Over 250 Executives from Unlisted and Listed Companies Worth Over $1 Billion

79% Expect at Least Two Sales Within the Next 18 Months

52% Discuss ESG Factors During Sales

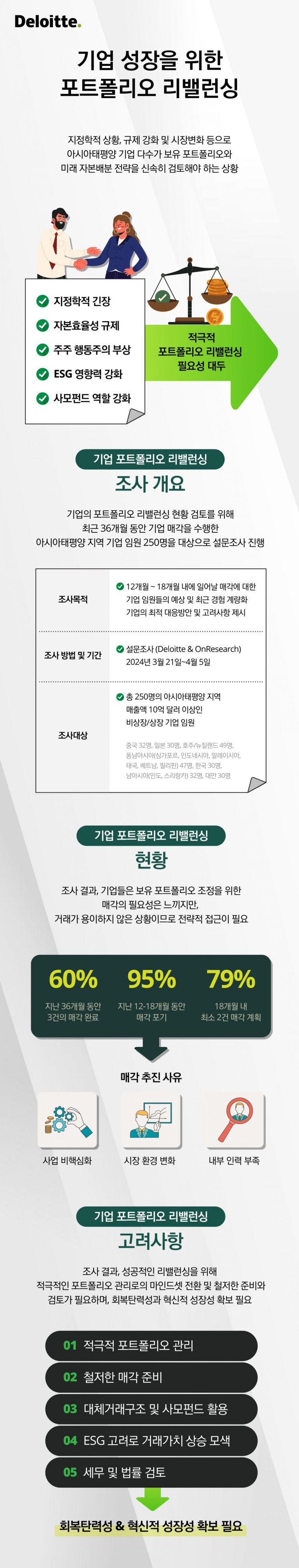

Deloitte Korea Group, together with market research firm OnResearch, announced the results of a survey conducted on the 23rd targeting 250 executives from both unlisted and listed companies in the Asia-Pacific region with revenues exceeding 1 billion USD.

The report titled 'Portfolio Rebalancing for Corporate Growth' emphasized the necessity of portfolio rebalancing for companies to respond to various trends such as geopolitical tensions, capital efficiency regulations, shareholder activism, and the strengthening of ESG and net-zero targets.

According to the report, 79% of respondents expected at least two divestitures within the next 18 months. 95% responded that they had abandoned sales due to internal strategic changes, indicating the need for a multidimensional and detailed approach. Additionally, 40% of respondents prioritized managing changes with customers and partners and planned communication, 37% prioritized developing attractive stories and securing performance records for the divestiture targets, and 35% prioritized analyzing potential deal structures.

The report presented five key factors for successful portfolio rebalancing: ▲ proactive portfolio management and securing capital efficiency ▲ thorough divestiture preparation to protect corporate value ▲ utilization of alternative deal structures and private equity ▲ consideration of ESG ▲ tax and legal management.

59% of respondents said they review their portfolios at least twice a year, an increase compared to 2022. This is to respond to shareholder value creation, geopolitical conflicts, regulatory pressure adjustments, and technological adoption disruptions. Strategic insights and strong execution capabilities are required to create and preserve value during corporate spin-offs.

99% of respondents said they consider alternative deal methods, particularly favoring joint ventures (JVs), partnerships, and strategic alliances. This can help achieve strategic goals through attracting private capital, flexibility, and collaboration with private equity firms in non-competitive relationships.

52% of respondents said they discussed ESG factors during divestitures. ESG provides growth opportunities related to climate change response, energy transition, and sustainable solutions, offering benefits such as reputation branding, operational efficiency improvement, and capital cost reduction to both buyers and sellers.

68% of respondents said changes in tax law had a significant impact on divestiture strategies. This suggests the importance of thorough tax planning from the early stages of portfolio rebalancing.

Gil Ki-wan, Head of the Management Consulting Division at Deloitte Korea Group, said, "We hope companies will examine growth opportunities and asset rebalancing strategies to gain insights." The full report is available on the Deloitte website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)