In Case of Urgent Large Sum Needs, 'Partial Withdrawal Service'

One-Stop Youth Financial Consulting Center to Be Established in the Second Half of the Year

On the 15th, the day the 'Cheongnyeon Doyak Account,' which allows young people to save up to 50 million won by depositing 700,000 won monthly for five years, was launched, counselors at the Cheongnyeon Doyak Account non-face-to-face consultation center in Jung-gu, Seoul, were providing consultations. Photo by Kang Jin-hyung aymsdream@

On the 15th, the day the 'Cheongnyeon Doyak Account,' which allows young people to save up to 50 million won by depositing 700,000 won monthly for five years, was launched, counselors at the Cheongnyeon Doyak Account non-face-to-face consultation center in Jung-gu, Seoul, were providing consultations. Photo by Kang Jin-hyung aymsdream@

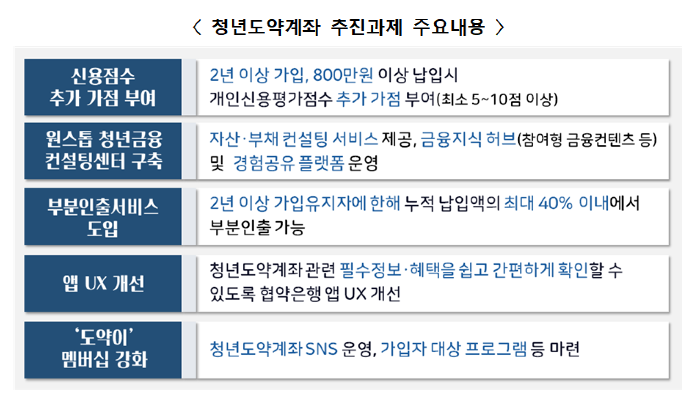

Going forward, account holders who have been enrolled in the Youth Leap Account for more than two years and have deposited over 8 million KRW will receive an additional 5 to 10 points on their personal credit evaluation scores. Additionally, those who have been enrolled for more than two years and urgently need a lump sum will be allowed partial withdrawals.

On the 23rd, the Financial Services Commission held an event titled "One Year Since the Introduction of the Youth Leap Account ? Youth Talk About Finance" at the OnDream Society in Myeongdong, Seoul, in collaboration with the Korea Inclusive Finance Agency, where they discussed these operational plans.

Account holders who have been enrolled in the Youth Leap Account for over two years and have deposited more than 8 million KRW will be granted additional personal credit evaluation points. Even if the account holders do not individually provide their Youth Leap Account deposit information to credit rating agencies, the additional points will be automatically applied if the conditions are met. The extra credit score points are expected to help young people, whose creditworthiness is often rated low due to insufficient financial history, to build and accumulate credit.

Considering the unavoidable and urgent lump sum needs of young people enrolled in the Youth Leap Account, a partial withdrawal service will be introduced exclusively for those who have been enrolled for more than two years. The amount available for partial withdrawal will be limited to a maximum of 40% of the cumulative deposits, and interest, interest income tax, and government contribution payment criteria on the withdrawn amount will be the same as those applied in cases of early termination.

Until now, the Youth Leap Account did not offer a partial withdrawal service commonly provided by regular savings products in the market, so young people urgently needing a lump sum had no choice but to either take out a secured loan with an interest rate of 5.0% to 7.8% per annum or terminate their accounts early. With the introduction of the partial withdrawal service, young people will have various options to respond to urgent financial needs while maintaining their Youth Leap Account subscriptions and continuing their savings and asset formation.

A one-stop youth financial consulting center will also be established online and offline in the second half of the year. The center plans to offer services such as ▲asset and debt consulting ▲participatory financial content including financial lectures and asset management simulations, targeting Youth Leap Account subscribers and others. The center will operate five offline locations and an online website, aiming to enhance young people's asset and debt management capabilities and broaden their financial experience.

The user experience (UX) of the Youth Leap Account-related applications (apps) will also be improved. Although young people can check Youth Leap Account information through the apps of their respective banks, it has been identified that some banks have inconveniences in confirming essential information and benefits. Efforts will be made to improve app UX so that essential information and benefits of the Youth Leap Account can be checked more easily. Subscribers will be able to conveniently view essential information such as government contribution accumulation status, preferential interest rate fulfillment status, expected returns at maturity, and the flexible deposit structure, which is expected to increase both convenience and savings incentives. Additionally, a Youth Leap Account social networking service (SNS) will be launched to strengthen the provision of financial information and benefits related to the Youth Leap Account. Various programs, including a deposit goal challenge involving Youth Leap Account subscribers, will also be prepared.

Kim So-young, Vice Chairman of the Financial Services Commission, stated, "Within one year of the Youth Leap Account's introduction, 1.33 million people have subscribed, meaning one in five eligible young people has joined, and the current retention rate is 90%, which is significantly higher than that of regular savings products in the market." She added, "We must provide young people with universal opportunities for asset formation and improve financial conditions to reduce the gap between opportunities and burdens. The Youth Leap Account will play a central role in this effort."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)