Increased Demand for Real Assets Amid Fed Rate Cut Expectations

Rising Preference for Safe Assets Due to Geopolitical Tension Concerns

International gold prices reached an all-time high on the 16th (local time). This is interpreted as a result of increased demand for safe-haven assets due to expectations of a benchmark interest rate cut and the 'Trump risk.'

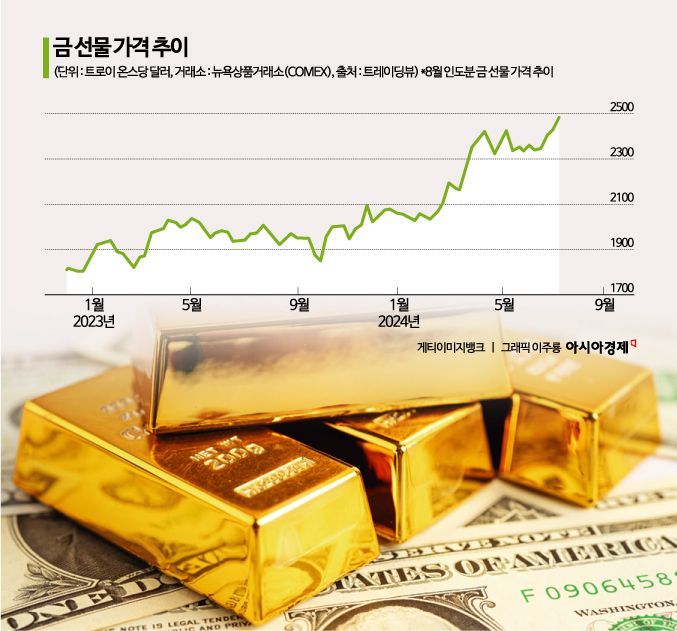

On that day, gold futures prices on the New York Mercantile Exchange (COMEX) rose 1.6% from the previous trading day to $2,467.80 per ounce, surpassing the previous high set on May 20. Gold prices have risen 19% so far this year. During the same period, spot gold prices also surged to a new high of $2,469.66 per ounce intraday. As of 6:35 PM (Eastern Time), spot gold was trading at $2,467.56 per ounce.

The rise in gold prices is seen as reflecting expectations of a benchmark interest rate cut. When market inflation expectations rise or interest rates fall, the value of currency declines, boosting investment sentiment in tangible assets like gold. According to the Chicago Mercantile Exchange (CME) FedWatch on that day, the federal funds futures market fully priced in a 100% probability that the Federal Reserve (Fed) will cut rates by at least 0.25 percentage points at the Federal Open Market Committee (FOMC) meeting in September.

Johnny Teves, a strategist at global investment bank UBS, said, "Amid strong investor interest in buying gold at its lows, the Fed's dovish comments have acted as a catalyst for gold investment," adding, "Since gold market prices are just above the psychological level of $2,400, investors are likely to expand their gold buying positions going forward."

The prospect of the launch of Trump’s second term is also seen as fueling the gold price rally. Analysts suggest that former President Donald Trump's tariff and tax cut policies will reignite inflation by causing U.S. fiscal deficits and geopolitical tensions. In an interview with Bloomberg News on the same day, former President Trump stated plans to impose a 10% tariff on all imported goods and tariffs ranging from 60% to 100% on Chinese imports.

David Haggins, head of trading at Marion Gold, noted, "If former President Trump is elected, many people will buy gold," explaining, "Investors associate him with instability." Nikki Sills, chief analyst at Swiss gold trading firm MKS Pamp, also explained, "Investors are wary of inflation and fiscal deficit risks in the U.S. during Trump's administration," adding, "There are concerns about potential infringements on the Fed's independence." In his Bloomberg interview, former President Trump guaranteed the term of Fed Chair Jerome Powell but expressed the view that benchmark interest rates should not be lowered before the November election.

Central banks are also establishing themselves as major players in the gold market. Bernard Dada, an analyst at French investment bank Natixis, assessed that as central banks worldwide continue to seek alternatives to the dollar amid U.S.-China tensions, Trump’s re-election would incentivize central banks to increase gold purchases despite high prices. Earlier, UBS also reported, "Some central banks have begun to question holding dollar- and euro-denominated assets amid the global debt crisis and the Ukraine war," adding, "Many banks are replenishing their reserves with gold."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.