2Q Insurers' Net Profit 2.1198 Trillion KRW...18.1% YoY Increase Expected

Life Insurers Make Strides in 3rd Insurance Market

Non-life Insurers' Auto Insurance Loss Ratio Worsens

Domestic insurance companies' performance in the second quarter of this year is expected to vary by sector. Life insurers are anticipated to achieve better results than last year due to the growth of the third insurance market, while non-life insurers are expected to experience mixed outcomes amid rising loss ratios in automobile insurance.

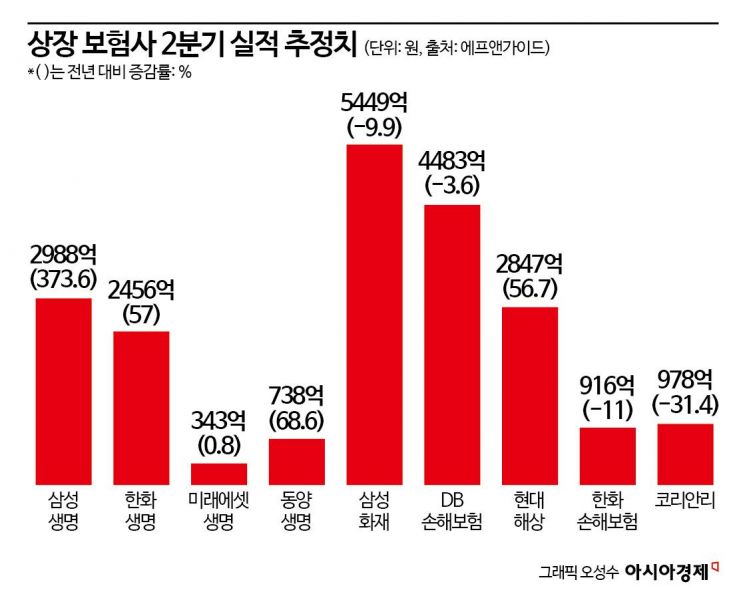

According to financial information analysis firm FnGuide on the 17th, the consensus net profit for the second quarter of this year, based on separate financial statements of nine listed domestic insurance companies (Samsung Life, Hanwha Life, Tongyang Life, Mirae Asset Life, Samsung Fire & Marine, Hyundai Marine & Fire, DB Insurance, Hanwha General Insurance, and Korean Re), was estimated at 2.1198 trillion KRW. This represents an 18.1% increase compared to the net profit of 1.7938 trillion KRW in the second quarter of last year.

By sector, life insurers are expected to perform better than non-life insurers. This contrasts with the first quarter, when non-life insurers’ net profit increased by 15%, while life insurers’ net profit sharply declined by 35%. At that time, the five major non-life insurers (Samsung, DB, Meritz, Hyundai, KB) all posted record quarterly earnings, but they are expected to slow down this time.

Among life insurers, Samsung Life’s net profit for the second quarter is estimated at 298.8 billion KRW, a 373.6% increase compared to the same period last year. Part of this high growth rate appears to reflect a base effect. Last year in the second quarter, Samsung Life incurred an investment loss of 368 billion KRW due to replacement trades converting bonds with mid-1% yields to mid-3% yields. This year’s second quarter is expected to see a turnaround to investment gains and a stable trend in core insurance profits. Seol Yong-jin, a researcher at SK Securities, said, “New contracts centered on health insurance have stabilized, and overall margin improvements are occurring simultaneously due to a decrease in the proportion of short-term payment whole life insurance. Investment gains are expected to generate a surplus of 160.8 billion KRW on a general account basis, influenced by reduced insurance finance costs from changes in accounting for lapse contracts since the first quarter, as well as improved valuation gains from interest rate declines and index increases.”

Hanwha Life’s net profit for the second quarter is forecasted at 245.6 billion KRW, a 57% increase year-on-year. SK Securities expects Hanwha Life’s profitability in the second quarter to improve compared to the previous quarter due to expanded sales focused on general protection insurance such as cancer and dementia. KB Securities anticipates Hanwha Life will record investment gains of 62.8 billion KRW, attributing this to bond valuation gains and a base effect from last year’s non-recurring valuation losses.

For Tongyang Life, which Woori Financial Group is pursuing to acquire, the second quarter net profit is expected to reach 73.8 billion KRW, a 68.6% increase year-on-year. Shinhan Investment Corp. forecasts Tongyang Life’s insurance profit for the second quarter at 65.1 billion KRW, up 18.2% from the same period last year. Investment gains are projected to surge by 1,018% to 23.9 billion KRW during the same period.

In the second quarter of this year, life insurers competed fiercely in the third insurance market as the popularity of short-term payment whole life insurance waned. Third insurance products provide monetary or benefit payments for human diseases, injuries, or related nursing care. Both life and non-life insurers can offer these products. Life insurers have recently launched various products, including differentiated riders related to cancer, brain, and heart diseases, as well as nursing care insurance, which has gained attention due to aging demographics. Samsung, Mirae Asset, and LINA have recently acquired exclusive usage rights related to third insurance products, differentiating their offerings. Exclusive usage rights are monopoly sales rights granted by the Insurance Association for a minimum of three months up to one year to products recognized for originality, usefulness, and advancement.

Among non-life insurers, except for Hyundai Marine & Fire, most are expected to post weak results in the second quarter. For major companies, the main cause is attributed to the impact of automobile insurance premium reductions. The cumulative automobile insurance loss ratio for the five major non-life insurers from January to May was 79.4%, up 2.6 percentage points from 76.8% in the same period last year. With the onset of the rainy season in the third quarter, loss ratios are expected to worsen further due to flooding accidents.

Hyundai Marine & Fire’s net profit for the second quarter is estimated at 284.7 billion KRW, a 56.7% increase year-on-year. Kang Seung-geon, a researcher at KB Securities, said, “Following the reversal of large loss-bearing contracts in the first quarter, the improvement in the difference between expected and actual insurance claims and expenses in the second quarter has stabilized performance. Insurance profits are expected to improve significantly.” However, automobile insurance profits are projected to decline by 54.5%.

Samsung Fire & Marine’s net profit for the second quarter is expected to decrease by 9.9% year-on-year to 544.9 billion KRW. Jung Jun-seop, a researcher at NH Investment & Securities, said, “New protection contracts are expected to decline compared to the first quarter, and automobile segment performance will be somewhat weak due to rate cuts. Increases in claims due to rising non-reimbursed medical expenses and higher business expenses from intensified competition in new contracts are also anticipated.”

DB Insurance’s net profit for the second quarter is forecasted to decrease by 3.6% year-on-year to 448.3 billion KRW, and Hanwha General Insurance’s net profit is expected to decline by 11% to 91.6 billion KRW. During the same period, reinsurer Korean Re is projected to record a net profit of 97.8 billion KRW, down 31.4% year-on-year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.