KOSDAQ Falls Over 1% Breaking 840 Level... KOSPI Slightly Up

KOSPI Up Over 7% This Year... KOSDAQ Down 3%

AI and Value-Up Benefits Concentrated in Large Caps... KOSDAQ Left Out

Earnings Expectations Also Lower for KOSDAQ Compared to KOSPI

The KOSDAQ has not been able to escape the slump. While the KOSPI has risen more than 7% this year, the KOSDAQ has recorded negative returns. Given the relatively low earnings expectations compared to the KOSPI, it seems unlikely that the temperature gap between the KOSPI and KOSDAQ will be resolved anytime soon.

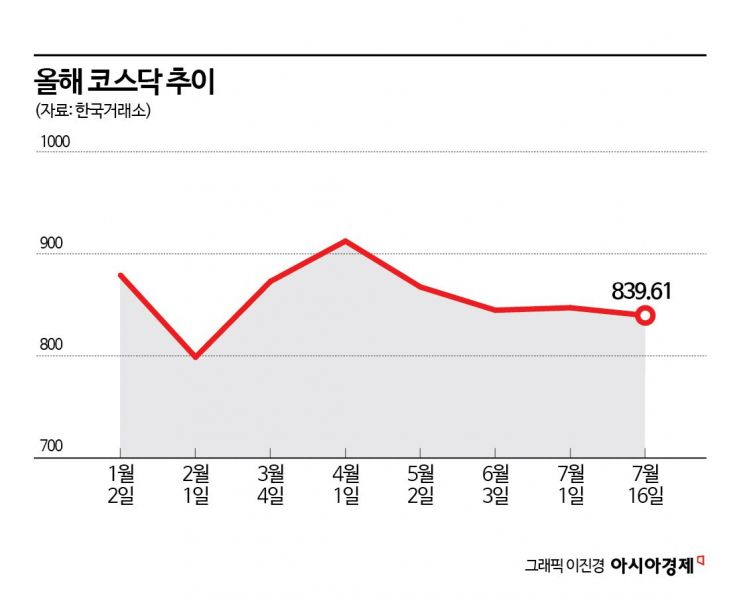

According to the Korea Exchange on the 17th, the KOSDAQ closed at 839.61, down 13.27 points (1.56%) from the previous day. Although it recovered to the 860 level on the 9th, it fell back to the 830 level due to continued declines. Meanwhile, the KOSPI showed a slight upward trend the previous day.

The KOSDAQ’s sluggishness is prolonging. This year, the KOSPI has risen 7.94%, while the KOSDAQ has fallen 3.11%. As the KOSPI climbed to the high 2800s and took a brief breather earlier this month, the KOSDAQ also rose for a while, but after recovering to the 860 level, it failed to advance further and retreated again.

Trading volume is also decreasing. Looking at the monthly average daily trading value of the KOSDAQ market this year, it was in the 11 trillion won range in February and March, dropped to the 8 trillion won range in April, and is currently below 8 trillion won this month. In contrast, the KOSPI has steadily maintained the 11 trillion won range since February, approached 13 trillion won last month, and is recording the 12 trillion won range this month.

The KOSDAQ’s weakness is attributed to the fact that the strength of AI semiconductor stocks and the benefits from corporate value-up programs, which have acted as stock price growth momentum this year, have been concentrated in large-cap stocks, and earnings have fallen short of expectations compared to the KOSPI. Additionally, the KOSDAQ has a high proportion of growth stocks sensitive to interest rates, and with ongoing US interest rate uncertainties throughout the first half of the year, coupled with the poor performance of secondary battery stocks, which hold a large share in the KOSDAQ, the market’s weakness has deepened. On the previous day, secondary battery stocks EcoPro BM, ranked first in market capitalization, and EcoPro, ranked third, both fell more than 5%, dragging the index down.

The market expects it will be difficult for the KOSDAQ to escape relative underperformance. Shin Seung-jin, head of investment information at Samsung Securities, said, “The temperature gap between the KOSPI and KOSDAQ is likely to be inevitable for the time being,” adding, “The KOSDAQ still has a high proportion of secondary battery stocks with weak earnings momentum, and when funds flow into large-cap KOSPI stocks, small- and mid-cap stocks are likely to continue being sidelined.”

In terms of earnings, lower expectations compared to the KOSPI appear to be affecting the index. Kang Dae-seok, a researcher at Yuanta Securities, explained, “Although there is strength in US small- and mid-cap stocks, including the Russell 2000 index, it will take more time before a rotation to the KOSDAQ can be sustained,” adding, “The relative strength of KOSPI and KOSDAQ stock prices shows a high correlation of about 0.8 with the relative strength of operating profit estimates since 2001. This year, operating profit forecasts for the KOSPI have been revised upward by about 5.1% since the beginning of the year, while the KOSDAQ has seen a downward revision of 20.6%.”

Although concerns about interest rate hikes are subsiding and expectations for rate cuts are growing in the second half of the year, some opinions suggest this is still insufficient to act as a growth momentum for the KOSDAQ. Researcher Kang said, “While growing expectations for rate cuts are a positive factor for the KOSDAQ’s relative strength compared to the KOSPI, the need for further market rate reductions means there is no clear trigger yet.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.