Analysis of Major 6 Countries' Car Markets in H1 This Year

Domestic Sales in China, USA, Europe, India Up 2~6%

Only Korea Shows Decline Excluding Japan Amid 'Toyota Certification Scandal'

High Interest Rates and Inflation Reduce Household Real Income

Car Replacement Demand Plummets Due to Weakened Consumer Sentiment

In the first half of this year, car sales in South Korea noticeably declined among major global automotive markets. Except for Japan, where vehicle shipments were partially halted due to the Toyota certification manipulation scandal, South Korea was virtually the only market to experience a decrease. The significant impact stems from increased interest burdens caused by high interest rates and rising inflation, which have reduced actual household income. Additionally, a base effect from the boom experienced in the first half of last year also played a role. This contrasts with South Korea's automobile exports reaching an all-time high during the same period, leading to forecasts that domestic demand-driven economic recovery will require more time.

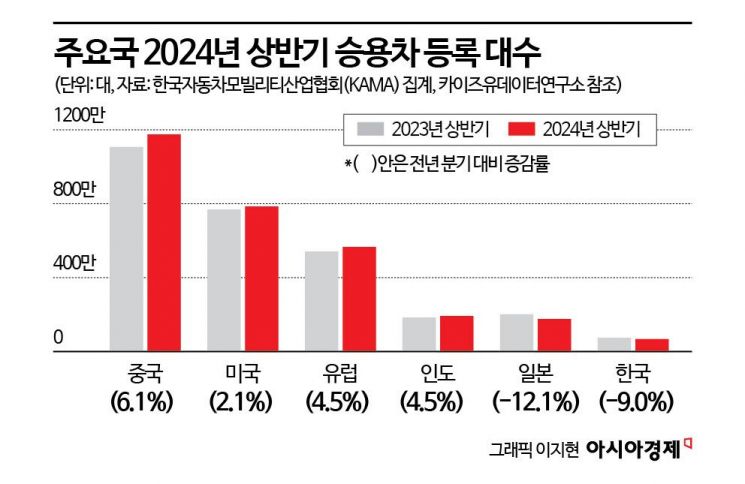

According to an analysis conducted by the Korea Automobile Mobility Industry Association (KAMA) commissioned by Asia Economy on the 23rd, new passenger car registrations in six major regions (China, the United States, Europe, India, Japan, and South Korea) showed declines in South Korea (-9%) and Japan (-12%) compared to the previous year. Excluding Japan, where the Toyota certification scandal affected not only the automotive industry but society at large, South Korea was the only major country to see a decrease in its domestic market.

By market, new passenger car registrations in South Korea (including domestic and imported vehicles) totaled 713,481 units in the first half of this year, down 9% from the previous year. In contrast, markets in China, the United States, Europe, and India increased by 2% to 6%. In China, sales rose 6% to 11,751,000 units, and U.S. sales also increased by about 2% to 7,865,634 units. Additionally, Europe and India each saw sales grow by approximately 4.5%, showing a slight upward trend in major countries' sales.

Looking at market trends over the past three years, 2022 was a period when new car sales worldwide sharply declined due to semiconductor supply shortages. From the first half of 2023, as supply shortages eased, pent-up demand surged all at once. As a result, sales in major markets increased significantly by 8% to 20% in the first half of last year, and single-digit sales growth rates have been maintained through this year.

However, South Korea stands alone with a declining trend. The increase in household debt and decrease in real income have greatly dampened consumer sentiment. Although consumer sentiment was also weak last year, there was still residual pent-up demand due to aggressive promotions ahead of the end of the individual consumption tax cut (July 2023) and easing semiconductor shortages. This year, the policy effect of the tax cut has disappeared, and new car launches are concentrated in the second half. The decline was further exacerbated by shipment delays caused by some automakers switching production lines to electric vehicles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.