Data Centers, Differences Between Government and Industry

Concerns Over AI and Related Industry Growth Slowdown

Shift to Overseas Investment Amid Regional Decentralization Efforts

The tug-of-war between the government and industry over data centers, emerging as a core infrastructure for artificial intelligence (AI) technology development, is intensifying. While IT companies are lining up to build data centers in the Seoul metropolitan area, the Ministry of Trade, Industry and Energy is reluctant to approve them due to the facilities' massive power consumption. The industry has expressed dissatisfaction, stating that it has become virtually impossible to build data centers in the metropolitan area following the enforcement of the Special Act on the Activation of Distributed Energy (hereinafter referred to as the Distributed Energy Act).

LGU+, Mega Data Center in Paju

According to industry sources on the 18th, LG Uplus announced in April that it would build a mega data center in Paju, Gyeonggi Province, covering an area nine times the size of a soccer field (22,300 pyeong). However, it has not yet applied for building permits from the local government office of Paju City. A Paju City official stated, "A data center is a large-scale project, not a small commercial facility, and due to its high power consumption, it has significant ripple effects on the surrounding area," adding, "We will conduct a comprehensive and thorough review based on the Building Act and related laws." An LG Uplus representative said, "We have completed all necessary permits related to data center construction with Gyeonggi Province and Korea Electric Power Corporation (KEPCO)," and added, "We plan to proceed with detailed procedures such as building permits once the building design is finalized to ensure the data center project progresses smoothly."

There are many challenges to establishing data centers in the metropolitan area. According to the Ministry of Trade, Industry and Energy, 732 new data centers have expressed intentions to be established by 2029, of which 601 (82%) are located in the metropolitan area, including Seoul, Gyeonggi, and Incheon. The ministry expects that only 40 of these 601 sites (6.7%) will be able to supply power in a timely manner. It proposed a plan to disperse data centers in areas with smooth power supply to ensure timely construction. Additionally, through amendments to the Enforcement Decree of the Electricity Business Act this year, if a data center consuming 5 megawatts (MW) or more of large-scale power places excessive burden on the power grid, KEPCO now has the legal grounds to refuse power supply.

Strengthened Data Center Regulations... Shift Toward Overseas Expansion

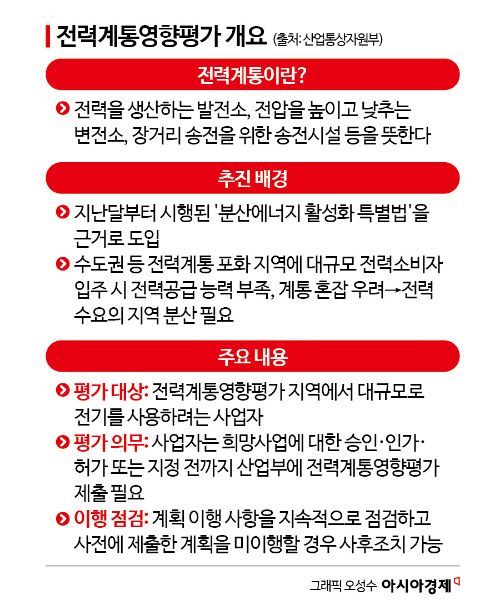

Establishing data centers in the metropolitan area is also legally challenging. The Distributed Energy Act, which came into effect last month, includes a 'Power Grid Impact Assessment' system, which the industry claims is tightening restrictions on data center establishment in the metropolitan area. This assessment applies when applying for electricity usage of 10 MW or more and consists of technical evaluation items (60 points) and non-technical evaluation items unrelated to the power grid (40 points). According to the Korea Data Center Association, for the technical items, submitting an operation plan that self-generates more than 50% of the contracted power is required to receive the full 10 points.

The association expressed concerns that the Power Grid Impact Assessment acts as a de facto permit for data center construction projects, potentially stifling growth in related industries. Last year, the Ministry of Trade, Industry and Energy established communication channels among 10 companies and local governments to alleviate the concentration of data centers in the metropolitan area and resolve corporate difficulties, but no tangible results have been seen. From the companies' perspective, the farther data centers are from AI companies, the higher the cost burden.

The data center business of the three major telecom companies has seen an average annual revenue growth of 20% over the past three years. Some have even called it a "golden goose." However, with the enforcement of the Distributed Energy Act, securing growth has become difficult.

Some companies are turning their eyes overseas. Hanwha Energy is pursuing a new business to build a data center in Texas, USA, while SK Telecom has made a 280 billion KRW investment in SGH, a US-based AI data center solution specialist. An industry insider said, "As the institutional environment for data center business in Korea deteriorates, attempts to diversify business by operating overseas are becoming apparent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.