and Kanab. Sales are projected to increase by 9.9%, and operating profit by 49.5%. Minsoo Shin, a researcher at Kiwoom Securities, stated, "Second-quarter intravenous fluid sales grew by 7.1% compared to the same period last year," and added, "By shifting distribution channels from large hospitals to secondary hospitals, they successfully minimized the impact of the medical strike." Boryung, the sales partner for K-CAB and Kanab, is also expected to continue sales growth with 254.2 billion won in sales, making it likely to achieve its annual sales target of 1 trillion won this year.

There are companies expected to see deteriorating performance. However, most of the sales declines cannot be attributed to the medical-government conflicts but are expected to result from other factors such as product portfolio adjustments, increased research and development (R&D), and higher selling and administrative expenses, leading to reduced operating profits.

Chong Kun Dang is projected to record second-quarter sales of 383.6 billion won and operating profit of 30.3 billion won. While sales are expected to decrease by only 3.2% compared to the same period last year, operating profit is forecasted to drop by 32.7%. Minjung Kim, a researcher at DS Investment & Securities, explained, "Sales of Januvia sharply declined due to price reductions following patent expiration in the third quarter of last year, and K-CAB was excluded after the partnership with HK Innoen ended," adding, "Although the sales gap was minimized through new products like Pexuclu and Godeks, profit decline is inevitable."

Celltrion is expected to see sales increase by 52.2% to 797.3 billion won, but operating profit is forecasted to decrease by 60.0% to 73.1 billion won. This is attributed to a temporary rise in cost ratios and amortization of intangible assets during the merger process with Celltrion Healthcare. Yuhan Corporation is also expected to see a 25% decrease in operating profit due to increased R&D and advertising expenses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.