The deposit and loan balances of Saemaeul Geumgo have decreased. In particular, the loan balance dropped by more than 1 trillion won in one month due to the impact of credit quality management.

According to the Bank of Korea's Economic Statistics System on the 17th, Saemaeul Geumgo's loan balance as of the end of May was 182.3217 trillion won, down 1.5077 trillion won from the previous month. Compared to the beginning of the year, it decreased by 4.361 trillion won, and compared to the same period last year, it fell by 15.8116 trillion won.

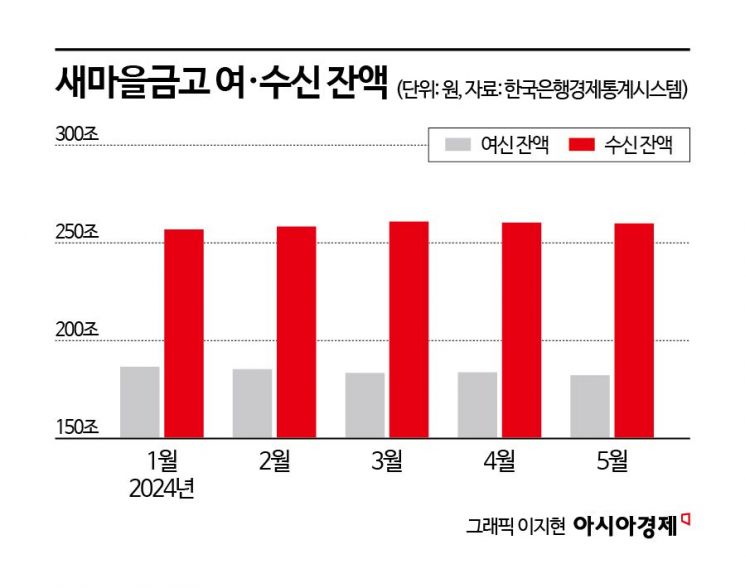

Saemaeul Geumgo's loan balance has steadily declined this year except for April, with figures at the end of January (186 trillion won), end of February (185 trillion won), end of March (183 trillion won), and end of May (182 trillion won).

This is because Saemaeul Geumgo, which has started credit quality management amid rising delinquency rates, is handling loans conservatively. A representative from the Saemaeul Geumgo Central Association explained, "Since corporate loans have been virtually completely suspended, corporate credit has decreased, leading to an overall decline in loans."

Deposit balances also decreased for two consecutive months. As of the end of May, the deposit balance was 259.8712 trillion won, down 161.4 billion won from the previous month. With loan operations shrinking, there is little suitable way to manage funds, so the deposit balance naturally decreased.

In fact, even the credit unions that competed with high-interest deposit products have recently diminished significantly. As high-interest products at each credit union decreased, the average interest rate on Saemaeul Geumgo's one-year fixed deposits recorded 3.79% (as of last May), down 0.07 percentage points from the previous month. The deposit interest rate, which had maintained the 4% range until February this year, has fallen to the high 3% range. Compared to the beginning of the year (4.2%), it dropped by 0.41 percentage points.

Meanwhile, the loan balance of credit unions also decreased compared to the previous month. As of the end of May, it was 106.6993 trillion won, down 121.8 billion won from the previous month. Credit unions are also strengthening credit quality under financial authorities' supervision due to a recent surge in delinquency rates. However, the deposit balance increased by 80.1 billion won to 137.6562 trillion won compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)