Governance Center Analyzes Listed Companies' Governance Reports: "Smaller Scale Leads to Lower Compliance Rates"

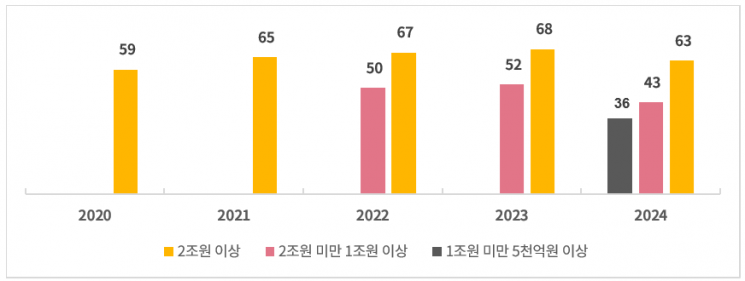

This year, the average compliance rate with key indicators among KOSPI-listed companies was only half (50%), down from 62% last year. In particular, the compliance rate with key indicators showed significant variation depending on the size of the listed companies. The compliance rate for companies with assets between 500 billion KRW and less than 1 trillion KRW was only 36%, while companies with assets of 2 trillion KRW or more had a compliance rate of 63%.

On the 16th, Samil PwC Governance Center announced that it recently published the 25th issue of 'Governance Focus,' which contains these findings. The report analyzed corporate governance reports of 488 KOSPI-listed companies (non-financial) with assets of 500 billion KRW or more disclosed by the end of May and introduced the current status of compliance with key indicators and noteworthy implications.

From this year, KOSPI-listed companies with total assets of 500 billion KRW or more based on consolidated financial statements are required to submit corporate governance reports. Accordingly, they must disclose compliance with 15 key indicators across three categories: shareholders, the board of directors, and audit organizations.

The overall compliance rate with key indicators declined compared to last year. The average compliance rate, which was 62% last year, dropped to 50% this year. Looking by size, the compliance rate of companies with assets of 2 trillion KRW or more, which had shown a continuous upward trend over the past four years, decreased for the first time this year. Companies with assets between 1 trillion KRW and less than 2 trillion KRW, in their third year of mandatory disclosure, also saw a decline in compliance rate compared to the previous year. Notably, companies with assets between 500 billion KRW and less than 1 trillion KRW, which were subject to mandatory disclosure for the first time this year, had a compliance rate of only 36%, indicating that smaller listed companies have significantly lower compliance rates.

The report pointed out that "the deterioration in compliance rates with key indicators regardless of company size is due to changes in the key indicators following guideline revisions." Two indicators that had the highest compliance rates until last year were removed, and the newly added item 'Provision of predictability related to cash dividends' and the revised item 'Whether the chairperson of the board is an outside director' had low compliance rates. However, even excluding the new and revised indicators, the average compliance rate increased by only 1 percentage point compared to the previous year.

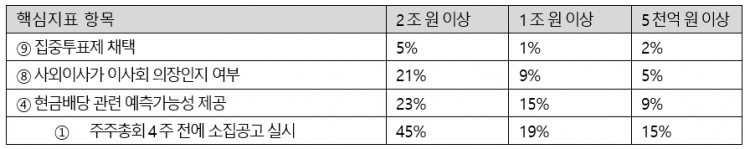

By category, the 'Adoption of cumulative voting system' showed the lowest compliance rate. The compliance rate for this item was 5% for companies with assets of 2 trillion KRW or more, 1% for companies with assets between 1 trillion KRW and less than 2 trillion KRW, and 2% for companies with assets between 500 billion KRW and less than 1 trillion KRW. The cumulative voting system is a method used as a means to check the monopoly of major shareholders' management rights, where voting rights are not given as one vote per share at the general shareholders' meeting, but voting rights are granted according to the number of directors to be appointed. Following this, items such as 'Whether the chairperson of the board is an outside director' and 'Notice of convocation issued four weeks before the general shareholders' meeting' consistently showed low compliance rates every year. The newly added item this year, 'Provision of predictability related to cash dividends,' also had a very low average compliance rate of 17%.

Jang On-gyun, head of the Samil PwC Governance Center, said, "It is difficult to conclude that there is a problem with corporate governance simply because key indicators were not complied with. However, for items with consistently low compliance rates, it is necessary to analyze the causes and actively consider alternative governance measures that align with the purpose of the respective indicators while fitting the company's circumstances."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.